The ranks of challenger banks offering financial products and services to small businesses are growing.

But what do these firms offer that banks don't or won't?

In interviews, several executives argue that they make the process easier and more user-friendly. Loans can be approved quickly and digitally and challenger banks say they can provide a better customer service experience than traditional institutions.

Some observers say most banks haven't poured the same kind of resources or attention into small-business lending as institutions have done for larger firms.

"Small business is still an orphan from a business banking standpoint,” said Jacob Jegher, senior vice president of banking and head of strategy at Javelin Strategy & Research. “Is it consumer banking? Is it commercial banking? The answer is, it’s a little bit of both.”

Jegher, along with several leading fintech small-business lenders, is scheduled to discuss the issue at American Banker's

But many also shared a preview of their insights in interviews. Following is where they saw challenger banks as having an edge.

Attention

Tyler McIntyre, founder and chief technology officer at Bank Novo, a challenger bank for small businesses, said that while big firms receive personalized apps, most businesses do not because they are simply not big enough. That leaves an opening for fintechs to exploit.

“Small businesses want the services commercial businesses get, but they’re treated more like mass-market consumers, just because of their size,” McIntyre said.

That includes the ability to open accounts digitally.

Kathryn Petralia, co-founder and president of Kabbage, recently opened a business checking account with a super-regional bank based in Atlanta.

“It literally took me over an hour to open the account,” she said. “They asked me all kinds of irrelevant questions like how many checks I’d write and wire transfers I’d need to send. Most business owners don’t know those answers in advance.”

According to Javelin’s research, only five of the top 30 U.S. banks offer digital account opening for small businesses.

This is a matter of prioritization, according to Jegher.

“The technologies are all available today, it’s just that they’re not being leveraged," he said.

Strong mobile apps

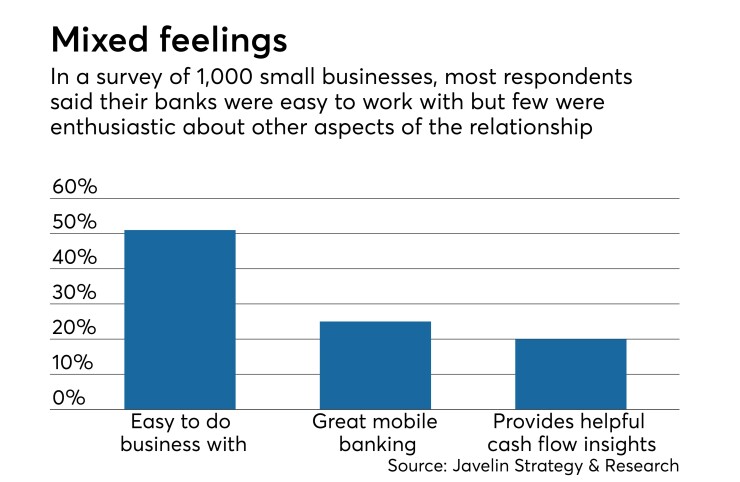

Only 52% consider their bank’s mobile banking solution to be satisfactory, according to Javelin surveys.

“That’s a wild number; it’s really low,” Jegher said. “That’s because banks haven’t invested in it.”

Most mobile offerings for small businesses look like consumer offerings, he said.

“I think that’s one reason we’ve seen the emergence of some of these neobanks.”

Bank Novo’s app lets small-business owners send, hold and receive money. It supports ACH payments and will also mail checks on customers’ behalf when necessary. It provides remote deposit capture and a dashboard of the business’s financial activity.

Similarly, Azlo's app offers deposits, debit cards, bill pay and ACH and debit push and pull. Brian Hamilton, Azlo's CEO, noted that many of the modern applications small-business owners use for things like payments, e-commerce, expenses and accounting play nicely with each other.

Intuit and Square, for instance, started out offering accounting and payment technology and have added lending and other banklike services.

“Once they’ve got you there, they want that to be the primary experience, the place you’re going to for you day to day, and it relegates the bank to the dumb data behind the scenes that gets piped in,” Hamilton said.

