Customers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

The company, the product of a big merger shortly before the outbreak, had to build portals on the fly, help many customers shift to mobile and accomplish in days tasks that once took months, its digital chief says.

Artificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

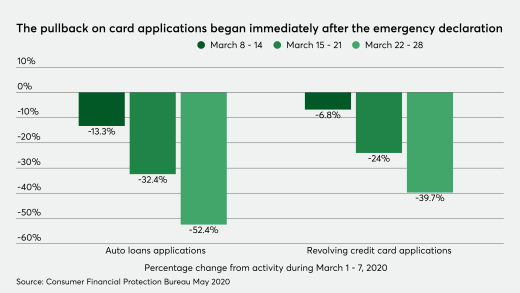

Unlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

The credit union regulator has implemented a host of measures to help the industry manage the pandemic, but there may be only so much it can do without congressional action.

A transparent, decentralized ledger will speed up payments while mitigating the inevitable next round of federal mismanagement, says Polyient Labs' Jeff Hinkle.

The challenge posed by digital-only remittance services has prompted a rapid change at MoneyGram.

-

Customers normally receive debit and credit cards inside a branch. Now banks are shifting the process to their drive-throughs and finding alternative ways for cardholders to key in their PINs.

May 21 -

The company, the product of a big merger shortly before the outbreak, had to build portals on the fly, help many customers shift to mobile and accomplish in days tasks that once took months, its digital chief says.

May 21 -

Artificial intelligence and machine learning are some examples of technology available now to help combat money launderers profiting from the pandemic.

May 21 Consilient

Consilient -

Unlike past economic recessions where businesses and consumers have had to adjust their payment habits and debt levels over the course of months or quarters as the economy shrank, the coronavirus-induced economic crisis has forced many to make much more abrupt financial adjustments.

May 21 -

Jennifer Roberts, the company's head of business banking, details a process to have units work one-on-one with customers to get Paycheck Protection Program funds deployed faster.

May 21 JPMorgan Chase & Co.

JPMorgan Chase & Co. -

The credit union regulator has implemented a host of measures to help the industry manage the pandemic, but there may be only so much it can do without congressional action.

May 21 -

A transparent, decentralized ledger will speed up payments while mitigating the inevitable next round of federal mismanagement, says Polyient Labs' Jeff Hinkle.

May 21 Polyient Labs

Polyient Labs