-

Eagle is trying to debunk claims by Aurelius Value that CEO Ronald Paul and other directors are involved in an insider loan scheme. Eagle dismissed the report as an effort by short sellers to manipulate its stock.

December 4 -

The court decision regarding the “valid when made” doctrine moved us further away from creating a more effective and inclusive financial system.

December 4 Fenway Summer

Fenway Summer -

Umpqua has taken a cue from other regionals that have found success in investment banking.

December 1 -

Richard Cordray won’t be around anymore to keep an eye on the fintech sector. The question now is: Who will?

December 1 University of Iowa College of Law

University of Iowa College of Law -

Ware has been named a 2017 Banker of the Year award winner for transforming the family-owned bank into a highly profitable community lender that takes calculated risks and prides itself on treating employees and customers well.

November 29 -

Partnerships with financial technology companies could be effective in helping banks meet small-dollar credit demand, but those partnerships face a legal cloud. Thankfully Congress is considering adding needed clarity.

November 29 -

The pilot could help the agency improve its image after past criticism of slow responses to catastrophes.

November 28 -

A New York banker who mastered the art of buying low and selling high, broke industry norms and learned from his mistakes in commercial real estate, Kanas became a model regional bank builder and a central figure in the post-crisis recovery.

November 27 -

Citing the dim financial outlook for a business it entered just six years ago, the Wayzata, Minn., company will stop making auto loans on Dec. 1.

November 27 -

After success in residential solar, the San Jose, Calif.-based credit union is financing solar systems for businesses.

November 27 -

Beth Mooney is taking KeyCorp to new heights through bold dealmaking and with a relentless commitment to doing what's right for customers, employees and communities.

November 26 -

The British banking giant has been testing its new online lending platform with a handful of its U.S. customers and plans to roll it out in full force next year. It's all part of a broader effort to expand its U.S. consumer business beyond credit cards.

November 21 -

The Michigan company, which lost more than $1.4 billion in the aftermath of the financial crisis, is trying to become more of a commercial lender. Its recent agreement to buy a deposit-rich franchise in California could help it get there.

November 21 -

Jefferson Financial Credit Union in Louisiana struck a deal to bring in $12 million in secondary capital, which is believed to be the biggest haul to date for a credit union. Will it embolden other CUs to pursue similar fundraising efforts?

November 20 -

Lending -- and particularly member business lending -- in the two states continues to rise, according to new data.

November 20 -

Fed researchers purported to show that consumers who use peer-to-peer loans have bad financial outcomes, but questions quickly emerged about the data they used.

November 19 -

Jefferson Financial in Louisiana struck a deal to bring in $12 million in secondary capital, which is believed to be the biggest haul to date for a credit union. It could also embolden other credit unions to pursue similar fundraising efforts.

November 17 -

The report’s authors presented findings that seemed to reflect issues with the peer-to-peer lending industry, but they actually relied on data from a much broader category of loans.

November 17 Upstart

Upstart -

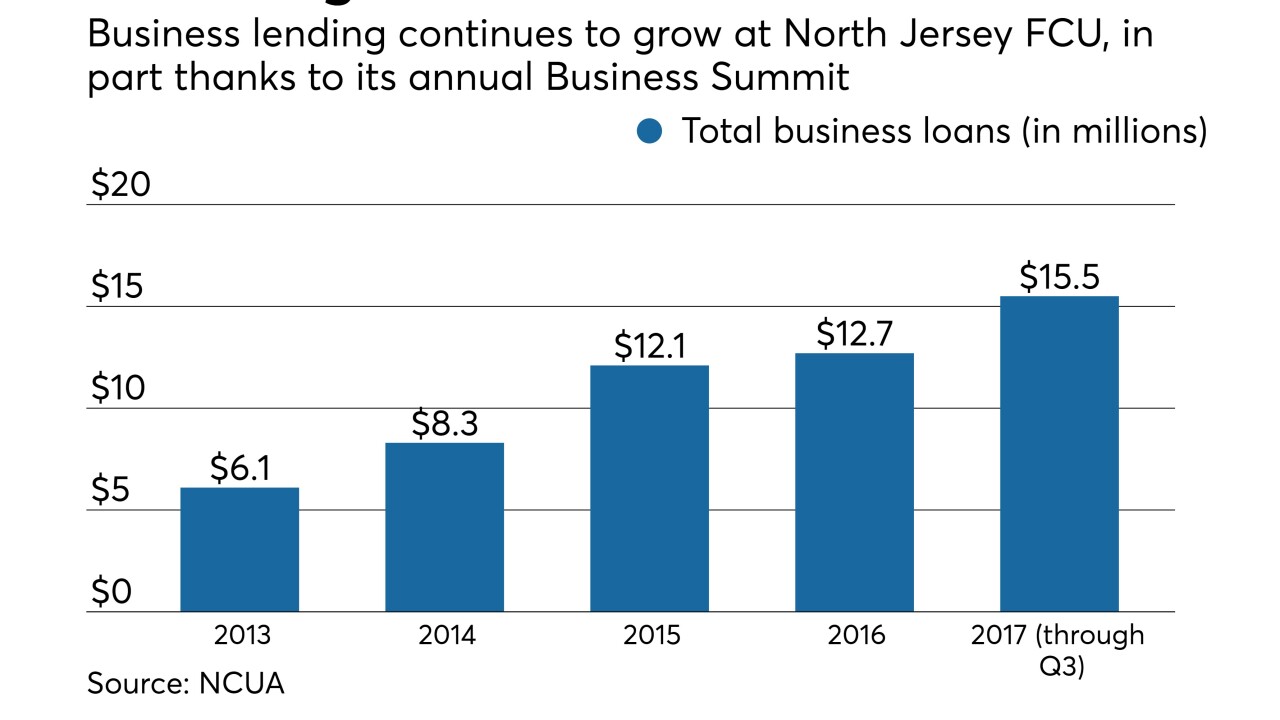

The credit union has hosted its annual Business Summit for the last seven years, and the event continues to grow in popularity.

November 17 -

Readers weigh in on the departure of Richard Cordray, debate whether online lenders are akin to subprime lenders, offer praise of a community banker, and more.

November 16