Bank consolidation in Miami is picking up, with more deals expected in coming months.

Continental National Bank and Brickell Bank are the latest Miami banks to find buyers. The $490 million-asset Continental is being sold to First American Bank in Elk Grove Village, Ill., while Brickell's parent company agreed to sell the $440 million-asset bank to Banesco USA in Coral Gables, Fla.

They join a growing list of area banks that have changed hands in recent years, including TotalBank, Gibraltar Bank & Trust, Sabadell United Bank and Stonegate Bank.

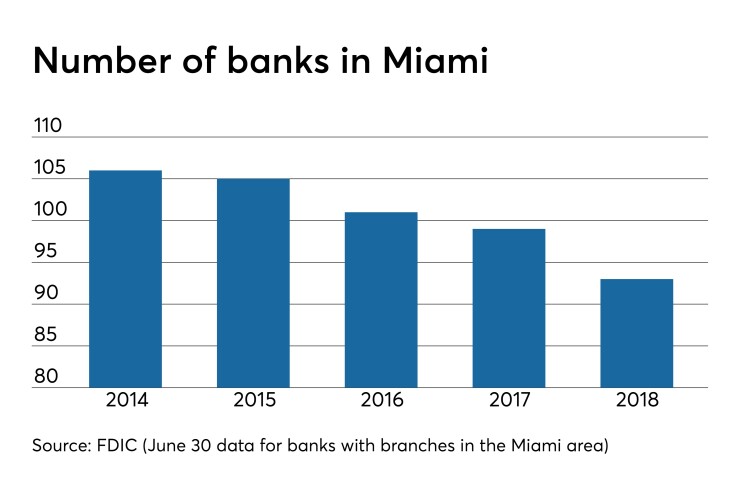

The Miami area has seen a slow decline in the number of banks operating branches, losing a dozen banks since mid-2014, according to the most recent data from the Federal Deposit Insurance Corp. Premiums are higher than they have been in years.

"It’s the best time to sell if you're planning to sell," said Ken Thomas, president of Community Development Fund Advisors, particularly for bankers concerned that another economic slowdown is nearing.

For now, buyers don't seem overly concerned about a correction. For them, the market offers a chance to diversify in terms of demographics, geography and product mix.

Thomas Wells, CEO of the $5.3 billion-asset First American, said his bank is interested in focusing more on Hispanic customers, including the Cuban-American clientele at Continental National.

“Getting a Hispanic grounding is important," Wells said.

Continental, formed in 1974, was also attractive because it has been around for a while and has a good balance sheet, Wells said. He cautioned that some newer banks in the area have more transactional and less “sticky” business.

Scale in South Florida was another driver at First American. It only has one branch in Miami, which it obtained in a 2014 acquisition.

In addition to tourism and hospitality, Miami is a “vibrant, economic hub” driven by its position as a gateway to Latin America, Wells said. “You can compare it to Naples, which is also a nice market, but you don’t have the commercial side over there,” he said of the Gulf Coast.

More banks will likely want to bulk up around Miami, said Dennis Holthaus, a managing director for Skyway Capital Markets in Tampa, Fla. The only issue is the limited number of community banks available, which will likely keep premiums above 200% of a seller's tangible book value.

Out-of-state banks and those in other countries eager to be in Miami are paying up for local banks, as seen in the recent Banco Bradesco-BAC Florida Bank deal, Thomas said. Bradesco will pay $500 million, or 2.6 times book.

"Bradesco has had an impact on the thoughts of sellers, but pricing still needs to make financial sense for a buyer," Holthaus said.

While premiums often topped 5 times tangible book value more than a decade ago, getting half that much is viewed positively today given the dearth of deals that took place immediately after the financial crisis, Thomas said.

That pricing change is due in part to Miami's cosmopolitan status and its role as the gateway to Central and South America, industry observers said.

"As a financial institution, if you have significant growth plans in Florida, those plans have to include Miami," Holthaus said.

A sale to First American will allow Continental to move beyond a focus on commercial real estate, while providing some compliance depth, Wells said. Another plus was the fact that both companies are family owned and closely held.

First American, given its size, says it believes it can pursue commercial deals that smaller banks must pass on but are also too marginal for bigger banks.

Wells could look to add more First American branches in Miami over time. As for an interest entering other markets to bridge the gap between the Midwest and Florida, Wells said the bank has enough on its plate already.

“If we conquer Chicago and Miami we’ll have done a lot,” he said.