-

Kearny Financial in Fairfield, N.J., has withdrawn its application for a mutual-to-stock conversion.

December 23 -

Mutual-to-stock conversions are facing new hurdles, as evidenced by events at a pair of Massachusetts mutuals. Depositors at Beverly Bank recently rejected its proposed conversion, while Reading Co-op Bank changed its bylaws to make it more difficult to convert.

August 19 -

TFS Financial announced dividend plans recently that have many wondering whether it is headed toward a second-step conversion in the near future. The speculation makes sense, but the Cleveland company would face some obstacles.

July 3 -

A Massachusetts mutual's failure to gain depositor approval for a conversion suggests a way for small towns to push back against the loss of their local banks, according to lawyer Kevin Handly.

August 29

Mutuals stepped up the pace in 2014 of converting their institutions to stock banks. But the supply of obvious new candidates is running dry, suggesting a likely slowdown in the conversion business next year.

Further muddying the outlook is an apparent surge of opposition to mutuals, as depositors and some mutual executives question whether conversions help the bank's customers, or just the advisers who recommend them.

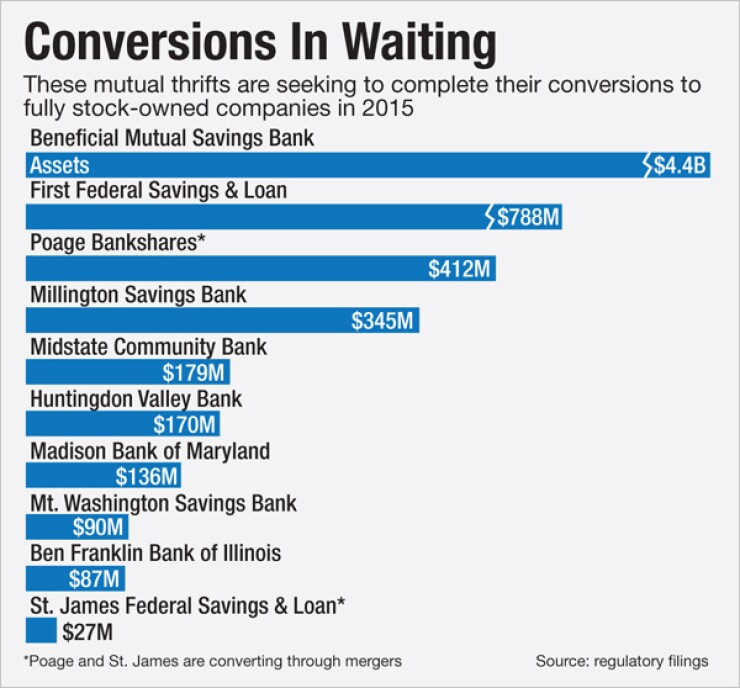

Through Dec. 15, a total of 14 mutual thrifts had completed conversions to fully stock-owned banks. An additional dozen had started the conversion process and were slated to finish by the end of the year or some time in 2015. There were only eight mutual conversions in all of 2013.

The $17.8 billion-asset Investors Bancorp in Short Hills, N.J., was the largest institution to convert this year. Investors had already sold some shares to the public previously. But Investors was still majority-owned by a mutual holding company, and this year it completely cast off all mutual ownership.

Other big mutuals are still in the process of converting, including the $4.4 billion-asset

The financial crisis delayed many mutuals' conversion plans, said Kevin Handly, a banking attorney in Boston who advises mutuals. But as the economy appeared to show stronger signs of rebounding this year, many mutuals decided to proceed.

"There was a little bit of a backup that built up during the financial crisis years and in the immediate aftermath," said Handly, who previously worked as a Federal Reserve staff attorney. "People were reluctant to make a move."

Many executives at mutuals feel constricted by the charter requirements of a mutual and want the greater flexibility of being a stock-owned bank, said Frank Schiraldi, an analyst at Sandler O'Neill. Plus, as the overall economy improves, converted mutuals can deploy their new capital into loans or acquisitions, he said.

"With economic growth will come more opportunity for levering down capital acquired in a conversion, making the transaction more appealing," Schiraldi said.

The deals can be lucrative. Investors raised $2.2 billion from its May conversion. The $3.2 billion-asset Meridian Bancorp, holding company for East Boston Savings Bank, raised $325 million in July.

Conversion "will provide us with additional capital to pursue our strategic and growth objectives," Gerard Cuddy, president and CEO of Beneficial, said on Aug. 14. The conversion "is a critical milestone in Beneficial's 161-year history."

With Investors, Beneficial, Meridian and others all converting, there are few obvious candidates left for a so-called second-step conversion, Schiraldi said. Those are conversions where a company has already sold some shares to the public, but still has a mutual holding company as the majority-owner and thus is able to generate more capital by selling off its shares.

"The new year is likely to pale in comparison to 2014 from a dollar-amount-raised standpoint," Schiraldi said. "2015 will likely see smaller-sized thrift conversions."

It's not always imperative for mutuals to convert, however, Handly said. For one reason, most mutuals have plenty of capital and don't need to raise more. Investors Bank, for example, reported a Tier 1 capital ratio of 10.25% before its conversion.

Often the trigger for a conversion is an executive who is nearing retirement, the constant sales pitches on converting that a mutual gets from investment banks and deal lawyers, or some combination of the two, Handly said.

"The usual reason for a conversion is that the CEO and the board of directors have essentially given up and decided that they are no longer committed," Handly said. "Investment banks make very handsome fees in doing these transactions, and they're constantly pressuring these CEOs to convert."

The executives at mutuals also stand to reap a financial windfall, Handly said.

"The conversion peddlers are constantly reminding CEOs and directors that they could get pretty rich off this transaction," Handly said. "They also say to them that, if they don't do it, their successors will."

There has been some pushback to mutual conversions. Depositors at the $448 million-asset

In August, the depositors at the $326 million-asset

Nor does every mutual executive appear eager to convert. Marc Stefanski, CEO of $11.8 billion-asset TFS Financial in Cleveland, said during an April 25 conference call that he had

A conversion "is nothing that is going to be enacted on in the near future," Stefanski said. "I always said that that is for the next generation of management for Third Federal."