Many businesses are turning to the popular videoconferencing platform to stay connected to employees, but institutions need to think about measures they can take to utilize it safely.

When ACI Worldwide acquired mobile and bill payment technology from Western Union last year, it couldn't have predicted an environment in which consumers would be handling nearly all of their finances from home.

Community banks that have used the Paycheck Protection Program to help businesses ride out the coronavirus outbreak are looking to turn that goodwill into deeper loan and deposit relationships down the road.

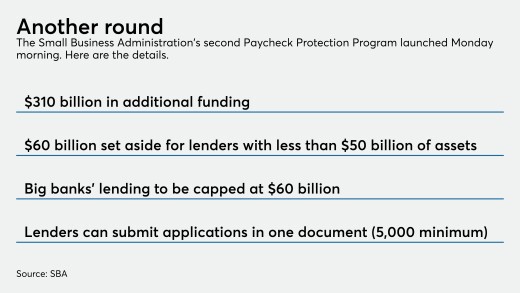

Queued-up loans. Extra bankers. Government tweaks to promote fairness. None of these precautionary measures has been enough for the second round of the Paycheck Protection Program to avoid the pitfalls of the first.

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.

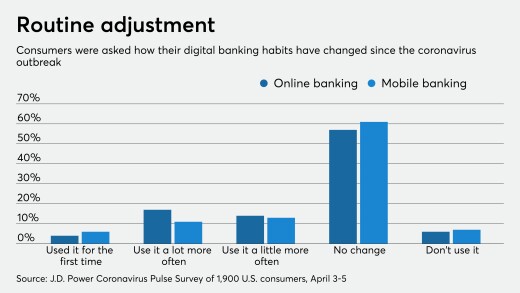

Use of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

The Small Business Administration's systems froze up shortly after the latest Paycheck Protection Program was launched Monday morning.

-

Many businesses are turning to the popular videoconferencing platform to stay connected to employees, but institutions need to think about measures they can take to utilize it safely.

April 28 -

When ACI Worldwide acquired mobile and bill payment technology from Western Union last year, it couldn't have predicted an environment in which consumers would be handling nearly all of their finances from home.

April 28 -

Community banks that have used the Paycheck Protection Program to help businesses ride out the coronavirus outbreak are looking to turn that goodwill into deeper loan and deposit relationships down the road.

April 27 -

Queued-up loans. Extra bankers. Government tweaks to promote fairness. None of these precautionary measures has been enough for the second round of the Paycheck Protection Program to avoid the pitfalls of the first.

April 27 -

The central bank expanded the reach of the program as pressure mounts on the government to support localities struggling economically because of the coronavirus pandemic.

April 27 -

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.

April 27 -

Use of banks' mobile apps and websites has risen about a third since the coronavirus crisis began, according to J.D. Power.

April 27