Brendan Pedersen covered Capitol Hill and regulatory politics for American Banker until September 2022. From 2019-2021, he covered the Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency as well as fintech policy. Originally from Chicagoland, he was previously a staff writer for Kiplinger's Personal Finance and covered local business affairs in Denver, Colorado for BusinessDen.

-

A group of eight Attorneys General filed suit against an FDIC final rule related to ‘rent-a-bank’ partnerships, mirroring a similar suit filed against the Office of the Comptroller of the Currency last month.

August 20 -

The largest bank in the country is reportedly in negotiations to lease space from the U.S. Postal Service. One credit union group called the plan a Wall Street "power grab."

August 20 -

The largest bank in the U.S. is reportedly in negotiations to lease space from the U.S. Postal Service where it would have ATMs and perhaps take deposits.

August 19 -

The largest bank in the U.S. is reportedly in negotiations to lease space from the U.S. Postal Service where it would have ATMs and perhaps take deposits.

August 19 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

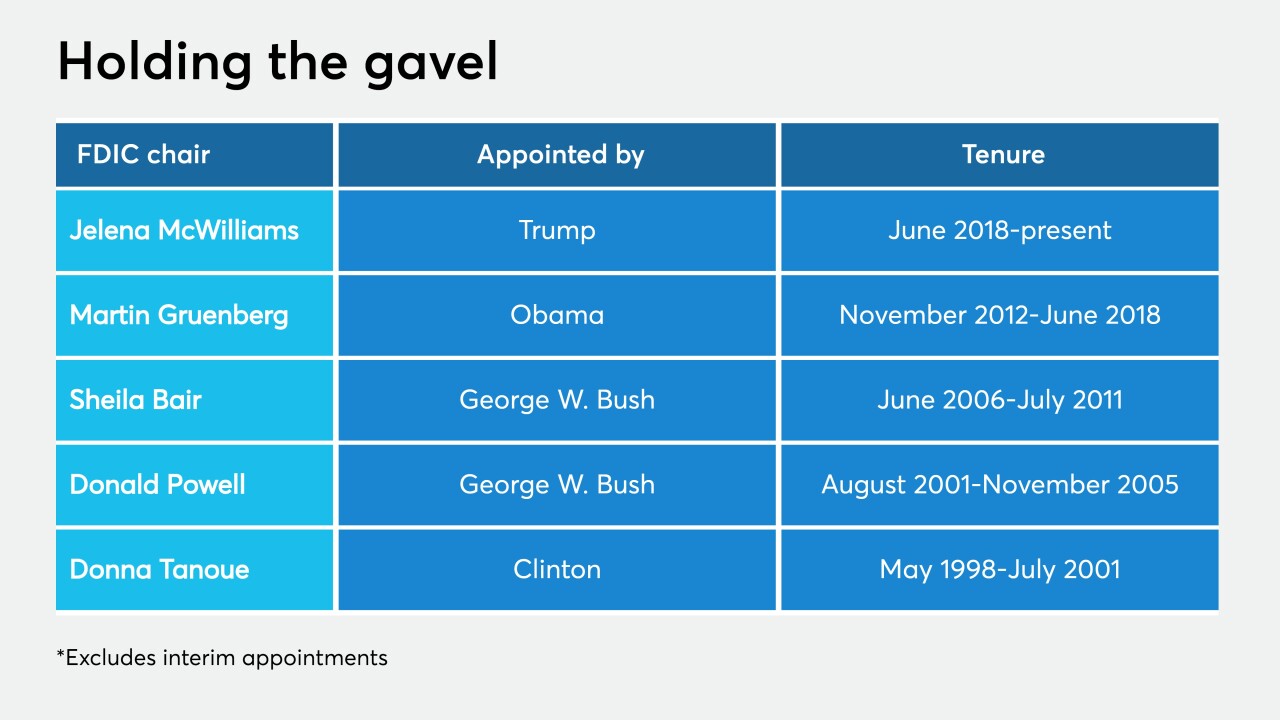

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

Appearing to support decentralized systems, the acting comptroller of the currency said on a podcast that "the ultimate public ownership of the payment rails is when you have a network, like the internet, of interconnected institutions and computers."

August 13 -

The regulator announced in June it would use call report data from before the crisis to calculate bank assessment fees in September, a one-time change.

August 7 -

Just as legal limbo has threatened the agency’s long-running effort to create a fintech license, a charter unique to payments companies could face a court challenge, observers say.

August 5 -

The Conference of State Bank Supervisors, banking law scholars and consumer advocacy organizations filed amicus briefs siding with the New York State Department of Financial Services in its court battle with the federal regulator.

July 31 -

Acting Comptroller of the Currency Brian Brooks said the agency plans to issue new assessment procedures within weeks as a follow-up to recent Community Reinvestment Act reforms. He also touched on the “true lender” issue and why the agency is considering a narrow-purpose payments charter.

July 30 -

Regulators are urging banks to offer small-dollar loans again and lifting existing restrictions on nonbank lenders. But the real challenge is making those loans favorable to consumers without losing money.

July 29 -

Seven trade groups said they would fight any effort by the agency to establish a tailored license for payments providers such as PayPal, Stripe and Square.

July 29 -

The three-month extension for the central bank's lending programs is one of several recent steps by policymakers to stabilize the economy as the coronavirus pandemic stretches through the summer.

July 28 -

The regulation allows banks to add employees with past convictions for trivial crimes after the industry complained the prior rules were too severe.

July 24 -

Responding to an unnamed bank that had sought the opinion, the regulatory agency issued an interpretive letter clarifying that an institution's custody services can be used for cryptographic keys and other digital currency-related assets.

July 22 -

Even though fewer cases are reported among the agency's employees compared to the government average, the watchdog said the Federal Deposit Insurance Corp. should improve its anti-harassment training and other procedures.

July 13 -

Backers say a bill to limit asset growth instead of restricting brokered funds addresses concerns about expanding balance sheets at troubled banks. But skeptics worry it would open the door to greater risk.

July 8 -

The investment firm is the latest nonbank to try to enter banking through a Utah-based ILC.

July 2 -

The so-called tech sprint involving 20 companies from across the country is intended to help improve the efficiency of banks' quarterly data submissions to the regulators.

June 30