A dramatic boardroom purge at the NCUA has unleashed a fierce debate over the future of credit unions, and whether they're still serving their original mission.

-

The New Hampshire congresswoman promised new investigations into scam drivers, including AI and digital payment platforms.

July 10 -

Despite bipartisan support and backing from bank trade groups, the Treasury scrapped a corporate ownership reporting rule meant to expose shell companies and aid financial compliance. But the problems that spurred the law's passage still remain.

July 10 -

The 30-year fixed mortgage rate rose for the first time in six weeks, driven by Friday's strong jobs report and renewed uncertainty around tariffs.

July 10 -

The U.K. fintech has launched a series of products that expand on its core payments business and compete with banks and other payment technology firms.

July 10 -

The AI and cybersecurity-focused startups completed the vetted proof-of-concept program to prepare for their next level of growth.

July 10

Big banks with the strongest financial performance varied in asset size, geographies and services.

Each of the top-performing banks with more than $50 billion of assets used their own mix of revenue streams to drive performance.

Among banks with between $10 billion and $50 billion of assets, those that targeted narrow lending markets rose to the top.

A dramatic boardroom purge at the NCUA has unleashed a fierce debate over the future of credit unions, and whether they're still serving their original mission.

The decision to rejoin the CEO and chairman roles comes roughly two months after regulators removed an asset cap that had stunted the San Francisco-based company's growth for seven years.

President Donald Trump is bringing in bank leaders to meet with him one by one at the White House. Beyond the economic discussion, there's a chance at a big payday for their firms.

The San Antonio-based company plans to remain in state borders, but sees opportunity for growth in major markets.

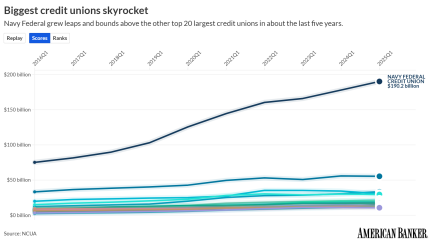

A dramatic boardroom purge at the NCUA has unleashed a fierce debate over the future of credit unions, and whether they're still serving their original mission.

The decision to rejoin the CEO and chairman roles comes roughly two months after regulators removed an asset cap that had stunted the San Francisco-based company's growth for seven years.

President Donald Trump is bringing in bank leaders to meet with him one by one at the White House. Beyond the economic discussion, there's a chance at a big payday for their firms.

Bankers are concerned about stablecoins gaining traction due to the passage of the GENIUS Act, and also continue to sound the alarm about the failure to resolve check fraud disputes, according to the latest quarterly survey from IntraFi.

Pulaski Savings Bank's failure will cost the FDIC's Deposit Insurance Fund 57.6% of its total assets.

The CEO of First Northwest Bancorp is promising to fight a lawsuit claiming the lender helped a client perpetrate a Ponzi scheme that bilked a hedge fund out of more than $100 million.

Most Influential Women in Payments honorees say the dramatic expansion in technology presents new opportunities and challenges as employers evolve away from traditional business models.

Honorees from American Banker's Most Influential Women in Payments discuss spotting tangible uses for innovation, rather than buying into hype.

Each year, American Banker recognizes the women who are advancing the payments industry in banking, retail, acquiring, processing and more.

- Crypto-as-a-service, stablecoins and tokenized deposits all present opportunities for banks, according to Nathan McCauley, co-founder and CEO of Anchorage Digital.Sponsored by IntraFi

-

The banks have invested in gen AI and embedded finance, respectively.

August 12

-

The digital bank is also partnering with two pro pickleball leagues to court fans through a consistent presence at tournaments later this year.

July 9 -

Regulators from California, Massachusetts, Minnesota, Nebraska, New York and Texas levied the fine for anti-money-laundering and Bank Secrecy Act violations, which comes as Wise seeks a banking license in the U.S.

July 9 -

U.K. regulators said Monzo didn't properly vet new customers, while Vocalink was dinged for risk management lapses. Also, Paxos launched a dollar-backed coin in the European Union; and more news in the weekly global payments and fintech roundup.

July 9 -

The case has put chief information security officers on notice that they could be personally liable for false statements about security policies and practices.

July 9 -

Growth in conventional originations at U.S. banks came with the unexpectedly rapid rise of 30-year fixed interest rates in 2022, Federal Reserve researchers found.

July 9