-

Anticipating recession, banks start scrubbing loan books; how Trump's political appointees thwarted tougher settlements with two big banks; the Fed's plans on its real-time payment service; and more from this week's most-read stories.

August 9 -

The New Jersey company was reportedly shopping itself around last fall. Fresh off an agreement to buy Gold Coast Bancorp in New York, CEO Kevin Cummings says he is ready to explore other acquisitions.

August 9 -

There are opportunities to make loans for strip malls and regional distribution centers but executives need to put the right risk management in place.

August 9 -

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

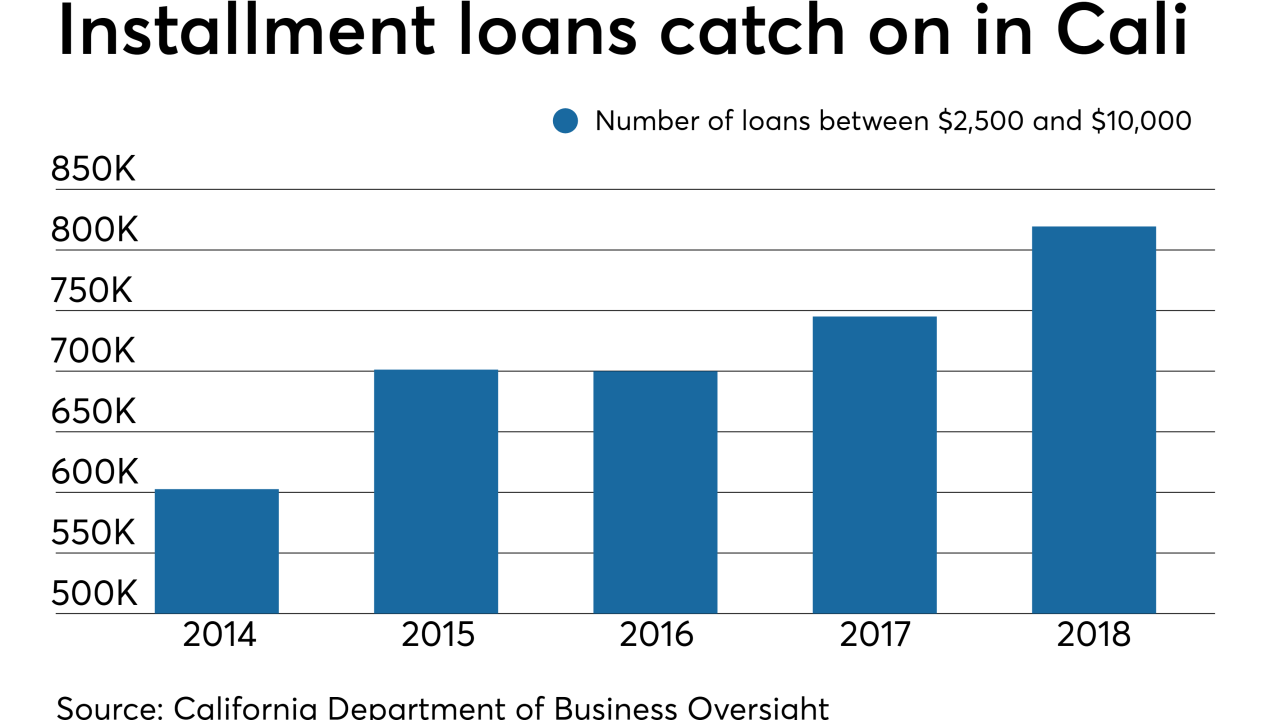

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

Mall landlords accustomed to offering rent reductions to ailing retailers are mulling a new strategy to forestall the industry's collapse: positioning themselves as lenders to tenants struggling to stay afloat.