Most banks silo bank data inside the bank website or app, Hamilton said. Though some banks offer integration with accounting software such as Intuit QuickBooks and Xero, that only lets users see bank account data within QuickBooks; they can’t see data from QuickBooks inside online banking.

Though some small businesses use their bank’s treasury applications on a daily basis, when they need to do something like send an invoice, they go to QuickBooks or a stand-alone invoicing application.

“If you’re a small-business owner, you want to interact with your bank as little as possible,” Hamilton said. “Banking is not what you’re getting up in the morning to do every day. The folks that are winning are those that are minimizing the time you have to spend in their app, but making it the primary user interface you go to to do most things, and that could be working capital, accepting payments, expense management.”

Azlo has built integrations with popular payment companies Stripe and Square, and it will have a PayPal integration completed soon. A QuickBooks integration is “imminent,” Hamilton said.

Advice

“Small businesses want their banks to be a partner to them, providing expert services and guidance about managing cash flow and other areas of the business,” Kabbage's Petralia said.

After a customer has been with Bank Novo for three months, it starts providing “insights” on their account activity. A typical notification might tell the client it’s spending 20% more in a category this month than it did the previous month.

“We’re trying to help small-business owners understand how and where they’re spending their money and where they should be focused, so they can spend more time in the front office instead of downloading and crunching numbers on Excel and QuickBooks,” McIntyre said.

Starting in early 2019, Bank Novo customers will be able to query the data, so they could ask questions like, How much money have I spent on coffee in the last three months?

Help at scale

Importantly, many challenger banks tailor their services to microbusinesses, like Uber drivers, Airbnb hosts, freelancers and contract workers.

One difficulty for such workers is commingling — using a personal account for business purposes.

“That creates all kinds of headaches for you as an individual when essentially you’re conducting yourself as a business,” Jegher said. “There are business challenges they face that mobile and digital banking solutions are not designed to meet.”

Azlo focuses on freelancers and smaller businesses.

“The nature of being a small-business owner is changing with the gig economy and there’s a lot of disruption to the traditional idea of a small business,” said Hamilton.

Such customers have “lumpy” cash flows and typically don’t have the three years of tax returns needed for most small-business underwriting, Hamilton said. Azlo is working on offering loans to them.

Card controls and reports

Bento for Business has developed controls over when, where and how much each employee of a business can use their business credit cards, as well as automated reporting such as expense reports for employees, “which is a time-consuming and painful task for people,” said Farhan Ahmad, the company's CEO. The results are synced with accounting software like QuickBooks.

“None of those things could be done by banks,” Ahmad said. “At most, banks would let you change the credit limit for employees on a monthly basis.”

The threat to banks is real

Some banks argue that since the challenger banks haven’t achieved scale or market share, they are not a threat.

“That sounds like what Blockbuster said about Netflix,” Hamilton said.

Others said it sounds like something Sears would have said about Amazon.

The disruptors have had trouble achieving scale. The challenger banks in this article would not share their customer counts; all said they number in the thousands.

Yet Hamilton sees a risk for traditional banks in dismissing the competitive threat.

If banks wait for small-business people to walk into their physical branches, “you’re going to wake up one day and realize you’re way behind the ball on acquiring them online, where everybody is now,” he said. “When they first realize they need a business bank account, when they form a company or they have a side gig that becomes a real gig, if you’re not there at that point, you may or may not get that business.”

Some banks are stepping up.

On Monday, Popular Bank announced a partnership with Biz2Credit to streamline the bank’s small-business loan application process. In September,

Yet challenger banks have some advantages.

At Bank Novo, “the No. 1 reason people are signing up is just because we’re not a bank,” McIntyre said. “They’re coming over because they like that breath of fresh air in banking and saying, 'I’d rather go with a technology provider than a traditional bank.' Seventy percent of millennials trust a tech provider more than they trust a bank today with their finances. The majority of people who are opening accounts with us are switching from major banks.”

Petralia pointed out that small businesses have demonstrated a willingness to bank with Amazon, Google, Facebook and Apple.

“This is the biggest threat to traditional banks and they should take that very seriously,” she said. “People and businesses care about their experience and their time, and banks simply aren’t able to deliver the same types of services in real time that nimble tech companies can provide.”

Editor at Large Penny Crosman welcomes feedback at