A properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.

Tokenization and buy buttons began, in part, as ways to calm the security concerns of online shoppers who were wary of moving away from plastic. They’re now becoming a way to keep a health and economic crisis from turning into a security problem as in-store checkout quickly gives way to apps and websites.

The coronavirus is accelerating contactless and digital payments, while upending traditional funding models for fintechs, says Sage's Pamela Novoa Ralli.

Often overlooked in narratives about essential workers, branch and call-center employees are responding to challenges posed by the COVID-19 crisis. They’ve processed emergency-relief loans late into the night, coached customers unfamiliar with mobile banking and made house calls to elderly account holders.

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

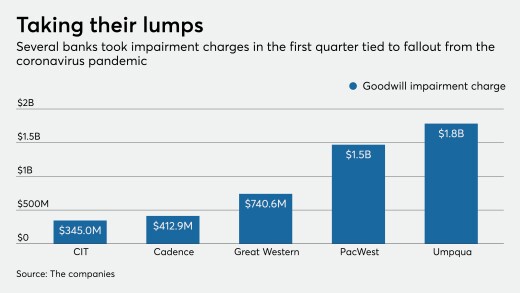

More write-downs seem inevitable as the coronavirus outbreak wreaks havoc on the economy and bank stocks.

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

After times of significant turmoil, habits never fully revert to previous norms. Instead, we respond to those events and permanently change the way we live, says Fiserv's Nandan Sheth.

-

A properly deployed combination of asset-based lending, commercial loans and investment banking is imperative in these circumstances.

May 14 SG Credit Partners Inc.

SG Credit Partners Inc. -

Tokenization and buy buttons began, in part, as ways to calm the security concerns of online shoppers who were wary of moving away from plastic. They’re now becoming a way to keep a health and economic crisis from turning into a security problem as in-store checkout quickly gives way to apps and websites.

May 14 -

The coronavirus is accelerating contactless and digital payments, while upending traditional funding models for fintechs, says Sage's Pamela Novoa Ralli.

May 14 Sage

Sage -

Often overlooked in narratives about essential workers, branch and call-center employees are responding to challenges posed by the COVID-19 crisis. They’ve processed emergency-relief loans late into the night, coached customers unfamiliar with mobile banking and made house calls to elderly account holders.

May 13 -

With the pandemic's economic toll leading to elevated billing error notices, the consumer bureau said card companies will not be cited if they fail to meet the typical time frame for resolving disputes.

May 13 -

More write-downs seem inevitable as the coronavirus outbreak wreaks havoc on the economy and bank stocks.

May 13 -

The head of the U.S. central bank said its emergency credit programs were not designed to prop businesses up over the long term.

May 13