Consumer banking

Consumer banking

-

The North Carolina-based credit union, which purchased the vacant bank branch last summer, serves some members across the state line but has not had a brick-and-mortar presence there until now.

February 5 -

First Foundation is relocating its corporate headquarters to Dallas, where the tax burden is lighter and it sees more opportunity to beef up lending, add wealth management clients and pursue acquisitions of community banks.

February 5 -

To avoid taxes on the divestiture of a commercial lending unit, Woodforest National Bank backed an Alabama redevelopment project through a government program that promotes investment in underserved communities.

February 4 -

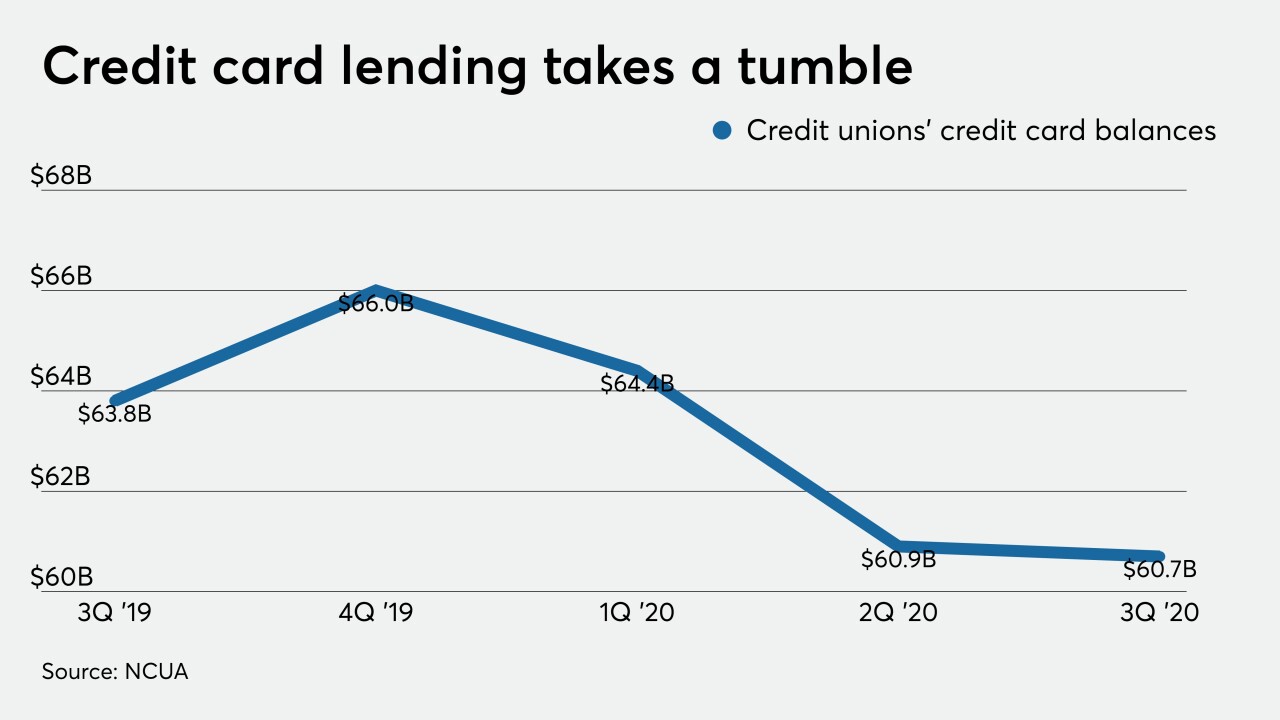

Credit unions are hoping for a return to normal credit card spending patterns sometime during the second half, but the pandemic has created a domino effect of complicating factors.

February 4 -

Community banks say Vizaline’s software, which converts property descriptions into images, helps them catch errors before they close real estate loans without resorting to expensive land surveys. But traditional surveyors say the results are of questionable value.

February 3 -

Vast Bank in Oklahoma is one of the first to allow customers to purchase digital currencies, a market that has proved lucrative for fintechs.

February 3 -

Canada’s fourth-largest bank is pressing ahead with big technology investments to cut costs and try to generate more revenue from existing customers, said Erminia Johannson, BMO’s head of personal and business banking for the U.S. and Canada.

February 3 -

The San Antonio-based company has promoted Paul Vincent to president of its banking unit. Neeraj Singh, previously chief risk officer for Citi’s U.S. consumer bank, has joined the parent company as chief risk officer.

February 3 -

Gemini Trust now offers a credit card and an uninsured savings account for bitcoin holders that pays 7.4% interest. It is the latest example of a cryptocurrency company marketing banklike products.

February 2 -

About 70% of Bank of America's customers are now “digitally active” and 17 million people use Erica, its virtual assistant. David Tyrie, who was recently promoted to head of digital, would like to get that rate up to 100%.

February 1