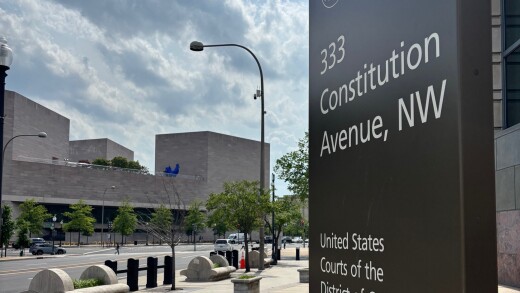

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

-

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency took a measured approach to developing the international capital standards, according to a Government Accountability Office report.

March 26 -

Rep. Andy Barr, R-Ky., who chairs the House Financial Services Subcommittee on Financial Institutions, called the CFPB under the Biden administration and former Director Rohit Chopra an "Orwellian predator."

March 26 -

Jack Dorsey's payments company cut 931 jobs. Also: Western Union looks to artificial intelligence; Marqeta adds an e-marketplace; Westpac takes on scams; and more news in the global payments and fintech roundup.

March 26 -

The president's son spoke at a panel alongside the co-founders of the Trump-backed World Liberty Financial the day after it launched a new stablecoin.

March 26 -

The digital bank announced upgrades to its online and mobile platforms that let users see financial information from multiple accounts on one dashboard.

March 26

Growing loans was a tall order in 2024, but banks that could do just that were able to outperform their peers.

Among banks with between $10 billion and $50 billion of assets, those that targeted narrow lending markets rose to the top.

Seven of the 20 top-performing banks with $2 billion to $10 billion of assets last year were based in Texas. But it's not about being bigger.

The merger, which provides for $6.75 million in payments to three Space City Credit Union executives, had drawn criticism. But Space City members approved it by an 82% to 18% margin.

Standard Chartered Bank hired a new head of digital assets, Europe and Americas; Provident Financial Holdings has a new chief financial officer; Bank of America is opening four branches in Boise, Idaho; and more in this week's banking news roundup.

Gregory V. Kanarian is an investment strategist at Natixis Investment Managers Solutions representing the firm's direct indexing strategies.

Prior to joining the investment strategies group, Greg was a portfolio consultant at Natixis for 12 years. Previously, he was a portfolio consultant with Deutsche Bank and a financial planning associate with Pillar Financial Advisors. He is a CFA charterholder and is FINRA Series 7 and 66 licensed.

Firing 90% of the Consumer Financial Protection Bureau's staff and stripping it down to "the statutory studs" is lawful, an attorney for the CFPB told an appeals court.

The merger, which provides for $6.75 million in payments to three Space City Credit Union executives, had drawn criticism. But Space City members approved it by an 82% to 18% margin.

Standard Chartered Bank hired a new head of digital assets, Europe and Americas; Provident Financial Holdings has a new chief financial officer; Bank of America is opening four branches in Boise, Idaho; and more in this week's banking news roundup.

Gregory V. Kanarian is an investment strategist at Natixis Investment Managers Solutions representing the firm's direct indexing strategies.

Prior to joining the investment strategies group, Greg was a portfolio consultant at Natixis for 12 years. Previously, he was a portfolio consultant with Deutsche Bank and a financial planning associate with Pillar Financial Advisors. He is a CFA charterholder and is FINRA Series 7 and 66 licensed.

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

The CEO of First Northwest Bancorp is promising to fight a lawsuit claiming the lender helped a client perpetrate a Ponzi scheme that bilked a hedge fund out of more than $100 million.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

-

John Buran shares how his New York bank and its small business customers are faring with tariff uncertainty — and how some have quickly changed suppliers and modified business plans — in the latest American Banker podcast.

July 15 -

Staking activities and stablecoins are two of the possible ways banks could have a role in decentralized finance, said Margaret Butler, head of the financial services practice at the law firm BakerHostetler and Kristiane Koontz, director of Treasury Services and Payments at Zions Bank, in interviews recorded at the Digital Banking Conference in June.

July 1

-

Rep. Andy Barr, R-Ky., who chairs the House Financial Services Subcommittee on Financial Institutions, called the CFPB under the Biden administration and former Director Rohit Chopra an "Orwellian predator."

March 26 -

Jack Dorsey's payments company cut 931 jobs. Also: Western Union looks to artificial intelligence; Marqeta adds an e-marketplace; Westpac takes on scams; and more news in the global payments and fintech roundup.

March 26 -

The president's son spoke at a panel alongside the co-founders of the Trump-backed World Liberty Financial the day after it launched a new stablecoin.

March 26 -

The digital bank announced upgrades to its online and mobile platforms that let users see financial information from multiple accounts on one dashboard.

March 26 -

The stablecoin known as USD1 will be on the ethereum and Binance Smart Chain blockchain networks.

March 26