Consumer banking

Consumer banking

-

Thomas O'Brien will take the helm at Sterling Bancorp, which is dealing with internal control issues and probes by the OCC and Justice Department into its mortgage operations.

June 1 -

It took a global pandemic to get many baby boomers to bank online. Lenders have taken notice.

June 1 -

How a twentysomething marketing entrepreneur helped transform a small community development financial institution into a digital leader.

May 31 -

Even after the Fed eased some limitations in April to promote emergency lending, the bank has had to make some “tough choices” to heed the $1.95 trillion growth ceiling set by regulators in the aftermath of its phony-accounts scandal.

May 29 -

Stu Lubow, who succeeded Kenneth Mahon, gained more responsibilities. Mahon remains Dime's CEO.

May 28 -

The website, ppp.bank, will help borrowers in the Paycheck Protection Program apply for loan forgiveness.

May 28 -

Customers' increased use of digital channels during the pandemic could compel the Minneapolis company to rethink its branch strategy, CEO Andy Cecere said.

May 28 -

The latest Credit Union Trends Report from CUNA Mutual Group predicts interest rates will be at record lows for at least two years and earnings are also likely to take a hit from record-high unemployment.

May 28 -

COO says bank is on track to meet growth targets but expects more consumer lending losses; the mortgage agencies’ ability to raise $240 billion in capital before going private won’t be easy.

May 28 -

The reloadable debit card resembles a bank account with new high-yield savings account and other tweaks.

May 27 -

Credit card and debit card spending have improved for several weeks in a row, according to a report from PSCU.

May 27 -

The company will incur an upfront fee but will save $7 million a year by walking away from a deal with the Los Angeles Football Club.

May 27 -

A new program is intended to reach individuals without a fixed address or checking account more easily access COVID-19 relief funds — and hopefully keep those consumers as members.

May 27 -

Forecasts about the pandemic's impact on the mortgage market have grown less dire after forbearance requests by homeowners nearly leveled off in the first half of May.

May 26 -

Cybercriminals have targeted at least four financial services technology companies in recent months, potentially giving hackers back-door access to clients. Here’s how banks can guard against that.

May 26 -

Year to date through Dec. 31, 2019. Dollars in thousands.

May 26 -

Credit unions need a clear strategy if they hope to break through to consumers already overwhelmed by the coronavirus.

May 26 -

The bank is trying to recover millions of dollars in returned deposits. It also has a $14 million loan to the company that allegedly conducted the scheme.

May 26 -

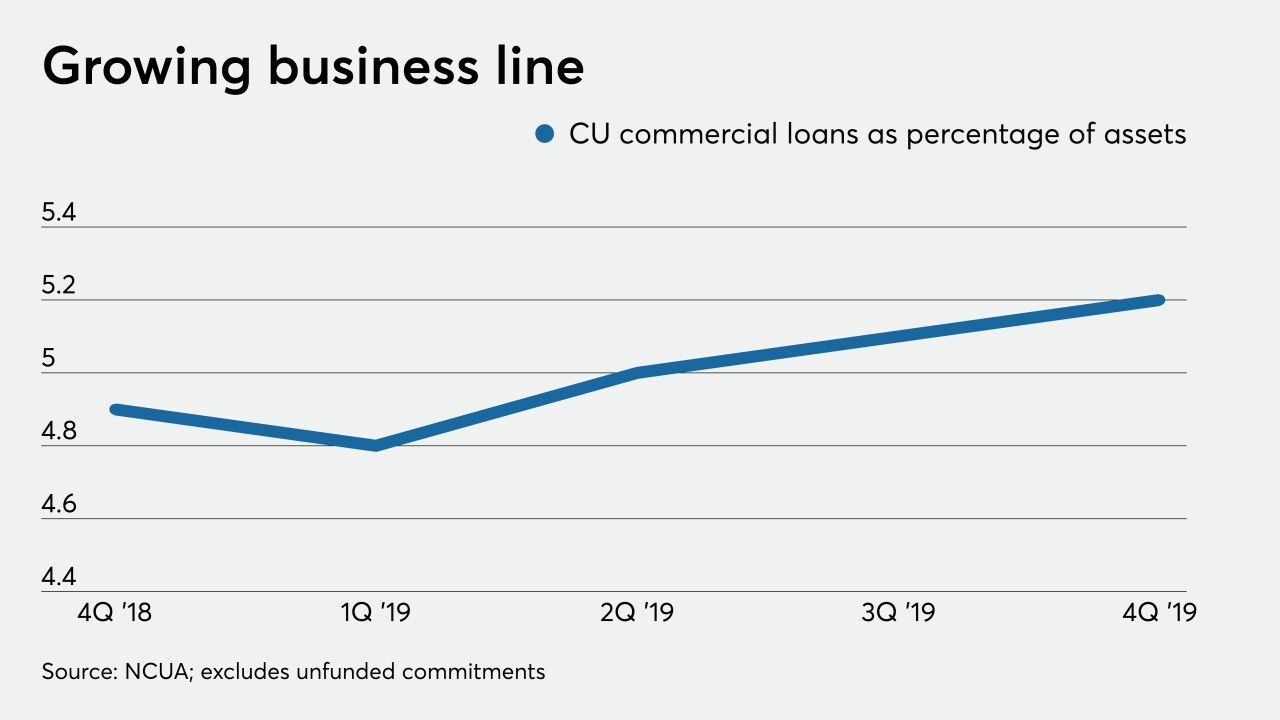

The industry is well positioned to gain market share, but institutions may not see the same levels of growth as after the last recession.

May 26 -

Demand has soared for mental health services as bank employees put in long hours, supervise kids while working at home and endure personal crises. Citi, BofA, Fifth Third and others are getting creative to help them decompress during the pandemic.

May 24