-

Lawmakers have also criticized the agency's decision to create qualifying standards for farmers and other small businesses.

February 20 -

When established card networks such as Visa, American Express and Mastercard start investing in fintech lending platforms such as Divido and ChargeAfter — as well as in the fintech lenders themselves such as Klarna and Vyze — it’s a clear signal that the future of unsecured personal loans may not be delivered by banks.

February 19 -

Wells Fargo appears to be outpacing its rivals in the API race; CFPB's unexpected showdown with Citizens; Varo gets vital FDIC OK for bank charter; and more from this week's most-read stories.

February 14 -

A large charge-off and an additional loan-loss provision reduced quarterly profit by 12%, to $47.8 million.

February 14 -

The startup spawned in Eastern Bank's innovation lab says its bank customers asked for client-friendly software for account opening, credit cards and more types of commercial lending.

February 13 -

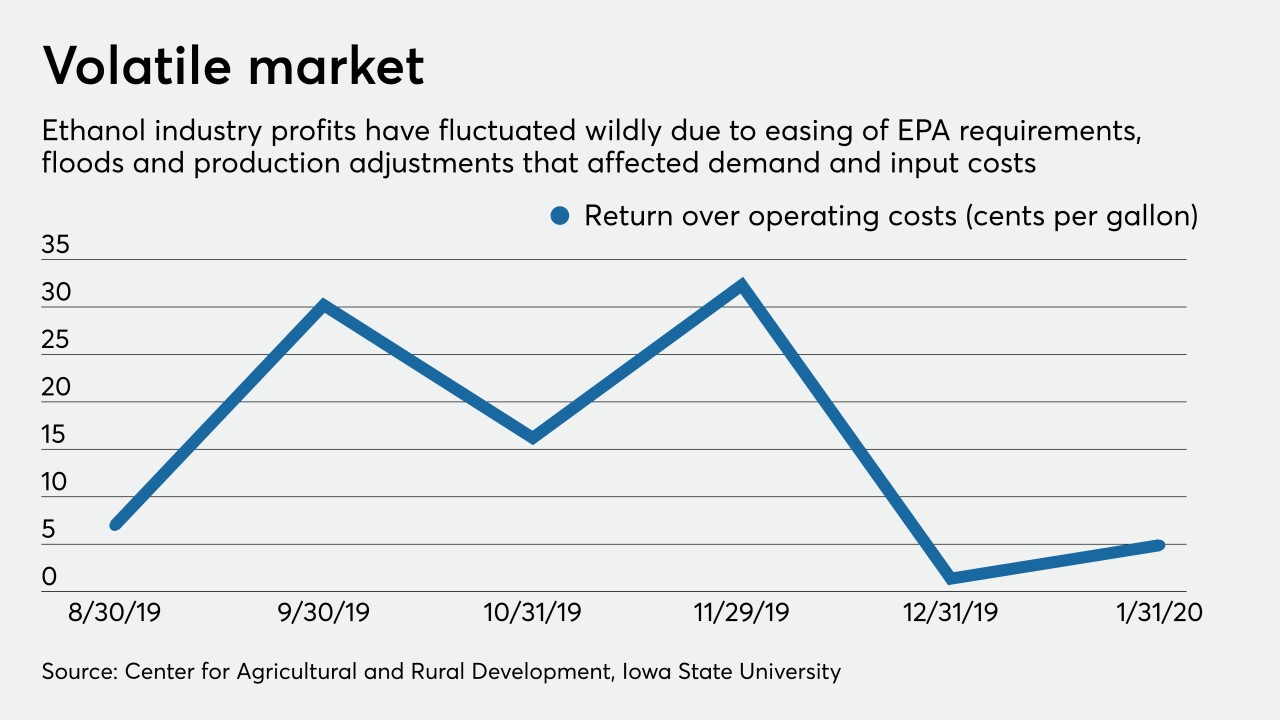

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Activist investors say the lender's words on combating climate change have not matched its actions. But the company argues that requests to put climate resolutions to a shareholder vote amounts to micromanagement.

February 12 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

February 11 -

Ken Karels will be succeeded by Mark Borrecco, who had been CEO of Rabobank's U.S. bank.

February 11 -

On Sep. 30, 2019. Dollars in thousands.

February 10 -

On Sep. 30, 2019. Dollars in thousands.

February 10 -

Payday lenders have long used bank partnerships and similar means to circumvent state interest rate caps. Lawmakers should stop such practices now.

February 10 Colorado

Colorado -

Greg Seibly guided Sterling through the financial crisis before engineering its sale to Umpqua Holdings in 2014. He had most recently served as CEO of the Federal Home Loan Bank of San Francisco.

February 6 -

The timing couldn’t be worse for ag and energy lenders as well as global banks, which were all counting on the Chinese market to help bolster commercial lending and fee income.

February 4 -

Reduced dine-in traffic is eating away at bottom lines, forcing eateries to rethink how they borrow money.

February 4 -

Kaustav Das was part of Kabbage’s effort to transform small-business lending by using new data analytics, and the CEO of Petal wants him to help it do the same in consumer credit cards.

February 4 -

Customers of the online lender's payments service can select their own loan terms.

February 4 -

The bank would make small-business loans on the online retailer’s platform; Fed survey says banks worry about increasing delinquencies, especially in subprime.

February 4 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

February 3 -

The people of tiny Duncan, Ariz., have found creative ways to adapt to life in a banking desert, but their experience augurs a worrisome future for many other rural communities.

February 2