-

Zachary Wasserman will succeed Mac McCullough, who is retiring at the end the year.

October 18 -

Tom Lopp will succeed Gary Judd at the end of November.

October 18 -

The companies say they're working hard to complete their deal this year — including spending millions on retention payments and other items — but there's no guarantee how quickly regulators will make their decisions.

October 17 -

The Gainesville, Fla.-based institution has a new TIP charter granting membership privileges throughout Florida, but no new branches are currently planned.

October 17 -

The Pittsburgh company’s “branch lite” approach to retail and middle-market banking in new markets will break even sooner than expected and has had a noticeable impact on loans and deposits.

October 16 -

The deal will create a nearly $500 million-asset bank.

October 16 -

Northern California utility company PG&E recently shut off power to more than 2 million consumers, meaning some insitutions had to move quickly to minimize the outages' impact on operations.

October 16 -

Perhaps the biggest test that Charles Scharf will face when he starts next week will be how to control expenses while still trying to make the necessary investments in risk management to satisfy regulators.

October 15 -

The acquisition of Farmers & Merchants Bank created a bank with more than $200 million in assets.

October 15 -

Its quarterly results show lower rates and emerging credit risks can be overcome. Whether most banks have all the same levers to pull is another matter.

October 15 -

The tiny Monarch Federal Credit Union joined Firefighters & Company FCU in order to offer its 1,000 members a wider range of products.

October 15 -

BofA’s do-no-harm approach to AI; looking at what comes next for Fannie and Freddie now that they get to keep their earnings; ruling cuts short debt collectors’ victory lap over CFPB proposal; and more from this week’s most-read stories.

October 11 -

Despite a strong economy, volume in the agency's flagship loan program has declined for two straight years. Here's why.

October 10 -

The Long Beach, Calif.-based institution can now serve workers from the healthcare industry in six counties.

October 10 -

MetroCity Bankshares has said it could use the proceeds to open branches or pursue acquisitions.

October 10 -

The financial industry should take notes from regulators that have diverse leadership.

October 10 FS Vector

FS Vector -

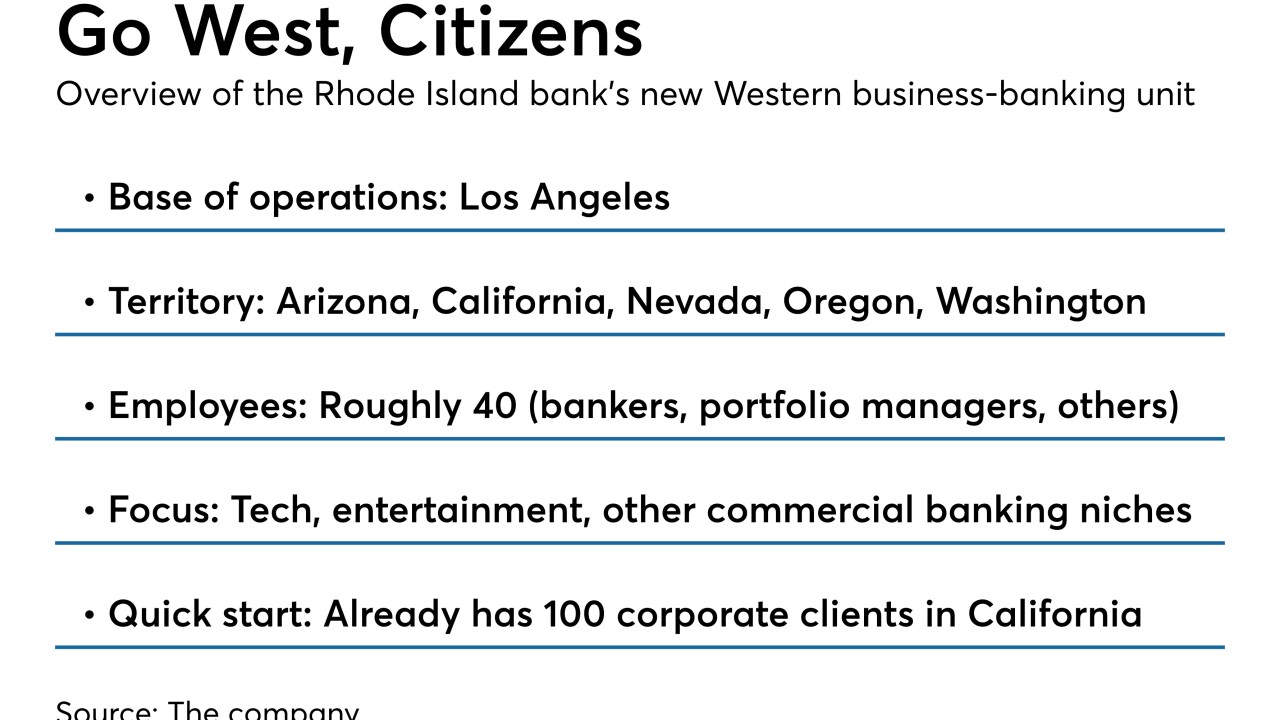

The Providence, R.I., bank recently installed a new regional head in California to oversee a commercial banking expansion into five western states. The bank says it’s trying to craft a successful growth strategy while reassuring investors it isn’t overreaching.

October 9 -

All personnel will qualify for up to six weeks of paid leave following the birth, adoption, or foster-care placement of a child in their home, the agency said.

October 9 -

A thorough process for approving experiments with artificial intelligence, clear philosophical principles and diverse human involvement are some of the ways BofA says it's working to ensure AI does no harm.

October 8 -

Investors expect banks to be honest and transparent about employee wages.

October 8 Arjuna Capital

Arjuna Capital