Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

Credit union trade groups said the regulator’s spending plan indicates the agency isn't listening to feedback and needs to make further cuts while providing more support for de novos.

December 17 -

Tonia Clark will leave Las Colinas FCU to take the helm of $116 million-asset Allied.

December 16 -

Columbus Metro Federal Credit Union members will have access to more products, including commercial loan services, and 14 branches with the merger.

December 15 -

Lawmakers and the credit union regulator have packed schedules this week as both groups attempt to wrap up their 2020 business before the holidays.

December 14 -

Ayn Talley will step down in January, to be succeeded by the credit union's longtime executive vice president.

December 11 -

The credit union regulator's monthly meeting will cover the agency's budget proposal and subordinated debt, among other items, along with taking another shot at an overdraft proposal that was rejected earlier this year.

December 11 -

The process will see the state's largest credit union split its president and CEO roles until longtime chief executive John Reed retires in January 2023.

December 10 -

To improve a declining rating in the annual American Consumer Satisfaction Index, credit unions may have to make hefty investments in technology upgrades, something most of them can't afford.

December 10 -

Canoga Postal's merger plans mark the second consolidation in a month for institutions serving USPS employees.

December 8 -

This could be the final opportunity for Congress to extend a pair of key measures for credit unions that took effect earlier this year.

December 7 -

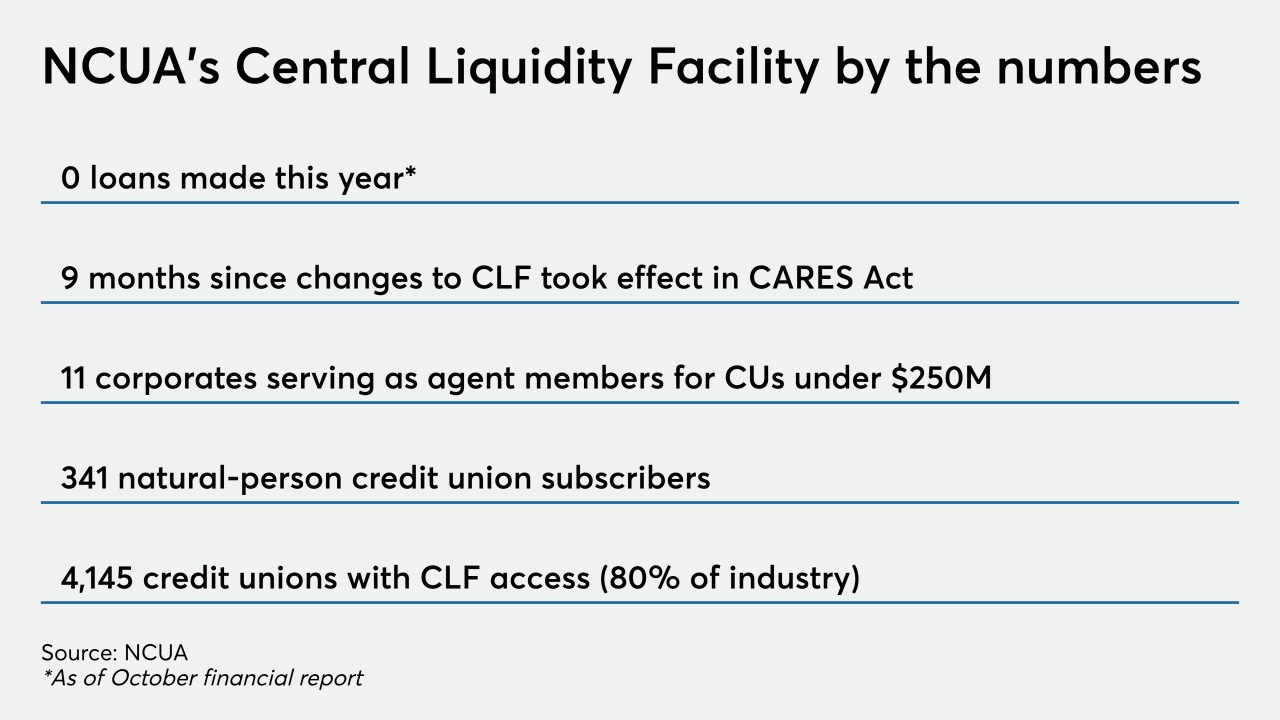

Thousands of institutions could lose a safety net on New Year's Day if Congress fails to act before leaving for the holidays.

December 7 -

Members of tiny Gloucester Municipal CU are set to vote early next year on whether to join Metro Credit Union.

December 3 -

Board member Todd Harper was concerned that the credit union regulator was not adequately preparing for the impact of prolonged economic turmoil and could be caught "flat-footed" as it was heading into the last crisis.

December 2 -

The confirmation ensures Republicans will hold the majority vote at the credit union regulator until at least 2023.

December 2 -

The credit union regulator's budget briefing could produce fireworks, but possible Senate action could make the result of an eventual budget vote a foregone conclusion.

November 30 -

The biggest questions following the former chairman's resignation aren't about regulation but whether the agency can recapture a spirit of bipartisanship and collaboration.

November 24 -

New analysis from CEO Advisory Group shows the asset size of merged institutions rising along with the number of mergers.

November 23 -

It remains unclear how Mark McWatters's departure will impact the credit union regulator, and there is growing evidence that the country could face a "double-dip recession."

November 23 -

The annual survey from the National Credit Union Administration shows credit unions making gains in some of their inclusion efforts, but the industry still has much it can do to improve.

November 23 -

The former chairman recently butted heads with colleagues over the agency’s budget plans, and the Senate is expected to vote to confirm a successor early next month.

November 20