-

Net income fell 46% in the first quarter as the company added nearly $5 billion to its loss reserves in anticipation of a wave of loan defaults.

April 15 -

With the coronavirus pandemic bringing economic activity to a virtual standstill, BofA, like Wells Fargo and JPMorgan Chase, is shoring up its reserves to brace for a likely recession.

April 15 -

Online lenders, core providers and software companies have created digital platforms that speed up and simplify Paycheck Protection Program loans for businesses reeling from the coronavirus pandemic.

April 14 -

Its prediction that business conditions will remain weak this year — and into next year — stands in stark contrast to forecasts from political leaders that the economy will rebound quickly from the coronavirus pandemic.

April 14 -

Though hopeful for a second-half bounceback in the economy, JPMorgan Chase is prepared for 20% unemployment, lackluster GDP and losses in its loan portfolio that could reach tens of billions of dollars.

April 14 -

The results preview a tough first year for new CEO Charlie Scharf as the coronavirus pandemic brings the U.S. economy to a standstill.

April 14 -

The nation's largest bank set aside nearly $8.3 billion for bad loans, more than double what some analysts had expected.

April 14 -

Bank’s earnings fall 69% in the first quarter; this week’s earnings reports could determine whether banks will need to suspend dividends.

April 14 -

By helping borrowers now, banks hope customers can quickly catch up on payments once the coronavirus pandemic ends. If they can’t, interest income will remain low and charge-offs could pile up if the crisis drags on.

April 13 -

PayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

April 13 -

Just days after the Fed lifted Wells Fargo's asset cap so it could make more Paycheck Protection Program loans, it warned customers its queue is long and they may want to go elsewhere before program funds are exhausted.

April 13 -

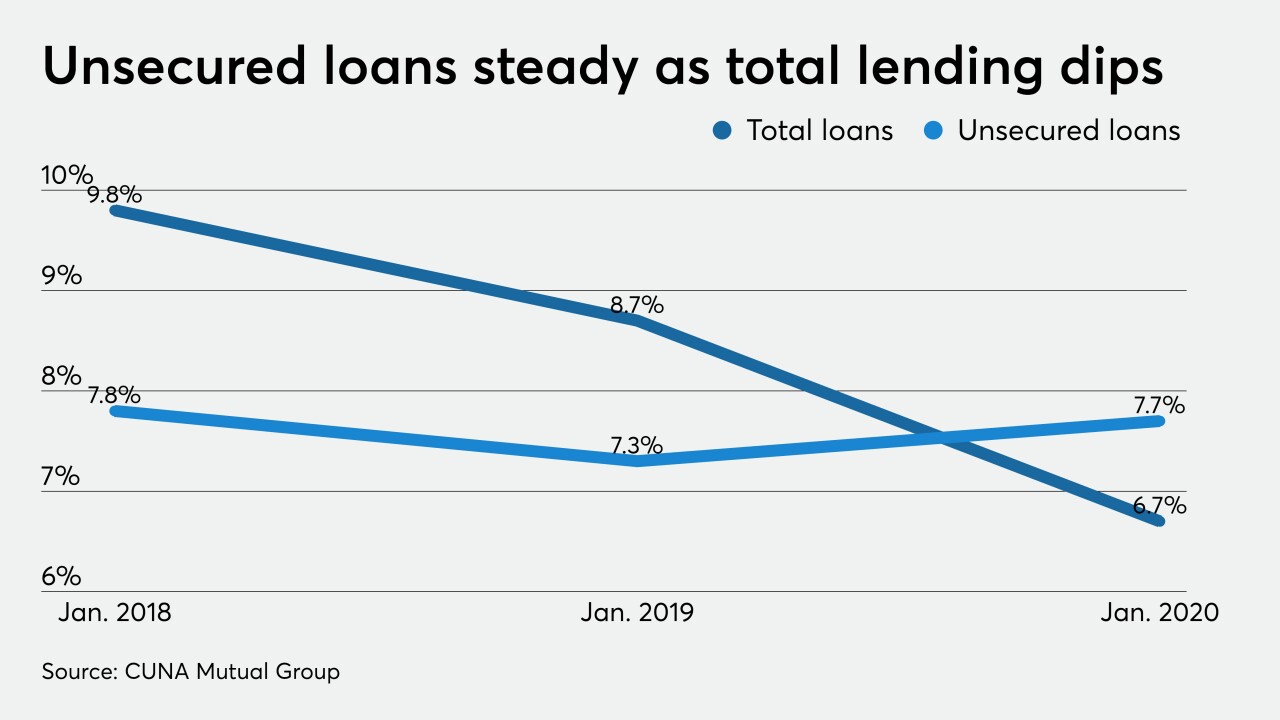

Banks, which previously shunned unsecured small-dollar lending, are now embracing the product because of the outbreak. It's just a matter of whether the shift is permanent.

April 13 -

After opening-day fiasco, SBA upgrades lender portal with Amazon assist; West Virginia’s First State Bank closed by regulators; BofA offers emergency loans to borrowers first, freezing out depositors; and more from this week’s most-read stories.

April 10 -

Bank of America, which came under fire for prioritizing applications from existing small-business customers, asked a federal judge in Baltimore to reject a request in a lawsuit to temporarily bar it from employing the practice.

April 10 -

Bankers say they’re still trying to figure out if the Fed’s complex loan-buying vehicles will help them cater to the needs of midsize commercial customers hammered by the economic shock from the coronavirus outbreak.

April 9 -

The week-old Paycheck Protection Program will be opened up to sole proprietors and independent contractors on Friday.

April 9 -

Midsize businesses and state and local governments are among the beneficiaries of the central bank's latest $2 trillion effort to mitigate the economic damage caused by the coronavirus pandemic.

April 9 -

Many banks were hitting their limits for lending to small businesses devastated by the coronavirus outbreak. They say the Fed's decisions to help fund additional loans and relax capital requirements will resolve many of their problems.

April 9 -

The maneuver could delay efforts by Senate Majority Leader Mitch McConnell, R-Ky., and Treasury Secretary Steven Mnuchin to add another $250 billion to the Paycheck Protection Program.

April 9 -

The majority of small businesses faced a financial challenge last year and that was before the pandemic curtailed consumer demand and forced nonessential companies to close.

April 9

!["Let’s take the opportunity to make some bipartisan fixes to allow [the Paycheck Protection Program] to work better for the very people it’s designed to help," said Sen. Chris Van Hollen, a Maryland Democrat.](https://arizent.brightspotcdn.com/dims4/default/473f544/2147483647/strip/true/crop/4777x2687+0+248/resize/1280x720!/quality/90/?url=https%3A%2F%2Fsource-media-brightspot.s3.us-east-1.amazonaws.com%2F21%2Ffd%2F4cc30d254e5c8f8b2cf92eabb0d2%2Fvan-hollen.jpg)