Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

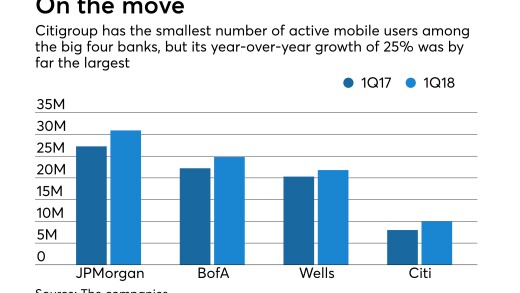

Alice Milligan, its chief digital client experience officer, said the company dedicated itself to delivering what customers really want and that more features are on the way.

-

BNPL lender Klarna officially revived its highly anticipated IPO, and cryptocurrency exchange Gemini also announced plans for a public offering. The offerings follow Chime and Circle's blockbuster IPOs in June.

-

The Cleveland-based credit union recently launched a fractional stock rewards program for members ages 18 to 28 through a partnership with Bits of Stock.

-

Buy now/pay later lender Affirm hit profitability goals for its fiscal year 2025 and set aggressive guidance for fiscal 2026 ahead of Wall Street's estimates. Its stock soared more than 10% Friday.

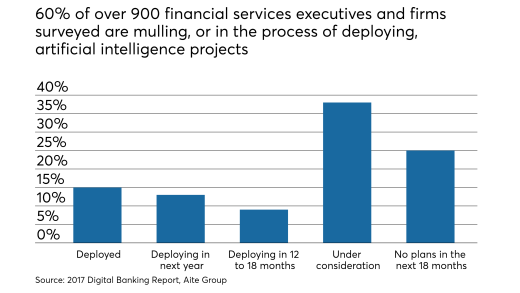

The two bills would require banking agencies to study artificial intelligence and its application in the banking sector, and would codify findings from an earlier AI working group formed by the committee.

On Thursday, the two banks disclosed a presentation that seeks to reinforce the strategic rationale behind the proposed $8.6 billion deal.

The Federal Reserve Friday issued a set of proposed changes to its stress testing program for the largest banks that would disclose the central bank's back-end stress testing models, a move that the Fed had long opposed out of fear of making the tests easier for banks to pass.

-

With vast amounts of capital locked in privately held companies, both employees of those companies and average investors would benefit from a loosening of the rules restricting private investment.

-

The decision to stop requiring U.S. companies to report beneficial ownership information is misguided. The compliance burden could be substantially eased by collecting the data at the state level.

-

Financial inclusion cannot be allowed to become a meaningless set of buzzwords. Strong economic growth and future prosperity hinges on the ability of everyone in society to access financial services.

-

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

-

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

-

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

-

It's not just Capital One Cafés; banks all over the country are repurposing branches and offices. Marketing experts call it innovative, but critics say some lenders are crossing a legal boundary between banking and commerce.

-

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

-

Stories about data breaches, fraud and one neobank were reader favorites this year.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

Defenses against financial schemes, both physical and digital, could leave executives scrambling to keep up with the pace of bad actors over the coming months.

Virtual reality and agetech devices were among the consumer electronics devices that caught the attention of U.S. Bank Chief Innovation Officer Don Relyea and Head of Research and Development, Innovation Todder Moning.

The 23rd annual ranking of women leaders in the banking industry.

- Sponsor Content from Chargebacks911

-

- Sponsor Content from Finzly

-