-

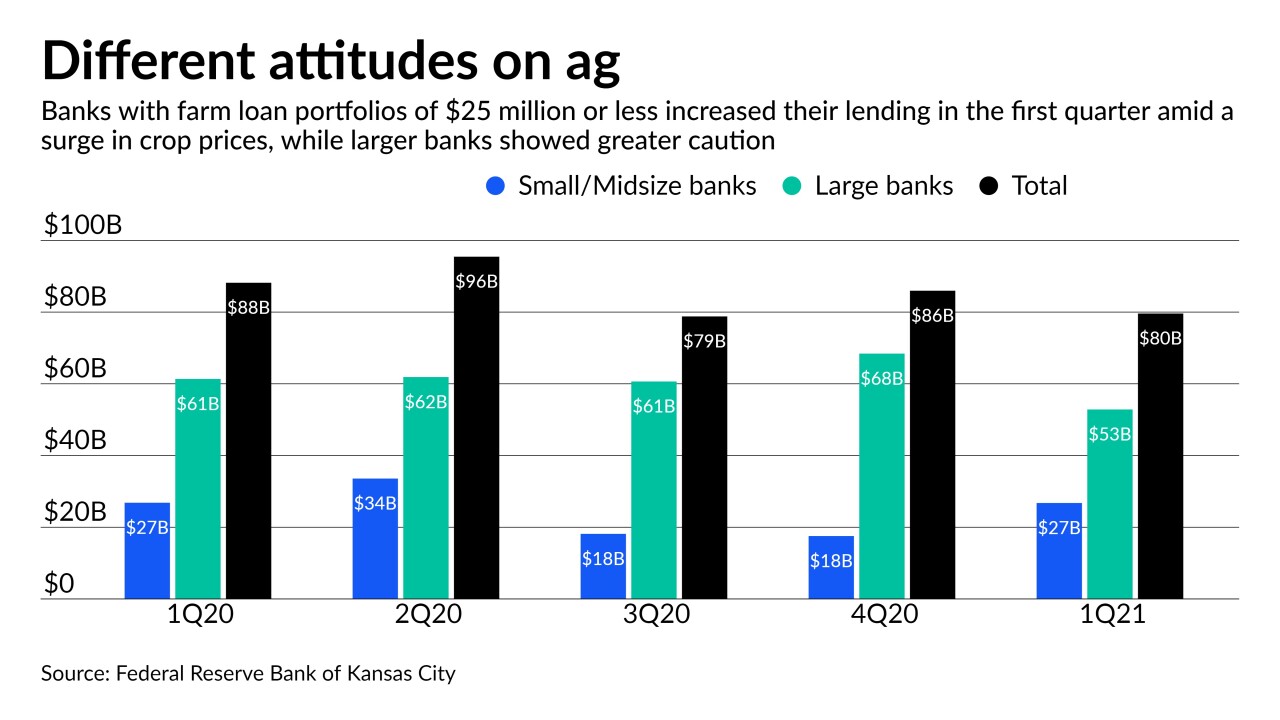

Smaller lenders have proved more aggressive than their larger rivals in making new loans during the farm country rebound. Market watchers warn that the price boom may not last.

By Jon PriorMay 5 -

The Texas company kept allowances steady, citing lingering concerns over the pandemic and commercial real estate. Yet it plans to open 25 offices in Dallas after a similar expansion in Houston drove asset and customer growth.

By Jon PriorApril 29 -

Looming defaults and the potential for heavier regulatory scrutiny have prompted banks to pull back from the sector. Is that a good thing?

By Jon PriorApril 28 -

The company’s retail banking and auto-lending businesses in the U.S. generated a larger share of overall profits in the first quarter, and Executive Chairman Ana Botín and other executives unveiled expansion plans for both units.

By Jon PriorApril 28 -

The investment, tied to PNC's deal to acquire BBVA USA, was always going to be large but seemed to grow as CEO Bill Demchak got intimately involved in the discussions and the needs of communities and businesses hit hard by the coronavirus pandemic became more apparent.

By Jon PriorApril 28 -

Oil and gas companies — flush with cash from rising oil prices — are catching up on debt payments and will seek new credit later in the year as the economy recovers, the Oklahoma company says.

