Spirit of Texas Bancshares named an interim CEO for Dean Bass, though the company said he is recovering.

The coronavirus has accelerated a move toward a public option for digital wallets that would tie government authentication to payment transactions. If successful, this could be the catalyst for a national digital identity system.

OakNorth helps banks analyze credit, identify pandemic-related risks and forecast borrower issues before they turn into defaults.

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

Firms that spread big-dollar deposits to community banks have seen a rush in demand as small businesses seek emergency loans to weather the coronavirus pandemic.

The Small Business Administration said lenders approved $71 billion in loans from the Paycheck Protection Program in less than five days.

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

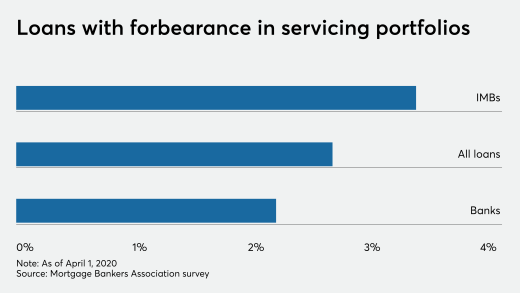

The share of borrowers seeking payment relief rose more than tenfold as COVID-19 concerns grew and authorities encouraged the practice, according to the Mortgage Bankers Association.

-

Spirit of Texas Bancshares named an interim CEO for Dean Bass, though the company said he is recovering.

April 8 -

The coronavirus has accelerated a move toward a public option for digital wallets that would tie government authentication to payment transactions. If successful, this could be the catalyst for a national digital identity system.

April 8 -

OakNorth helps banks analyze credit, identify pandemic-related risks and forecast borrower issues before they turn into defaults.

April 8 -

Measures that delay the Current Expected Credit Losses standard and reduce a community bank capital ratio are temporary, but the industry now sees an opening to argue that they should be permanent.

April 7 -

Firms that spread big-dollar deposits to community banks have seen a rush in demand as small businesses seek emergency loans to weather the coronavirus pandemic.

April 7 -

The Small Business Administration said lenders approved $71 billion in loans from the Paycheck Protection Program in less than five days.

April 7 -

Five Democrats on the Senate Banking Committee sent a letter to Director Kathy Kraninger calling the agency's response to COVID-19 “tepid and ineffectual at best.”

April 7