-

The credit union can now serve consumers in two additional counties.

February 7 -

The Mississippi company will pay $49 million for Traders & Farmers Bancshares.

February 5 -

The timing couldn’t be worse for ag and energy lenders as well as global banks, which were all counting on the Chinese market to help bolster commercial lending and fee income.

February 4 -

Fewer than 30 CUs in the state would be eligible to make use of the rule, intended to help rural institutions and others attract a more qualified pool of directors and committee members.

February 4 -

The Michigan company will pay $101 million for the parent of First National Bank in Howell, Mich.

February 4 -

Waltham Municipal Employees CU served fewer than 700 members with a total of $8.5 million in assets.

February 3 -

Unlike other regions of the country, the western U.S. has seen very few large bank mergers in recent years. Here's why Pacific Premier's acquisition of Opus Bank could change that.

February 3 -

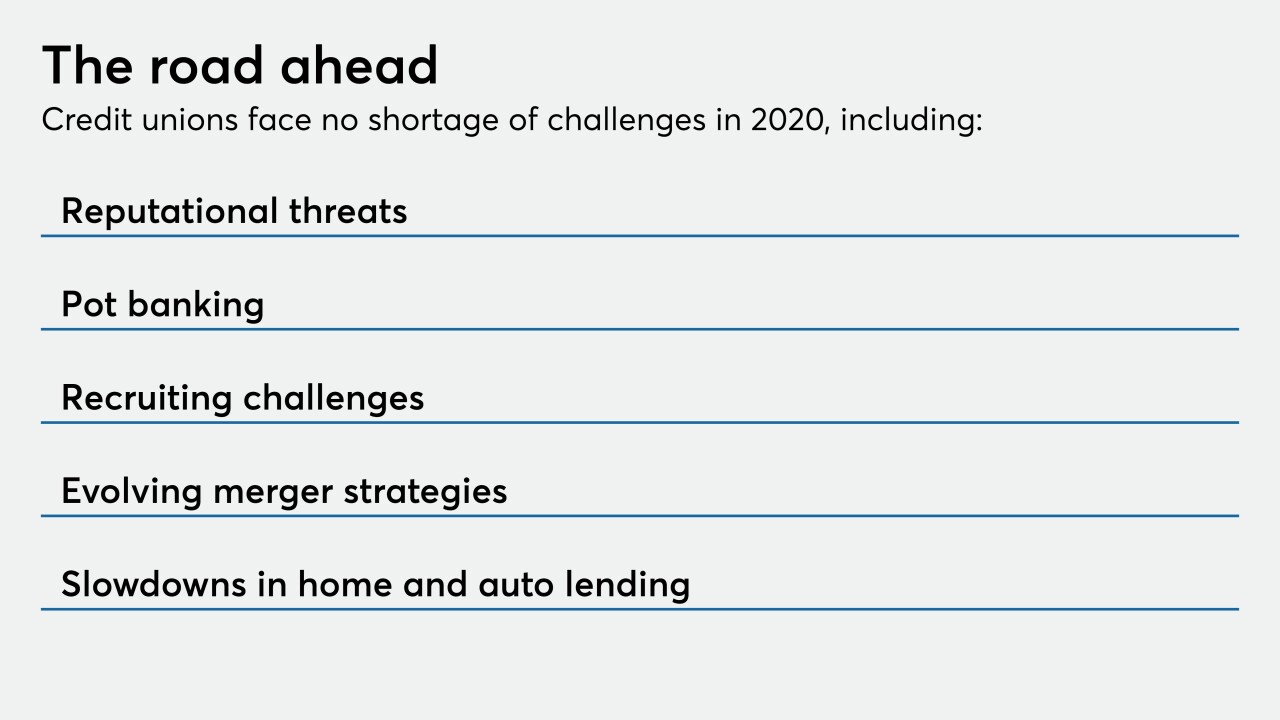

A look back at CU Journal's latest special report on the challenges the industry could face in the year ahead.

February 3 -

The California company will pay $1 billion for Opus, a once highflying bank that struggled with credit issues in recent years.

February 3 -

The Toronto firm, Canada’s fifth-largest lender by assets, must keep “a careful eye on costs” and improve efficiency, its CEO said in a corporate memo.

January 31 -

The Kansas City-area institution has sponsored the NFL’s Chiefs since 2016, but became its official banking partner in 2019. The timing couldn’t have been better.

January 31 -

A new app will allow small-business clients to quickly apply for credit while expanded offerings for homeowners associations will help CIT build up its base of low-cost deposits.

January 31 -

The expansion comes after a year in which net income at the Nashville-based credit union dropped by more than half amid a rise in delinquencies and charge offs.

January 31 -

A letter from the Independent Community Bankers of America calls on lawmakers to curtail credit unions' bank-buying spree or at least take measures to ensure parity between the two sides.

January 30 -

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30

-

The New York-based credit card issuer is expanding its board to 13 members with the addition of Karen Parkhill.

January 29 -

The Wall Street bank aims to double consumer deposits and triple outstanding consumer loans in five years. A checking account is slated for 2021, and more cobranded credit cards could be coming.

January 29 -

A deal bringing $16 million-asset RiverTrace CU into Call Federal Credit Union will take effect on Feb. 3.

January 29 -

A small number of institutions are beginning to add financial assistance for vocational training into their scholarship offerings, but that only accounts for a fraction of the industry's total giving for secondary education.

January 29 -

The deal will create a bank with $34 billion in assets and operations stretching from Virginia to Florida.

January 27