-

New York’s banking regulator ordered Habib Bank Ltd. to pay $225 million and surrender its license to operate in the state, effectively removing Pakistan’s largest lender from the U.S. financial system.

September 7 -

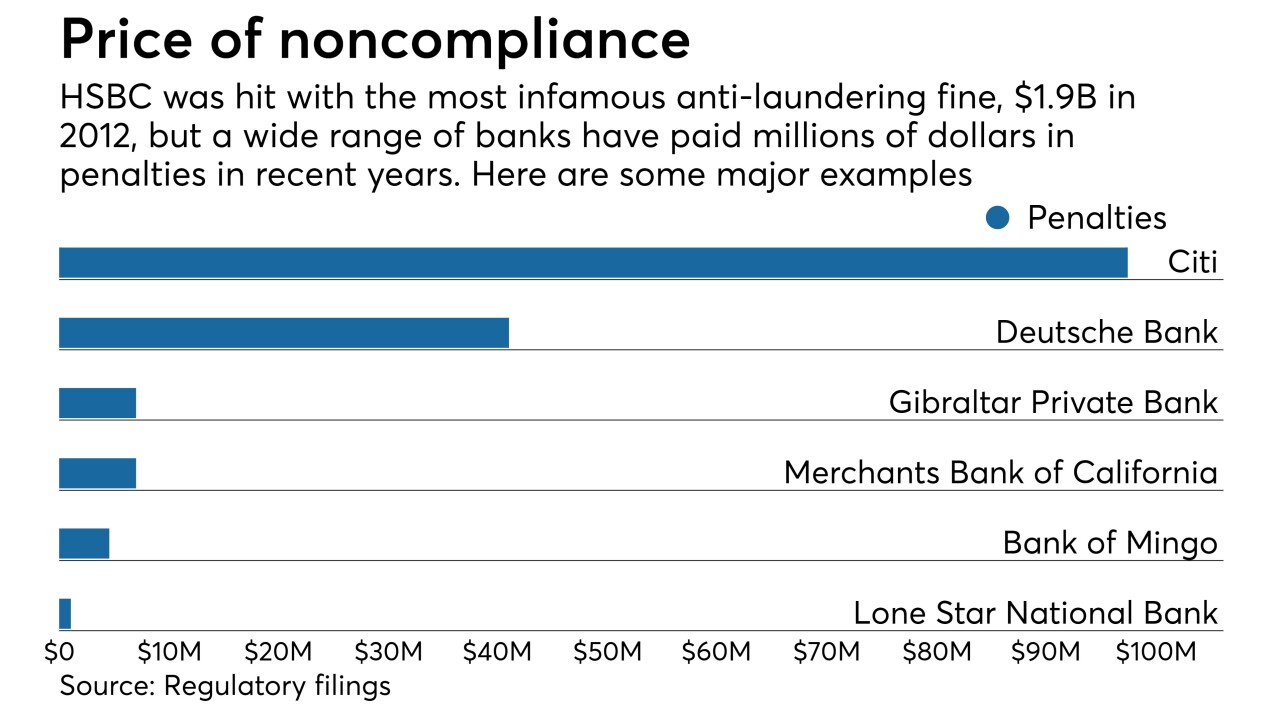

Nothing like revelations of a client’s Ponzi scheme that lead to your bank paying $4 million in anti-money-laundering fines. That’s what happened at Gibraltar Private Bank & Trust, but its CEO argues its compliance overhaul has given the bank a competitive advantage in cosmopolitan New York and South Florida.

September 5 -

The 3-year-old order was related to Discover Bank’s programs for combating money laundering. A related agreement with the Federal Reserve Bank of Chicago remains in effect.

August 30 -

A data-driven approach to money laundering prevention can help increase profits and improve regulatory compliance, writes Edmund Tribue, risk and regulatory practice leader at NTT Data Services.

August 30 NTT Data Consulting

NTT Data Consulting -

CFPB and OCC are looking at auto lenders’ policies regarding so-called GAP insurance; banks want greater collateral from retailers.

August 29 -

Payment processors and banks are being called on to cut off funds to white supremacist groups, but there are practical and legal limits to what firms can do.

August 17 -

Basel Institute says enforcement is the problem; wealth adviser says bank steered clients away from her to white colleagues and blocked her promotion.

August 17 -

The Commonwealth Bank of Australia money-laundering scandal has damaged the public's perception of the whole banking sector, according to the head of the industry's lobby group.

August 15 -

Democrats sent a letter to House Financial Services Committee Chairman Rep. Jeb Hensarling, R-Tex., asking that he investigate potential financial ties between President Trump and Russia.

August 11 -

Stephen Sanger is expected to leave as nonexecutive chairman; Barry Rodrigues, a former Citigroup and American Express executive, will join the British bank in November.

August 11