-

The Tampa-based institution says it is poised for growth, but the new asset class also opens it up to additional scrutiny from the CFPB.

June 10 -

The payments space is expected to see continued consolidation, new fraud patterns and more contactless cards for the second half of 2019.

June 10 -

April Tompkins has been chief operating officer at the South Dakota-based institution for three years.

June 4 -

The revised statute provides clarity on director travel, supervisory committees, conservatorship and more.

May 30 -

The industry is so worried that a proposed FCC rule could hamper communications with members that some trade groups are seeking help from an unlikely ally -- the Consumer Financial Protection Bureau.

May 30 -

Having already recently absorbed Los Angeles-based Cedars-Sinai FCU, Credit Union of Southern California is now set to pick up tiny FedONE FCU.

May 29 -

A closer look at a new plan from the Department of Labor still finds room for improvement, but is generally seen as markedly better than Obama-era rule that was rejected at the last minute.

May 23 -

The McLean, Va.-based institution said that its capital hit a record $2.5 billion last year.

May 23 -

The Alabama-based CU will continue to look for a permanent replacement for longtime CEO, who is retiring in June.

May 22 -

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

Credit unions on the Corda blockchain platform will be able to make payments via EFT with CU Pay, a product the CUSO plans to roll out next year.

May 21 -

From data analytics to focusing on a service culture and more, here's a look at how technology is radically remaking lending.

May 20 -

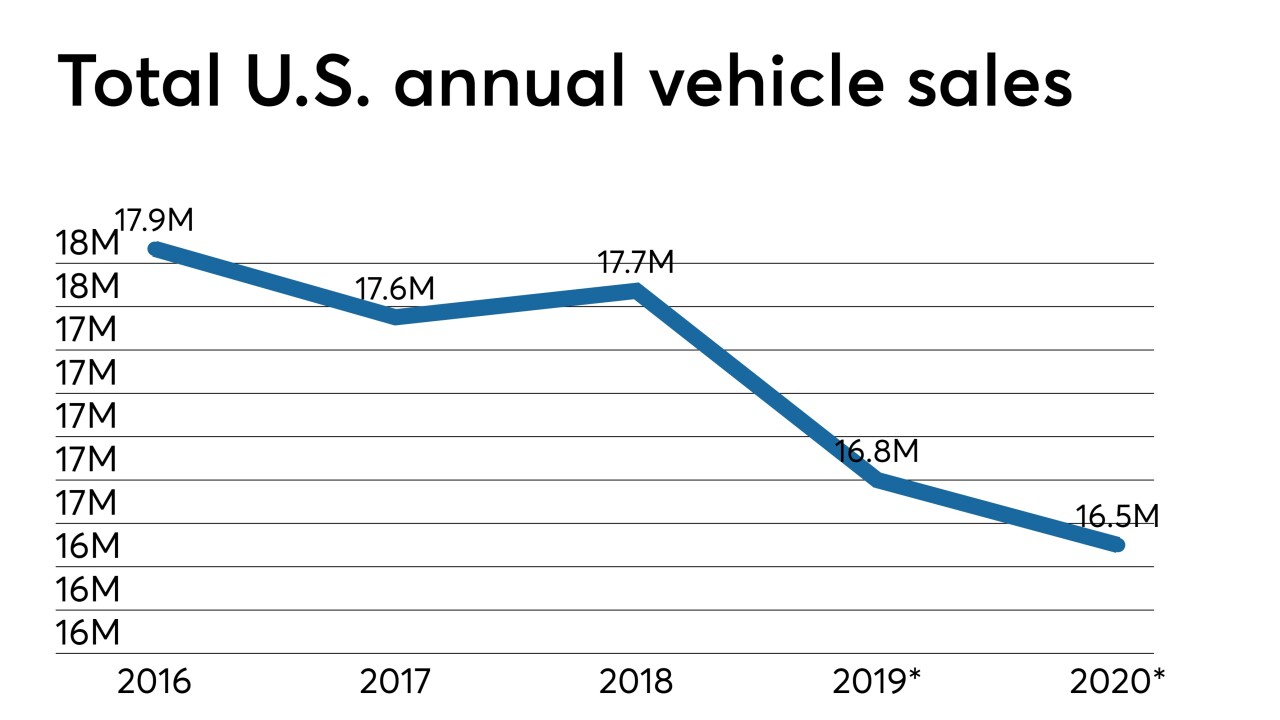

Two economists speaking during CU Direct's recent Drive conference in Las Vegas offered predictions on how a variety of economic factors could impact credit union auto lending portfolios in the not-too-distant future.

May 20 -

The first day of CU Direct's annual Drive conference included insights from dealers, executives at online car-buying platforms and more.

May 16 -

From availability issues to regulatory hurdles and changes in marketing strategies, dealers say there is plenty credit unions can do to improve relations between the two sides.

May 16 -

The new initiative could help expose American credit unions to best practices in biometrics, payments and monitoring collateral from their counterparts in Africa, Asia and beyond.

May 16 -

The industry has long complained that gathering the data is confusing and costly but two plans issued by the CFPB could help lighten the burden for a significant portion of credit unions.

May 10 -

A new study shows credit unions are confident about their ability to comply with recent changes to FinCEN guidance, but a closer look shows some concerns linger, especially regarding training front line staff.

May 8 -

The credit unions, all of them small institutions, will pay a total of $4,069 in penalties for tardy submission of Q3 2018 all reports.

May 7 -

A recent study shows credit unions are likely to be increasingly reliant on vendor partners if they want to maximize efficiency and security in the account-opening process.

May 7