-

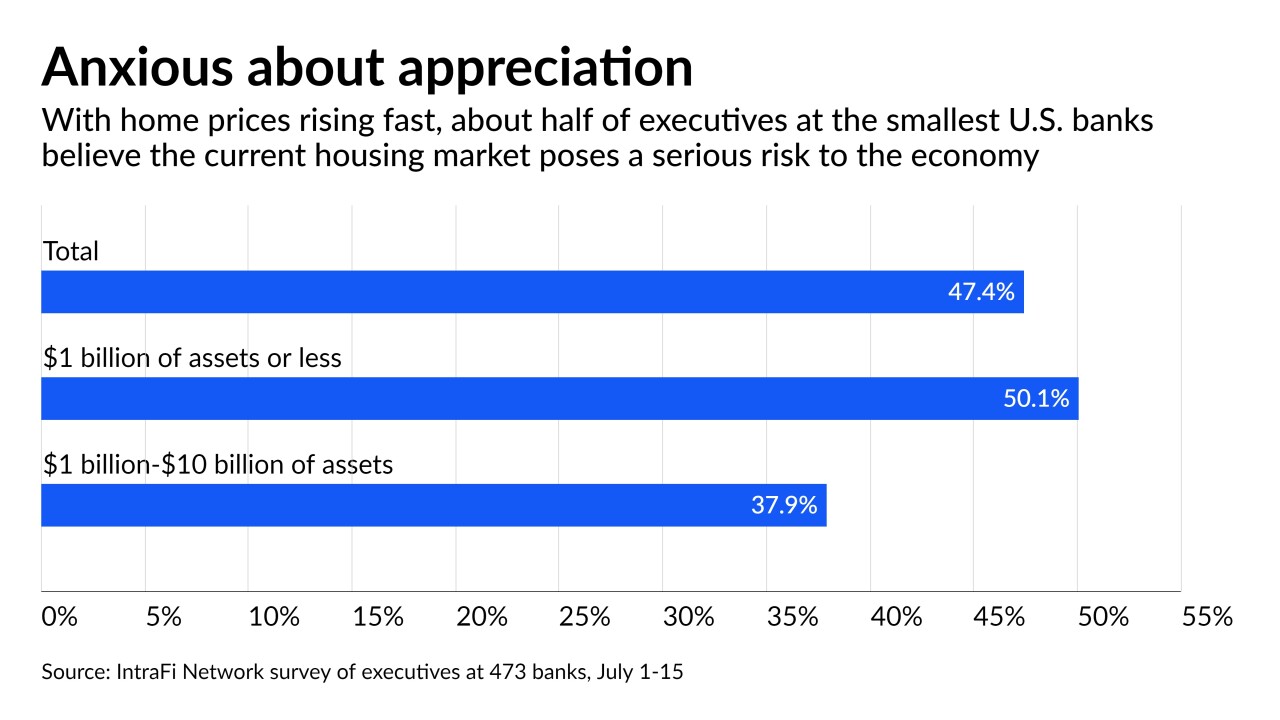

The very smallest banks, whose numbers shrank during the financial crisis, were most likely to express concern that the housing market will imperil the broader economy.

By Jon PriorJuly 27 -

The Wisconsin company’s growth initiative, expected to be unveiled by mid-September, will fund both a bigger commitment to online banking products and a push to expand in new and existing markets.

By Jon PriorJuly 23 -

As an investigation into its relationship with a former District of Columbia city councilman nears its end, the Maryland company has confirmed that Chief Financial Officer Charles Levingston has received a notice from the Securities and Exchange Commission signaling a potential enforcement action against him.

By Jon PriorJuly 22 -

Comerica, which focuses on the energy sector, reported strong payment trends last quarter, while M&T, which concentrates more on real estate, showed deterioration. The divergence reflects varying exposures to sectors hit hard by the COVID-19 recession.

July 21 -

The bank is planning to make product changes and roll out new digital tools that will allow customers to avoid the charges, according to CEO Kevin Blair.

By Jon PriorJuly 20 -

BNY Mellon and State Street have been granting millions of dollars in discounts to ensure investors in money market mutual funds stay in the black. Recent moves by the Fed are expected to relieve the pressure.

By Jon PriorJuly 19 -

PNC’s recent acquisition of BBVA's U.S. operations won quick approval from regulators, but a recent presidential directive promises more scrutiny of such deals, according to CEO Bill Demchak.

By Jon PriorJuly 14 -

PNC, Regions and TD are among the banks that have taken steps to reduce their reliance on charges that disproportionately hit consumers living paycheck to paycheck. The changes come at a time when the Biden administration is expected to take a tougher stance on overdrafts.

By Laura AlixJuly 13 -

The fintech, which arranges point-of-sale loans in partnership with merchants, was fined $2.5 million by the Consumer Financial Protection Bureau and ordered to refund up to $9 million to consumers who received loans they never applied for.

By Jon PriorJuly 12 -

The White House is calling on the Department of Justice and federal regulators to give bank deals more scrutiny as part of a broader executive order meant to encourage competition across the U.S. economy.

By Jon PriorJuly 9 -

The Minneapolis company has agreed to buy PFM Asset Management. Like many in the industry, it is hunting for additional sources of noninterest income.

By Jon PriorJuly 8 -

Community banks support legislation that would exempt them from paying tax on interest earned from farmland loans, arguing it would make them more competitive with government-backed lenders and expand access to credit in rural areas.

By Jon PriorJuly 2 -

Andrew Harmening, who took the helm of the Wisconsin company in April, pointed to an economy emerging from the pandemic and waning loan deferrals, saying that loan growth could resume by the end of the third quarter.

By Jon PriorJuly 1 -

Nine of the 12 largest banking companies in the U.S. proposed higher quarterly payouts to shareholders. In announcing the actions, the banks touted their strength after more than a year of economic dislocation.

By Polo RochaJune 28 -

Some of the 23 large banks that participated in last week’s stress tests will be better positioned to reward shareholders than others, since they padded their capital amid the pandemic. Still, all are expected to tread cautiously amid ongoing economic uncertainty.

By Jon PriorJune 28 -

Four companies — Regions Financial, MUFG Americas Holdings and the U.S. arms of the Royal Bank of Canada, BMO Financial— felt they had something to prove to the Federal Reserve after being assigned higher capital buffers than most of their peers last year. Will their decisions pay off for shareholders?

By Jon PriorJune 24 -

Splash recently raised $44 million from investors. It plans to use the funds to aid small institutions that lack the resources to build their own loan platforms but are flush with deposits and looking for new lending opportunities.

By Jon PriorJune 23 -

In a reversal of a Trump-era decision, the Consumer Financial Protection Bureau says it has the legal authority to test lenders for potential violations of a law protecting military borrowers.

By Jon PriorJune 16 -

Inventory shortfalls continue to constrain commercial lending, while the savings glut is holding back consumer borrowing, industry executives say. The good news: At some banks, pipelines are at or above pre-pandemic levels.

By Jon PriorJune 16 -

The bank has its eye on younger cardholders who are ready to spend more heavily now that pandemic restrictions have eased.

By Jon PriorJune 10