August 7 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

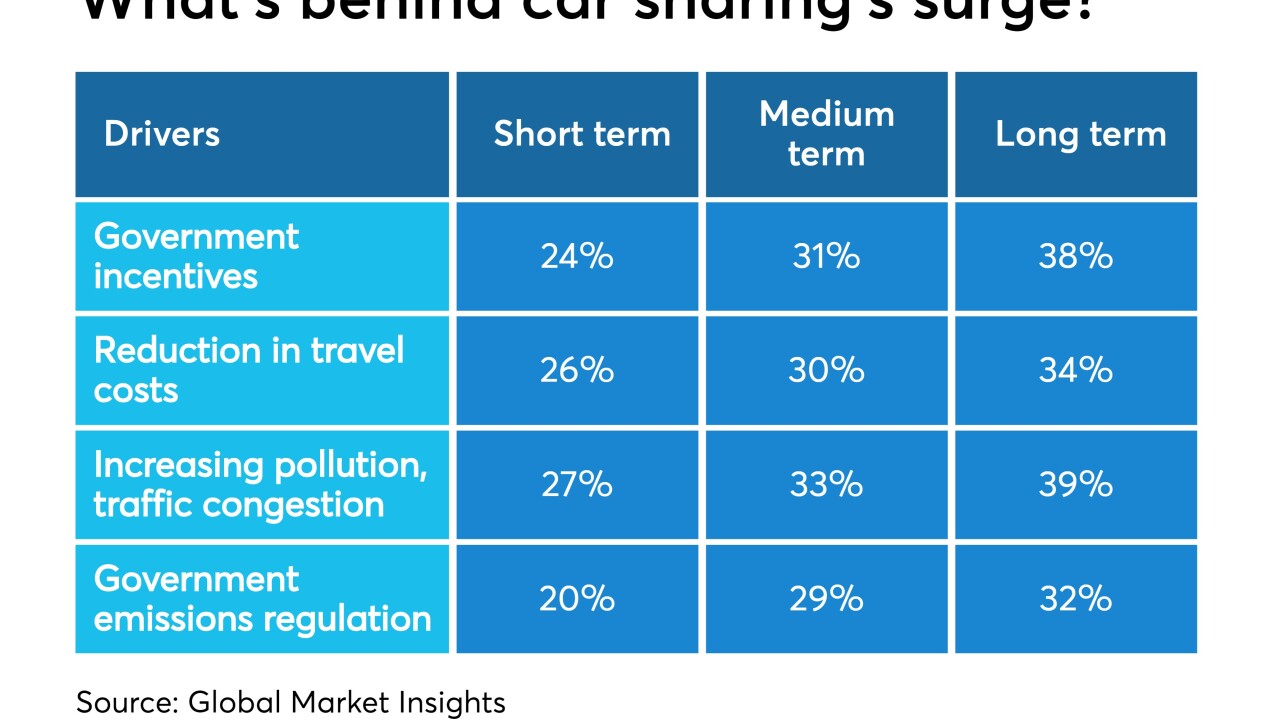

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

Krista Morgan, the founder and CEO of P2Binvestor, discusses her firm's bank deals and the tech driving its platform.

August 6 -

Credible Labs, which lets consumers shop for the best rates on student loans, mortgages and other credits, would be part of an evolving digital strategy at Fox after the multibillion-dollar sale of many of its traditional media assets to Disney.

August 5 -

Though the use of alternative data in lending is seen by some as untested, several fintechs say they couldn't function without it.

August 5 -

On Mar. 31, 2019. Dollars in thousands.

August 5 -

On Mar. 31, 2019. Dollars in thousands.

August 5 -

It’s hard to time the next economic slowdown. But lenders, many with lingering memories of the financial crisis, are taking steps now to limit exposure in commercial real estate, construction and other loan segments.

August 4 -

These banks posted strong quarterly results at a time when many others struggled with thinner margins and rising expenses.

August 4 -

JPMorgan Chase ends business loan partnership with OnDeck; Truist out to prove it can best the megabanks in tech; Capital One's data breach was bad, but it could've been worse; and more from this week's most-read stories.

August 2