By Jon PriorApril 21 -

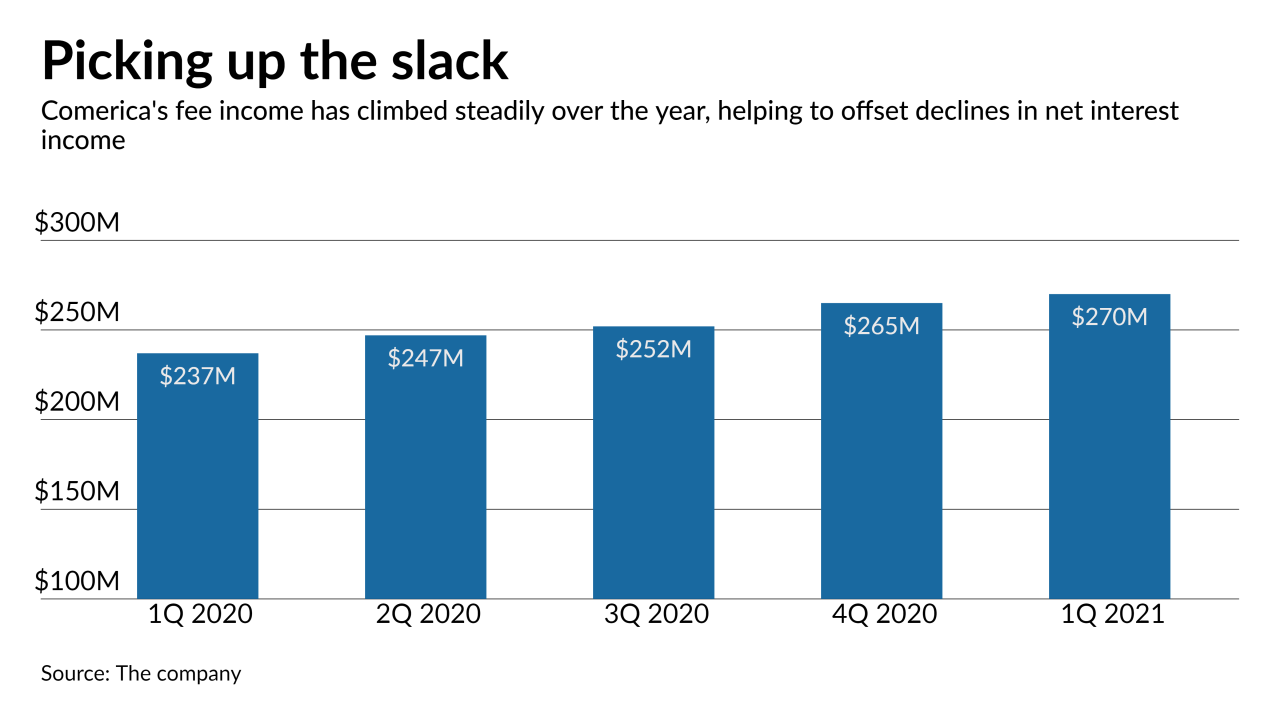

At Comerica and Synovus, higher fees from cards, mortgage banking and other sources helped to offset declines in net interest income.

By Jon PriorApril 20 -

The leaders of Citizens Financial and Truist predict lending will bounce back in the second half of 2021 as the economy normalizes. But PNC chief Bill Demchak says there are scant signs that businesses are gearing up for a rebound.

By Jon PriorApril 16 -

The San Antonio company will no longer charge fees on transactions of $100 or less that take checking account balances into negative territory, as long as the customer has a $500 monthly direct deposit set up.

By Jon PriorApril 15 -

The Charlotte, N.C., company has shuttered 400 branches in the past year and intends to close nearly 500 more by early 2022. It’s also eliminating office space and reducing headcount as it aims to keep quarterly expenses under $3 billion.

By Jon PriorApril 15 -

Loan growth and wealth management revenue drove a 53% increase in the San Francisco bank's profit from a year earlier.

By Jon PriorApril 14 -

The company will give retail account holders 24 hours to cancel upcoming payments that would put them in the red. The move addresses customers’ top gripe and will have benefits that offset the lost income, executives say.

By Jon PriorApril 13 -

Other fintechs’ rush to become banks is being driven by investors seeking “crazy returns," says CEO Dan Price. But he acknowledged that at some point Gravity may need a charter of its own to remain competitive.

By Jon PriorApril 9 -

In his annual message to investors, the JPMorgan Chase CEO said Big Tech and fintechs are "here to stay" and vowed to be aggressive in taking on these new challengers. He also predicted that the economy would take off this year, but said capital rules prevented banks from doing more to help blunt the impact of the pandemic recession.

By Laura AlixApril 7 -

The scheduled meeting with members of the House Financial Services comes at a time when large banks are warning of significant losses tied to the derivatives blowup at the hedge fund Archegos Capital.

By Jon PriorApril 6 -

Bankers are already working on marketing materials and new products for commercial borrowers that might secure government contracts under President Biden's $2 trillion American Jobs Plan.

By Jim DobbsApril 5 -

Caroline Taylor, who recently ran Small Business Administration lending at Capital One, aims to expand her team at Regions, help steer borrowers into economic recovery and reach out to women and minority small-business owners who have been underserved.

By Jon PriorMarch 31 -

Activist investors are pressuring big banks to further curtail lending to the fossil-fuel industry, undergo so-called racial-equity audits and disclose more about their lobbying practices and financing of nuclear weapons manufacturers.

By Jon PriorMarch 30 -

Bank of America, Wells Fargo and JPMorgan Chase also received high marks for transparency in reporting how they are paying women and employees of color, but Goldman Sachs, KeyCorp and Citizens Financial Group still have work to do, according to the advocacy investor firms Arjuna Capital and Proxy Impact.

By Jon PriorMarch 23 - LIBOR

Legacy contracts using the London interbank offered rate — which is set to be phased out at the end of this year — were granted a reprieve to mid-2023. However, there is no wiggle room on when the rate will expire for new deals, said Federal Reserve Vice Chairman Randal Quarles.

By Jon PriorMarch 22