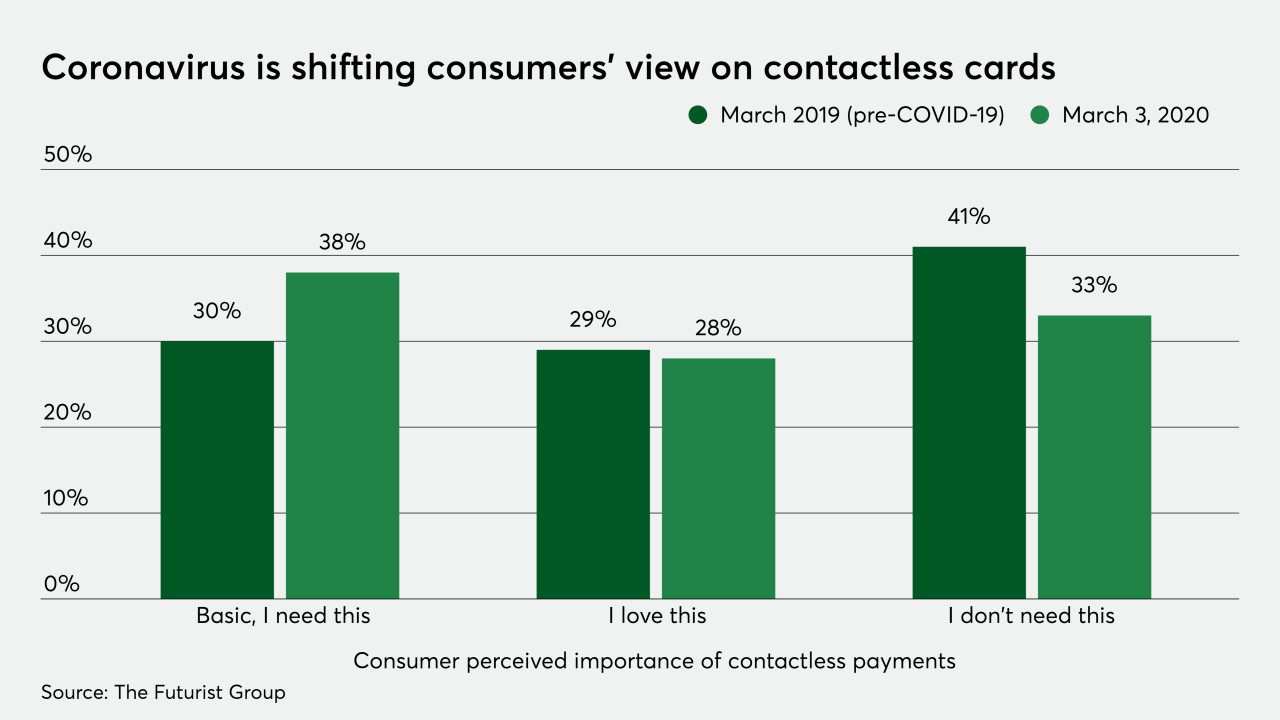

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

Alibaba Group Holding Ltd.’s parcel and meal delivery arms have returned to pre-coronavirus outbreak staffing levels, the latest example of how China’s largest corporations are getting back to work after Beijing’s entreaty to safeguard economic growth.

