-

Bill to end the guidance intended to fight discriminatory lending now goes to the House; card company’s push to make more loans to customers pays dividends.

April 19 -

Passage of a resolution blocking guidance on auto loan pricing could set a precedent that allows Congress to nullify other long-past regulatory issuances.

April 18 -

The Senate voted Wednesday to block guidance issued by the Consumer Financial Protection Bureau in 2013 that was meant to stop discriminatory markups on indirect loans made by car dealers.

April 18 -

The Senate is expected to pass a bill that would ax controversial guidance on loans at car dealerships; lower tax rate may have skewed year-on-year comparisons.

April 18 -

As the Senate closes in on overturning the Consumer Financial Protection Bureau's 2013 indirect auto loan rule, a central question is how lasting the congressional measure will be in limiting the CFPB's authority.

April 17 -

Lawmakers should not toss out an agency rule aimed at curbing auto dealer markups that adversely impact borrowers of color.

April 17

-

Sixty-four consumer groups are speaking out against a Senate measure, expected to be voted on this week, that would overturn the Consumer Financial Protection Bureau's 2013 regulation on discriminatory pricing by auto lenders.

April 16 -

A 28% increase in lease assets helped offset stagnant growth in traditional auto lending.

April 13 -

Concerned about rising default rates, banks "significantly" tightened underwriting in the first quarter, the Bank of England said in a report published Thursday.

April 12 -

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9 -

The subprime auto lender failed to disclose that it received fees for referring borrowers to CarMax, the used-car dealer, according to California's financial regulator.

April 6 -

The St. Louis-based company partnered with 38 new credit unions last fiscal year.

April 6 -

The Auburn Hills, Mich.-based credit union serves 200,000 members with more than $2.3 billion in assets.

April 6 -

Growing numbers of small subprime auto lenders are shutting down after loan losses and slim margins spur banks and private equity owners to cut off funding.

April 6 -

Late-payment rates at banks declined in nine out of the 11 consumer loan categories tracked by the American Bankers Association, including credit cards, auto loans and personal loans.

April 4 -

While the banking industry is divided on the use of conversational technology, the San Francisco company believes chatbots can make it easier for customers to discuss their finances.

April 3 -

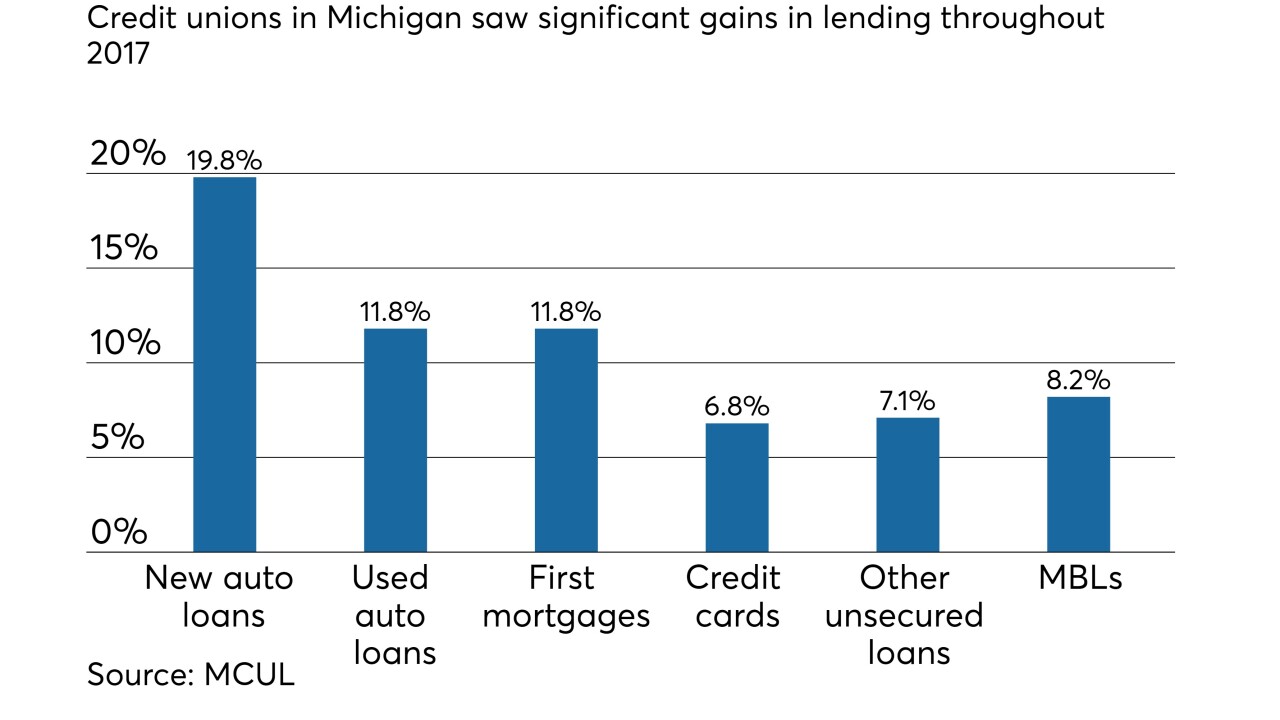

Credit unions in Michigan saw significant gains in Q4 2017, as CUs there ended the year with significant boosts to membership and lending.

March 28 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts robust membership growth in the year ahead and sustained lending growth due to positive economic factors.

March 26 -

The Federal Reserve raised interest rates by a quarter-point at its Wednesday meeting and more increases are expected this year. Here's what credit unions need to know to be prepared.

March 21 -

As it expands to the West Coast, the bank will first target car dealers at which it is already an indirect consumer lender.

March 14