-

Credit unions that take advantage of hedging could see better execution and increased profitability in their mortgage operations.

April 6 Vice Capital Markets

Vice Capital Markets -

Credit unions in the Great Lakes State saw widespread membership growth in 2019 but it was the third consecutive year in which the pace of growth slowed.

April 6 -

Emergency loan program plagued by chaos on eve of launch; why Moven, one of the first challenger banks, is calling it quits; Fed faces conundrum on whether to remove Wells Fargo's asset cap; and more from this week's most-read stories.

April 3 -

Cobalt Credit Union is currently a state-chartered institution but is looking to once again become a federal one because of Iowa state taxes.

April 3 -

Yes, the Small Business Administration's emergency funding program for the coronavirus crisis is off to a rocky start, but that shouldn't stop banks from helping customers in need.

April 3 JRK Advisors LLC

JRK Advisors LLC -

Nonbank financial firms spent years lobbying against tougher regulation and stricter capital requirements, arguing they didn't pose a risk to the financial system. Now, many of those companies say they are in desperate need of a bailout.

April 3 -

Limiting access to branches because of the pandemic has forced executives to re-examine whether they offer enough mobile and online services.

April 3 -

South Jersey Gas Employees Federal Credit Union will merge into Jersey Shore Federal Credit Union on June 1.

April 2 -

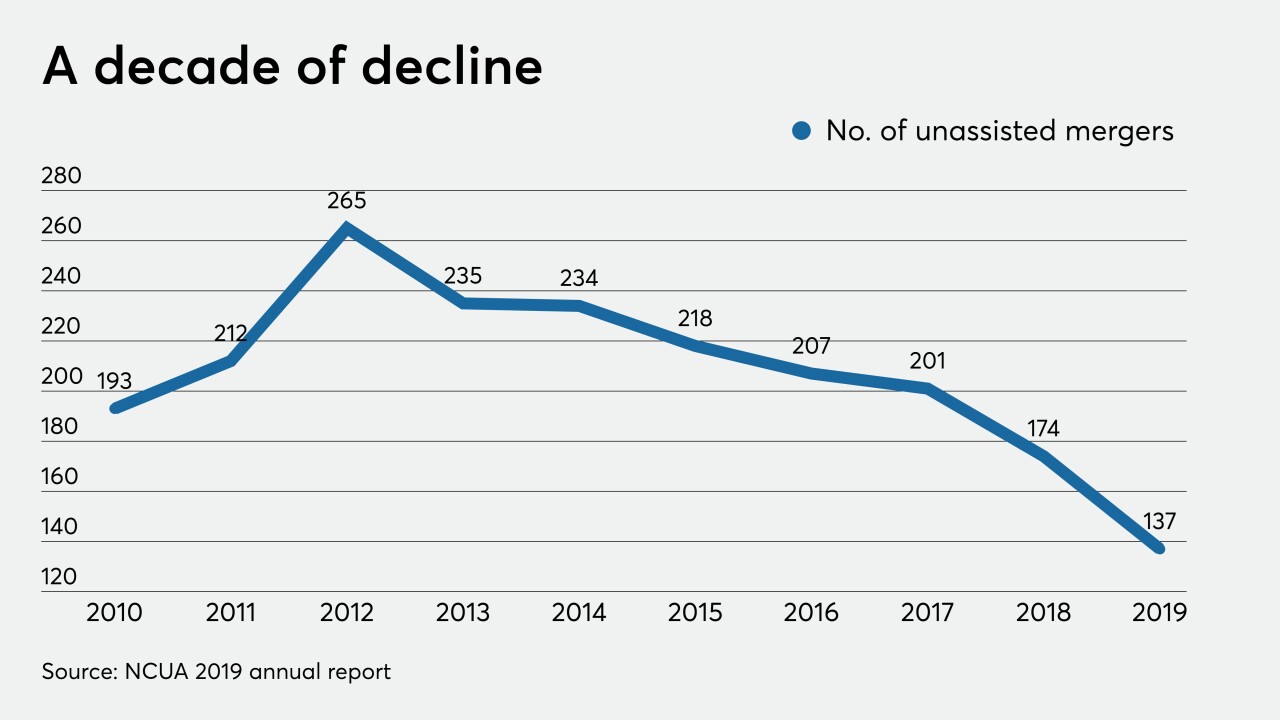

The number of deals per year was declining even before the pandemic, and it's unclear when things might pick up again.

April 2 -

Alabama Rural Electric Credit Union will merge into Alabama One later this year, creating a combined institution with a reach across 57 counties.

April 1 -

With branches closed and fewer opportunities for credit unions to have in-person interactions with members, the pandemic has reiterated the need for digital transformation in the industry.

March 31 Ignite Sales, Inc.

Ignite Sales, Inc. -

The regulator formally announced the 60-day delay on Monday after tweeting about it over the weekend.

March 30 -

Commercial real estate is facing another crisis as companies shift to work-from-home policies. Banks and regulators should brace themselves.

March 30 Community Bank Consulting Services

Community Bank Consulting Services -

What banks need to know about the coronavirus stimulus package; tech vendor Finastra hit with ransomware attack; bank CIOs confront challenge of so many employees working at home; and more from this week's most-read stories.

March 27 -

Thousands of bankers are set for a reprieve as Citigroup, Wells Fargo and Morgan Stanley joined European lenders in pledging to preserve jobs amid the widespread impact of the coronavirus.

March 27 -

The novel coronavirus poses not only an unprecedented health crisis, but an unprecedented financial crisis as well. Can we forestall a worst-case scenario?

March 26 -

Many banks are offering low-interest loans to help consumers and small businesses withstand the economic shocks of the pandemic. Some are also doing away with ATM, overdraft and late fees because, as one CEO put it, that revenue “is not the most important thing right now.”

March 25 -

Banks and credit unions should make it their top priority to pair with the central bank in distributing financial relief to small businesses, even if that means putting everything else on hold.

March 25 Community Bank Advocates LLC

Community Bank Advocates LLC -

Margins will be squeezed after the Federal Reserve lowered interest rates earlier this month to counteract the economic fallout from the coronavirus.

March 25 -

The COVID-19 crisis is forcing many banks to hold their spring shareholder meetings online only.

March 24