-

Kristy Kim was an immigrant success story with a degree from Berkeley and a lucrative job — except her lack of credit history precluded her from getting a car loan. She started TomoCredit to help the many young folks who struggle to qualify for a credit card.

August 29 -

The Cincinnati bank recently expanded its renewable energy banking business to include investment banking services. Its ambitious goals demonstrate the sector’s growing appeal to regional and community banks.

August 27 -

An economic downturn is likely to force industry consolidation; the legit firms only offer borrowers things they can get for free, while others are scams.

August 27 -

On Mar. 31, 2019. Dollars in thousands.

August 26 -

Nonbank lenders Monroe Capital and MGG Investment Group have made a combined $115 million of loans to firms that make cannabidoil and supply products to the cannabis and hemp industries.

August 26 -

House Financial Services Committee Chairwoman Maxine Waters and over a hundred other lawmakers want the agency to go forward with a mandatory underwriting requirement for payday loans.

August 23 -

Blooma has developed a software product that combs databases to create property profiles for commercial real estate lenders. It can drastically cut origination costs and approval times and help banks identify safer loans, the company says.

August 23 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23 -

Recent studies offer a dire outlook for water levels in drought-prone states. Some banks are bracing for this risk with changes to underwriting of real-estate-related loans.

August 21 -

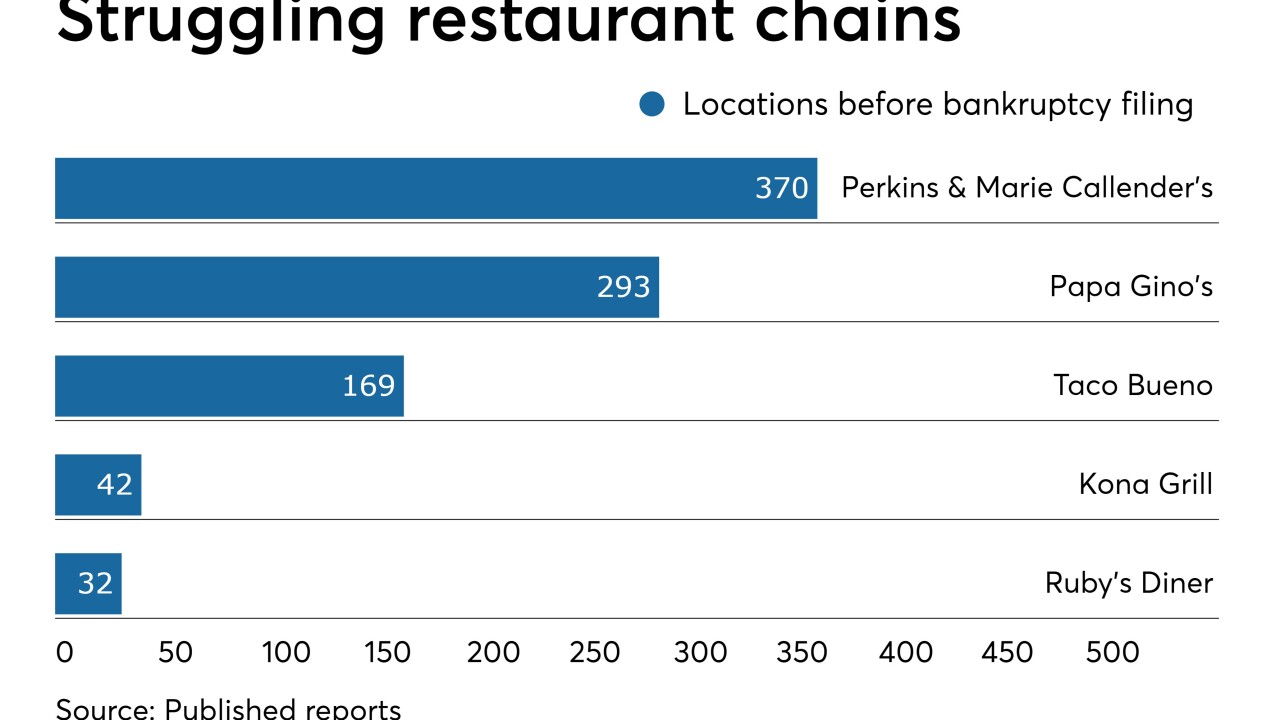

As a growing number of chains go bankrupt, loan charge-offs are rising.

August 21 -

Lenders insist they will be able to ramp up commercial loans and mortgage refinancings without skimping on underwriting.

August 19 -

Alternatives Federal Credit Union is making loans to pay for gender-reassignment surgery, but the initiative has bothered some members.

August 19 -

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

The LendingClubs and SoFis of the world have a big head start, but HSBC's U.S. unit says its partnership with the fintech Avant will help it close the gap in online personal loans.

August 14 -

Black and Hispanic owners of one-person businesses are more likely to be discouraged from applying for financing, and they’re less likely to receive financing when they do apply for it, than their white counterparts, according to a new report from the New York Fed.

August 14 -

The Los Angeles company said it is also looking into internal controls tied to construction lending.

August 13 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

The Michigan company disclosed that an unnamed client made a large payment on a $6.5 million nonperforming loan.

August 9