-

The company will pay an undisclosed amount of cash for Marshall Financial, the parent of Citizens Bank.

August 5 -

Delmar Bancorp will lose its regionally associated brand when it becomes Partners Bank.

August 5 -

-

The deal will give ORNL access to three additional counties in the region.

July 31 -

Lenders faced sudden high demand in the crisis to support stressed borrowers. One bank details how it built a digital portal swiftly to meet that challenge.

July 31 -

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

July 30 -

Lexicon Bank in Las Vegas, whose chairman was a professional gambler, is actively courting poker players to open deposit accounts for their tournament winnings.

July 30 -

Webster Federal Credit Union and Finger Lakes FCU plan to join forces before the end of the year, though the deal still needs approval from regulators and members.

July 30 -

The streaming service is taking out a two-year certificate of deposit with Hope Credit Union, which plans to use the funding to provide credit to communities often overlooked by mainstream banking.

July 29 -

From natural disasters to pandemics, the best business-continuity strategy may simply be to ensure you have a strategy.

July 28 PenFed

PenFed -

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

Financial firms should offer debt consolidation and faster payment services to help employees who may be struggling through the coronavirus pandemic.

July 27 Ceridian

Ceridian -

The Nashville bank had sued Gaylon Lawrence in 2017 over allegations that he was pursuing an illegal takeover, but the two sides announced terms of a settlement.

July 24 -

With the coronavirus pandemic intensifying and hopes for a quick economic recovery fading, banks large and small are reducing headcounts, shuttering branches, shedding office space and generally trying to trim expenses wherever they can.

July 24 -

CEO Greg Carmichael says the Cincinnati company has cut expenses but will proceed with branch openings in the Southeast and investments in its commercial loan and mortgage origination platforms to lay the groundwork for post-pandemic growth.

July 23 -

Recruiting directors from a variety of backgrounds is a challenge familiar to many credit unions. A member of one of the nation's largest CUs is calling for that institution to address the problem.

July 23 -

A letter from the National Taxpayers Union requested changes, such as requiring federal credit unions to fill out a certain IRS form for non-profits, before lawmakers considered easing member business lending limits.

July 22 -

See this crisis not as a nail in your corporate coffin but as an opportunity to move your team and members forward, said OBI Creative CEO Mary Ann O'Brien.

July 22 OBI Creative

OBI Creative -

United Methodist Federal Credit Union is set to become Interfaith Credit Union. It is also planning to absorb a small South Dakota-based institution with a similar field of membership.

July 20 -

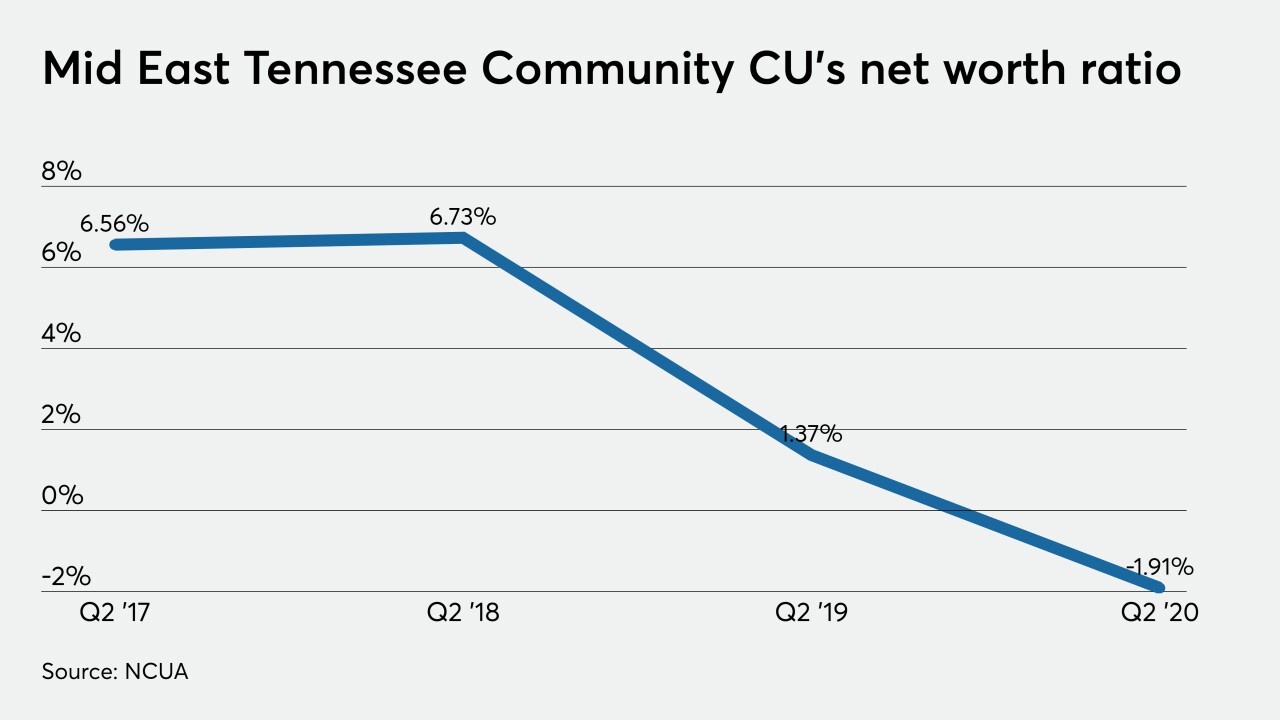

The streak of strong gains for new members was flagging by the end of 2019 and has only worsened since then.

July 20