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

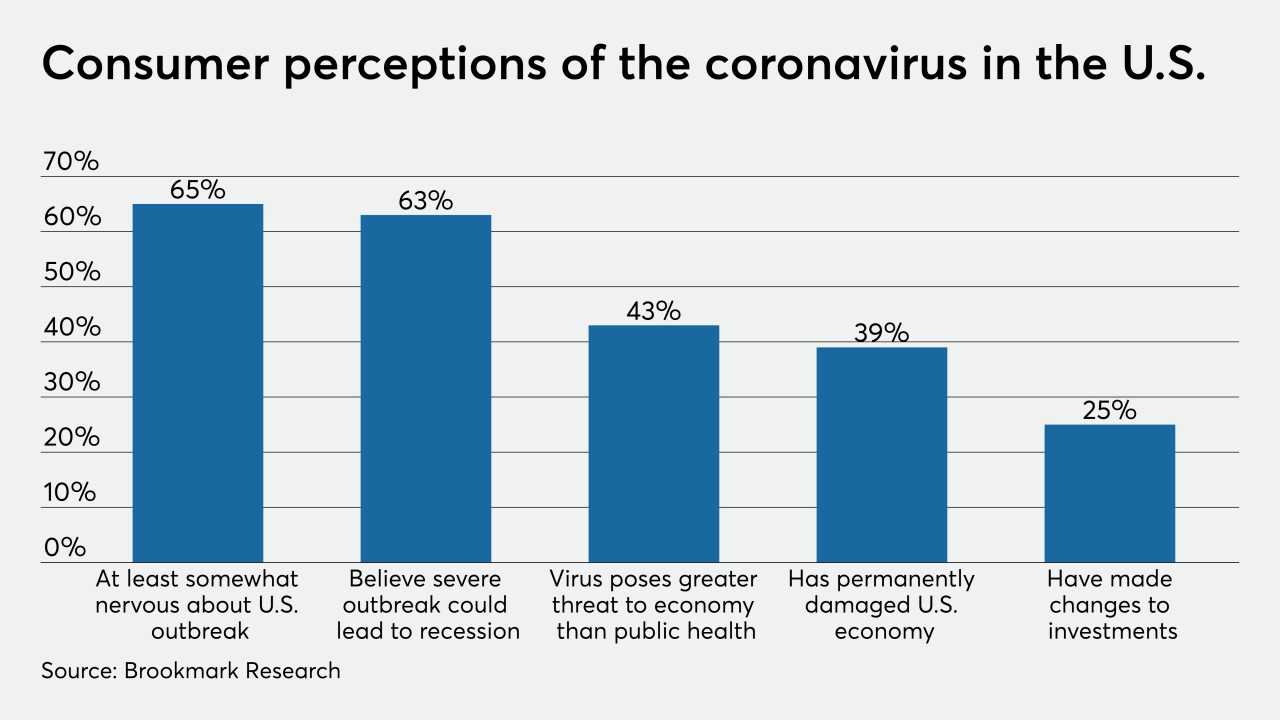

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

The employee, who works on the 23rd floor of the bank's 555 California St. offices in San Francisco, "is at home while their health is being closely monitored by their doctor and public health authorities," a spokeswoman for the bank said.

The outbreak and a free fall of oil and stock prices are rattling bankers at this year's ICBA gathering in Orlando, Fla.

-

Contactless cards are a potential refuge for consumers who fear plastic and cash are carrying COVID-19.

March 10 -

Alibaba Group Holding Ltd.’s parcel and meal delivery arms have returned to pre-coronavirus outbreak staffing levels, the latest example of how China’s largest corporations are getting back to work after Beijing’s entreaty to safeguard economic growth.

March 10 -

There may only be so much institutions can do if the outbreak affects borrowers' ability to repay credit.

March 10 -

Concerns about the economic fallout of coronavirus have mostly focused on supply chain disruptions. But fears are growing that weakening consumer demand could spark a recession.

March 9 -

State and federal officials committed to providing “appropriate regulatory assistance” to banks whose customers may be hurt by the coronavirus outbreak and said prudent measures would not be subject to criticism by examiners.

March 9 -

Sen. Mark Warner led a group of Democratic senators in calling on bank, credit union and GSE regulators to give detailed instructions on helping consumer and commercial borrowers hurt by the COVID-19 outbreak.

March 9 -

The employee, who works on the 23rd floor of the bank's 555 California St. offices in San Francisco, "is at home while their health is being closely monitored by their doctor and public health authorities," a spokeswoman for the bank said.

March 9