-

Banks are being "unbundled" by challengers in numerous business lines, but they can recapture the relationship with the help of technology and the right mindset.

October 13 -

Tech investors love fast-growing marketplace lenders like Social Finance, but Wall Street has taken a dimmer view of them. A huge equity fundraising round should allow SoFi to keep fueling rapid growth while remaining privately owned.

August 20 -

Marlette Funding, an Internet marketplace lender, wants to figure out a way to accept online deposits so it can rely less on investors to finance its loans.

February 4

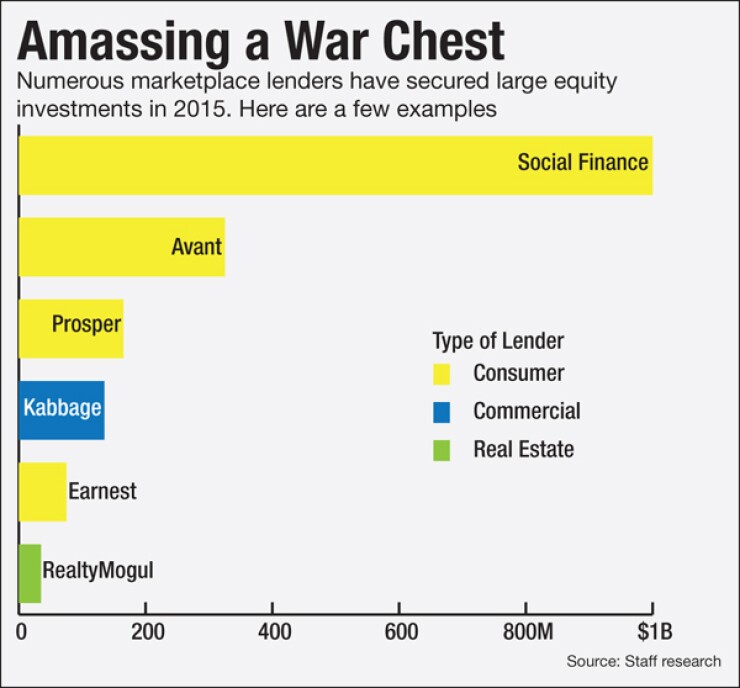

Add Earnest to the growing roster of Silicon Valley lenders intriguing venture capitalists with a promise to shake up the financial services industry.

The San Francisco company announced Tuesday that it has secured $75 million in new equity funding, plus another $200 million in institutional lending capital. Its ambitious, if now somewhat familiar, goal is “to rebuild banking from the ground up,” according to its fundraising announcement.

In an interview, Chief Executive Louis Beryl said that the two-year-old firm plans to eventually offer more than just loan products. Earnest currently makes personal loans, refinances student loans, and lends money to enrollees at coding academies. Like a raft of other online lenders, the firm aims to use technology to build a better customer experience.

"Today we're primarily focused on lending. But what I would say is that our vision long-term definitely would be to expand to products beyond just lending," Beryl said.

He added: "Capital One, about 20 years ago, started in just credit cards. And Capital One offers a pretty full suite of financial services products today, including deposits. It's very hard for me to say on what timeframe or in what order we will roll out new products. But certainly this fundraising is to expand our suite of products more broadly."

Much of the equity fundraising round, which was led by Battery Ventures, will be used to build Earnest's technology and product-development teams, according to Beryl. The company currently has about 160 employees, and it plans to make more than 200 additional hires over the next year, he said.

The $200 million in lending capital comes from New York Life Insurance Company and other undisclosed institutional investors.

Earnest targets prospective borrowers who are professionals in their 20s and 30s. The company's underwriting focuses on the applicants' cash flow and savings, rather than their income and credit scores, according to Beryl.

He drew an implicit contrast with competitors that have focused on extremely low-risk borrowers.

"We don't just focus on only people from certain schools. We don't just focus on only people of certain degrees. We don't just focus on only people of certain incomes. And we certainly don't focus on only people of certain FICO scores," Beryl said. "We're able to take a comprehensive view on all of our applicants, and ultimately approve a wider array of financially responsible people."

Still, in some ways Earnest appears to be pursuing a similar strategy as Social Finance, a better-known and

Today SoFi also offers personal loans and mortgages, and CEO Mike Cagney said in an interview Monday that the company plans to introduce a new wealth-management product by the end of November. SoFi customers who use the product will be able to invest in a portfolio of exchange-traded funds.

"It's a beachhead into our member base on the other side of the balance sheet," Cagney explained.

SoFi also plans to begin accepting deposits in the first half of 2016, according to Cagney, though key details of how it would do so remain unresolved. Because SoFi is not a bank, it does not have access to federal deposit insurance.

Numerous online lenders are trying to turn themselves into companies that more closely resemble full-service banks, said Alex Johnson, an analyst at Mercator Advisory Group.

He argued that the proliferation of competition in the marketplace lending sphere suggests it will be hard to make money in the long run by competing for borrowers each time they need a loan. So companies are looking to deepen relationships that will allow them to cross-sell higher-margin products.

"They want to position themselves as the place where consumers look first for a range of financial services," Johnson said.