An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

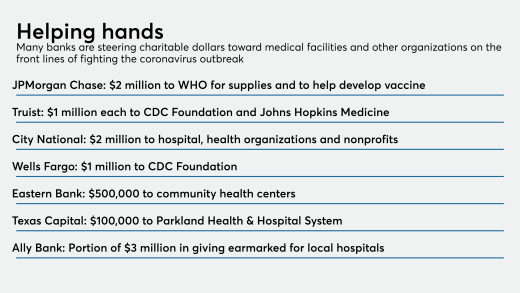

From helping hospitals purchase new testing kits and ventilators to backing efforts to develop a COVID-19 vaccine, banks large and small are pledging millions of dollars to assist with medical relief efforts.

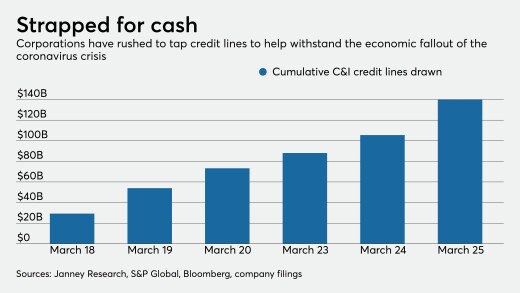

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

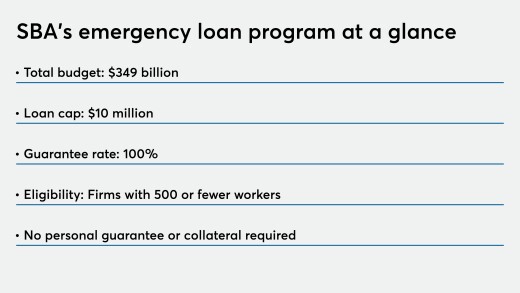

No online lenders are approved for the agency's traditional programs, but they could make loans under the COVID-19 stimulus package if they get special approval.

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

Arizent, the parent company of Credit Union Journal, has conducted a broad industry survey on both the impact of the crisis and emerging responses. The survey probed continuity efforts and remote workforce enablement as well as planning and investments being pursued against future potential disruptions.

Payments technology is a relative bright spot as coronavirus’ economic fears hit venture capital, since an emergency can be a catalyst for early-stage innovation designed to ease digital commerce.

-

An uptick in closings is likely, but how many institutions go under and how fast will depend on a variety of factors, including the duration of the pandemic.

March 26 -

From helping hospitals purchase new testing kits and ventilators to backing efforts to develop a COVID-19 vaccine, banks large and small are pledging millions of dollars to assist with medical relief efforts.

March 26 -

Draw-downs on C&I credit more than quadrupled in a seven-day period ended March 25. Lenders may try to rein them in if the crisis drags out, but legal precedent isn’t on their side.

March 26 -

The joint statement said examiners will not impede banks and credit unions’ responsible efforts to offer open lines of credit, closed-installment loans or other products to borrowers dealing with fallout from the pandemic.

March 26 -

No online lenders are approved for the agency's traditional programs, but they could make loans under the COVID-19 stimulus package if they get special approval.

March 26 -

NAFCU and CUNA wrote to the regulator asking for a variety of measures to help credit unions weather the pandemic, including not implementing the CECL standard until at least 2024.

March 26 -

Arizent, the parent company of Credit Union Journal, has conducted a broad industry survey on both the impact of the crisis and emerging responses. The survey probed continuity efforts and remote workforce enablement as well as planning and investments being pursued against future potential disruptions.

March 26