-

The proposed combination would create a bank with $3 billion in assets in central Virginia.

August 13 -

The industry's return on average assets has already dropped substantially and there are predictions that could get even worse. Many institutions will have to deal with elevated provisions for loan losses and expense management to survive.

August 13 -

The coronavirus pandemic has created major credit issues at the Boston bank and stymied efforts to improve profits, fueling speculation that the onetime serial acquirer could be a takeover target.

August 11 -

MatlinPatterson, which once owned more than 60% of the Michigan company, has been paring back its stake in recent years.

August 10 -

Some institutions have long worked to recruit a diverse workforce and address discrimination but these initiatives have taken on greater importance as protests have highlighted racial inequality.

August 6 -

Many sellers are ditching the loans to avoid the cumbersome forgiveness process. For others, the Paycheck Protection Program was never a strategic fit.

August 5 -

The account would complement the existing Community Development Financial Institutions Fund and could be replenished annually if banks and credit unions use the funds to help when natural disasters and other crises occur.

August 5 -

The company will pay an undisclosed amount of cash for Marshall Financial, the parent of Citizens Bank.

August 5 -

Delmar Bancorp will lose its regionally associated brand when it becomes Partners Bank.

August 5 -

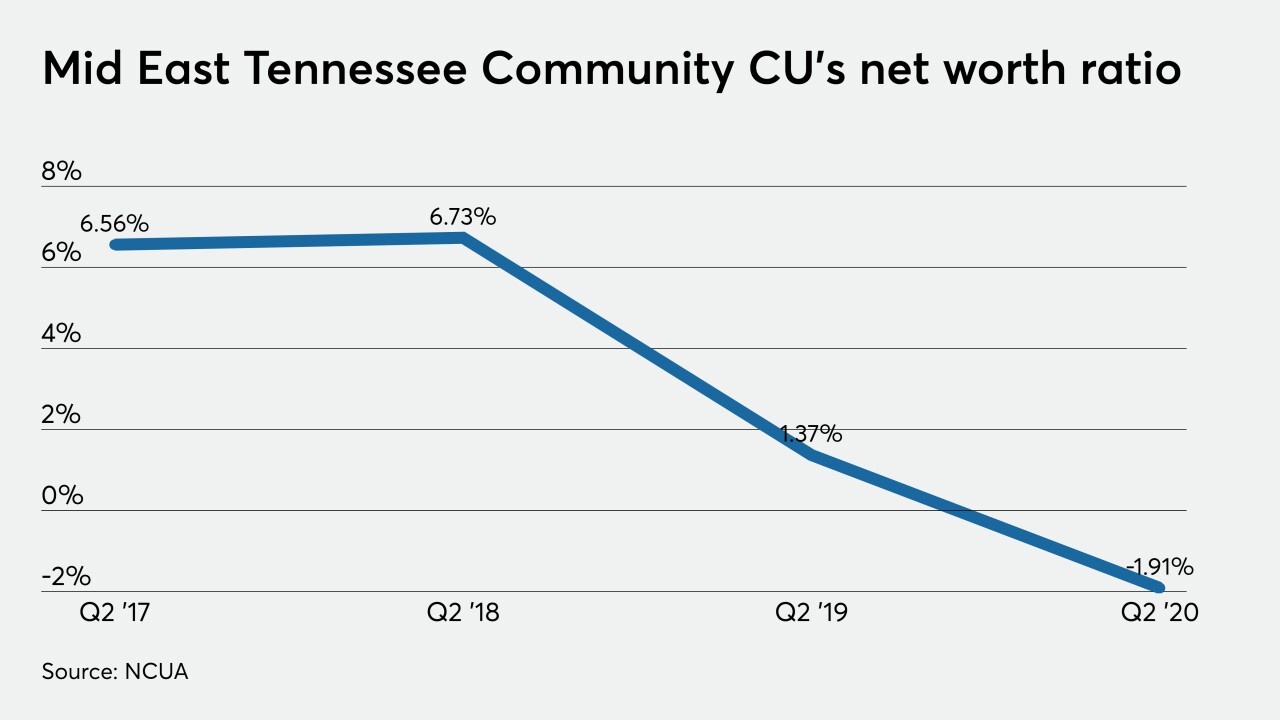

-

The deal will give ORNL access to three additional counties in the region.

July 31 -

Lenders faced sudden high demand in the crisis to support stressed borrowers. One bank details how it built a digital portal swiftly to meet that challenge.

July 31 -

Now that its deal with Texas Capital has been called off, Independent Bank in McKinney plans to scale back or exit some commercial lines and will seek to duplicate its retail banking successes in Colorado.

July 30 -

Lexicon Bank in Las Vegas, whose chairman was a professional gambler, is actively courting poker players to open deposit accounts for their tournament winnings.

July 30 -

Webster Federal Credit Union and Finger Lakes FCU plan to join forces before the end of the year, though the deal still needs approval from regulators and members.

July 30 -

The streaming service is taking out a two-year certificate of deposit with Hope Credit Union, which plans to use the funding to provide credit to communities often overlooked by mainstream banking.

July 29 -

From natural disasters to pandemics, the best business-continuity strategy may simply be to ensure you have a strategy.

July 28 PenFed

PenFed -

The National Credit Union Administration will also discuss the current expected credit losses standard, which trade groups have argued that the industry should be exempt from.

July 27 -

Financial firms should offer debt consolidation and faster payment services to help employees who may be struggling through the coronavirus pandemic.

July 27 Ceridian

Ceridian -

The Nashville bank had sued Gaylon Lawrence in 2017 over allegations that he was pursuing an illegal takeover, but the two sides announced terms of a settlement.

July 24