-

The Rhode Island bank’s deposit costs nearly doubled in the first quarter, but CEO Bruce Van Saun says it has to go on the offensive to sustain loan growth.

April 18 -

The cold, hard truth of bank mergers is that rivals often steal top producers and convince customers the bigger bank won’t care about them anymore. The CEOs of the merging banks explain their retention efforts.

April 18 -

Dealing with a service bureau arrangement can unexpectedly become a giant, expensive nightmare. Here's one cautionary tale.

April 18 Community First Credit Union

Community First Credit Union -

Marianne Lake, seen in recent months as a leading candidate to replace CEO Jamie Dimon, got the post she may have needed to round out her resume — consumer lending chief. And Jennifer Piepszak, another rising star at the company, will take over as CFO from Lake.

April 17 -

The Massachusetts Democrat said the agency could have used existing statutory authority to object to the bank’s appointment of now-departed CEO Tim Sloan.

April 17 -

Asked whether the BB&T-SunTrust deal had sparked a desire to pursue deals, Andy Cecere emphasized a focus on digital upgrades and opening branches in new markets.

April 17 -

Bank of America's Brian Moynihan had a lot to brag about in discussing 1Q results but faced questions about what he would do if economic growth slows and rates hold steady for a prolonged period. Other bank chief executives have gotten, or will get, similar questions this earnings season.

April 16 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

George McNichols helped build the Indiana-based institution from $10 million in assets in 1984 to $554 million today.

April 15 -

The San Francisco bank is under pressure from investors to get out from under a Fed-imposed asset cap and to hire a new permanent CEO. But executives said Friday that thoroughness is more important than speed.

April 12 -

The Illinois-based credit union, which recently announced an expanded field of membership, saw loans rise by nearly 7% in 2018.

April 12 -

From helping purchase a new fire engine to funding scholarships and more, here's a look at how credit unions are giving back.

April 12 -

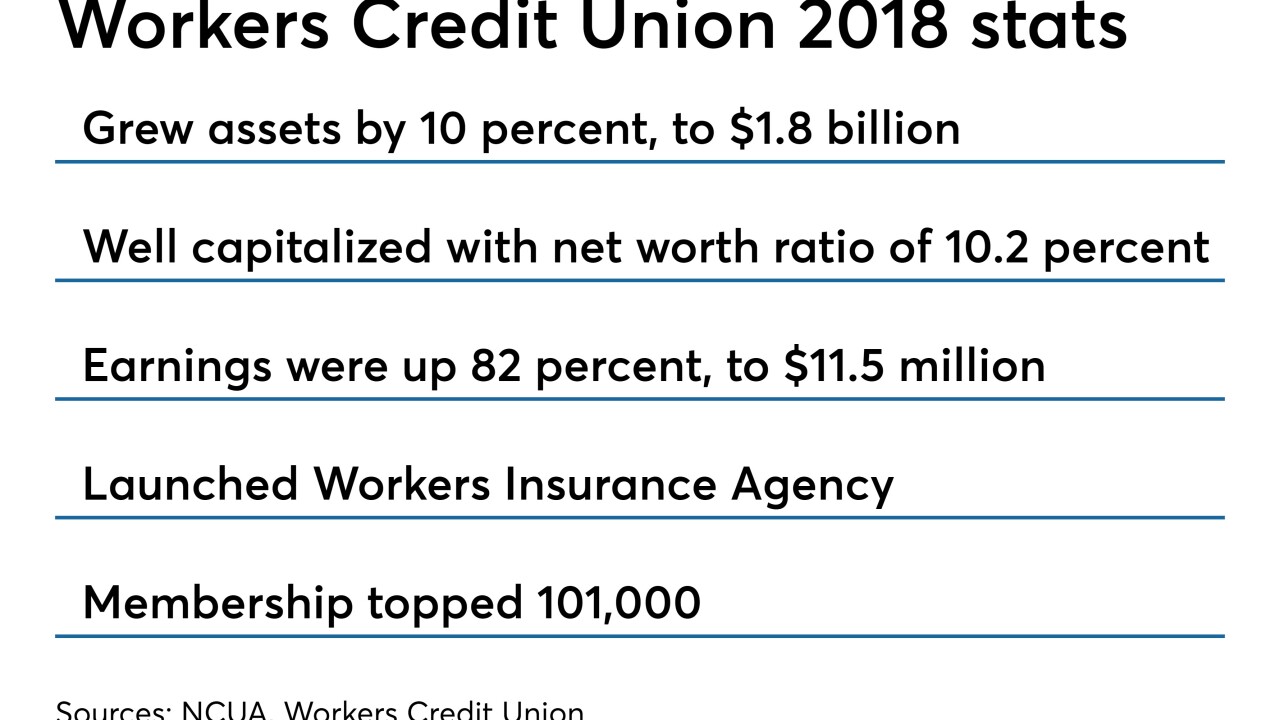

The Fitchburg, Mass.-based institution also started an insurance agency and upgraded its mobile banking last year.

April 12 -

Readers respond to this week's big-bank CEO hearing before the House, weigh the debate over Community Reinvestment Act reform, consider whether Wells Fargo needs a new brand and more.

April 11 -

A House Financial Services Committee hearing featuring seven large-bank CEOs tackled a host of contentious subjects, as Republicans and Democrats sparred over whether such institutions are simply too big.

April 10 -

The heads of three agencies reiterated their concern about the bank’s progress in fixing risk management and corporate governance flaws.

April 9 -

With an implementation deadline less than a year away, bankers will be pressed to detail how a new accounting rule for loan losses will affect reserves, earnings and capital.

April 9 -

Gateway Mortgage Group’s dream of being a national, diversified financial services player will hinge on its effort to turn a community bank into an online-only platform.

April 9 -

PR campaigns won’t be enough to salvage the bank’s reputation after a series of scandals. Instead, it should look into adopting a new name, among other crucial steps.

April 9 K.H. Thomas Associates

K.H. Thomas Associates