Aaron Passman is editor of Credit Union Journal, the nation’s leading credit union news resource. He was appointed editor in 2018 after two years as an assistant editor at CUJ and nearly five years as a reporter there. He has worked as a staff writer or freelancer for a variety of publications across the country and is a graduate of the University of Kansas.

-

The Iowa Republican followed one term in the Senate with six years as chairman of the credit union regulator.

November 16 -

Credit unions will have their first opportunity to hear from the federal regulator about its recently released budget proposal and also get an update on the agency's diversity self-assessment.

November 16 -

The pandemic has altered a variety of consumer behaviors, and that could make a difference in what sort of interchange and interest revenue financial institutions see in their credit and debit portfolios as they close out 2020.

November 16 -

Savings to the credit union regulator's operating budget are largely the result of surplus funds from 2020 and expected reductions in travel into next year.

November 13 -

Members of $5.3 million-asset WJC Federal Credit Union will vote to merge into $3.2 billion-asset Truliant FCU, based in North Carolina.

November 13 -

Kathie Kasper spent 24 years at the Livermore, Calif.-based institution, having started as a teller in 1976 and ultimately rising to the level of chief executive.

November 13 -

The deal, intended to bolster CUNA Mutual's digital capabilities, is the company's second such move in a month.

November 12 -

Bill Bynum, president and CEO of Hope Federal Credit Union, and Gail Laster, former director of the National Credit Union Administration's consumer protection division, are working with the incoming administration.

November 11 -

The chairman of the National Credit Union Administration said during his limited time in a Senate Banking Committee hearing that he hoped changes to the agency's Central Liquidity Facility would last for the duration of the pandemic.

November 10 -

The deal, PenFed's second merger announcement with a significantly smaller credit union, would expand its footprint into the Midwest.

November 10 -

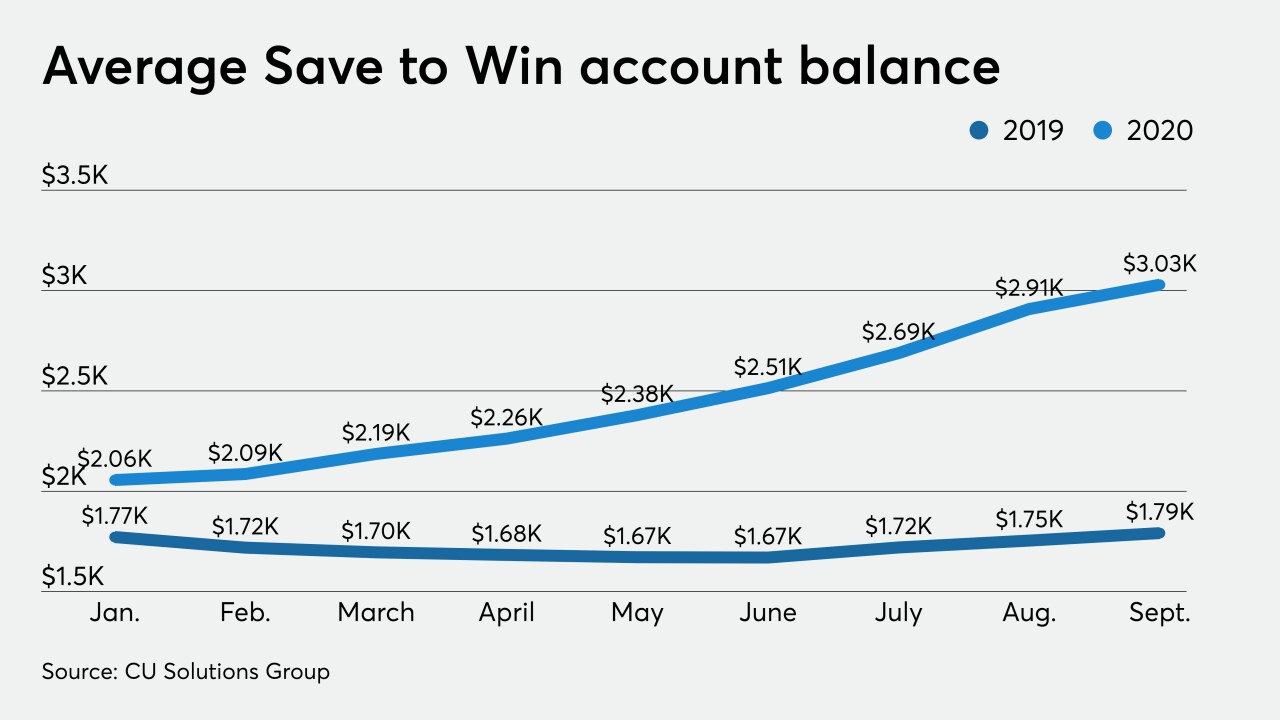

Many credit unions offer these accounts to help members improve their financial behaviors, but some in the industry are wondering how long the surge could last.

November 10 -

Gov. Laura Kelly has nominated Vickie Hurt to succeed Jerel Wright, who will step down Nov. 28.

November 9 -

Todd Sheffield has announced his intention to step down from the Santa Rosa, Calif.-based institution, which he has led since 2003.

November 9 -

The industry is calling for lawmakers to extend changes to NCUA's Central Liquidity Facility and more before Congress adjourns.

November 9 -

Muhlenberg Community Hospital CU said in a notice to members it needed a merger partner in part because it did not have the resources to keep up with monitoring for "cybersecurity and terrorism activities."

November 6 -

If the deal is approved, the $6.4 million-asset credit union would drop its federal share insurance upon joining Towpath Credit Union.

November 5 -

As lawmakers look for ways to plug budget gaps, credit union groups are preparing for a possible assault on the industry's tax exemption at the state and federal level.

November 5 -

The new initiative is aimed at boosting credit union innovation through investments in fintech and other areas.

November 4 -

A new service from NCR aims to reduce surface transmission of the coronavirus through the application of an antimicrobial cleaning product that kills germs.

November 3 -

A deal bringing Charleston County Teachers Federal Credit Union into the fold is South Carolina Federal’s third acquisition of 2020.

November 3