-

First Busey plans to close the $236 million cash-and-stock acquisition by the middle of this year.

February 6 -

Chaney was CEO of Hancock Holding in Mississippi for nearly a decade, overseeing a period of substantial growth.

February 6 -

While most ads for the big game are shrouded in secrecy, the credit union unveiled three spots and asked the public to choose which one should run Sunday.

February 3 -

Over the last five years, the credit union also saw a 66% rise in membership, 204% increase in auto loans and a 26% uptick in real estate loans.

February 2 -

Old Line will have more than $2 billion in assets when it completes the acquisition, its fourth since 2011.

February 1 -

The Las Vegas-based CU has returned more than $56 million to members since 2001.

February 1 -

Royal Bancshares in Pa. made tough choices to avoid collapse during the financial crisis

January 31 -

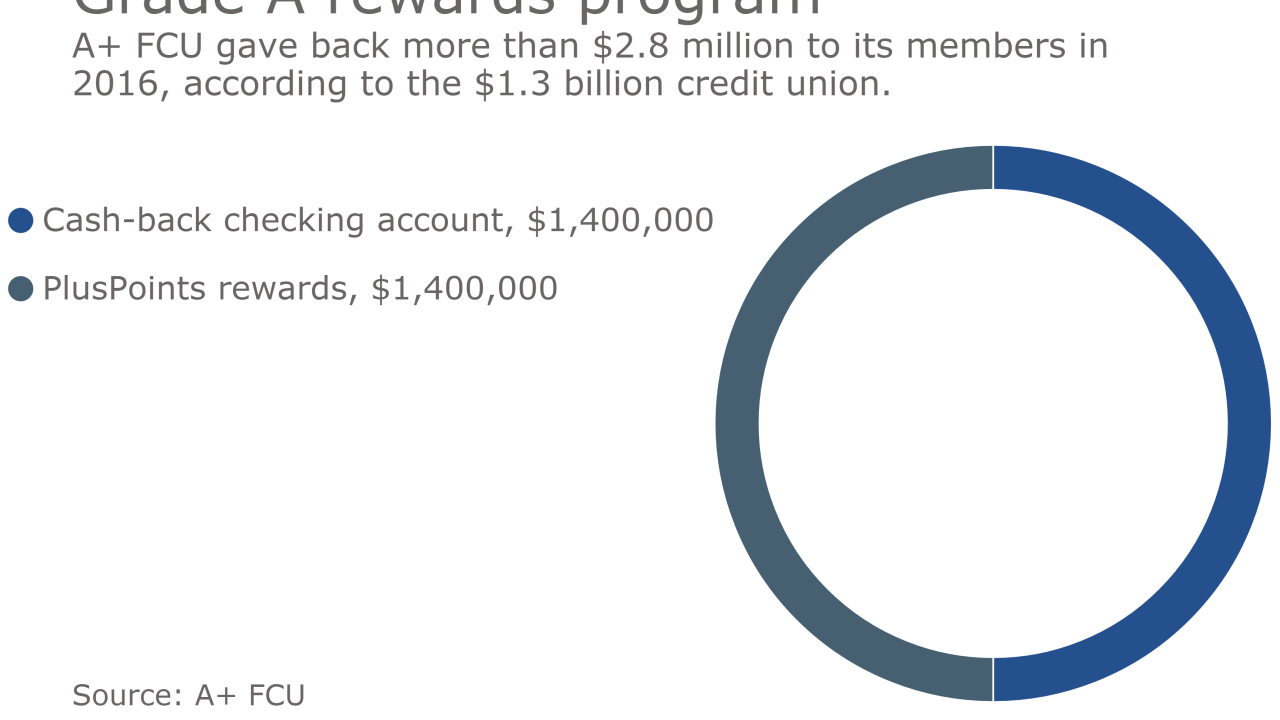

The $1.3 billion CU rewarded members for using their A+ FCU debit card, as well as interest rate discounts on loans and higher rates on certificates.

January 31 -

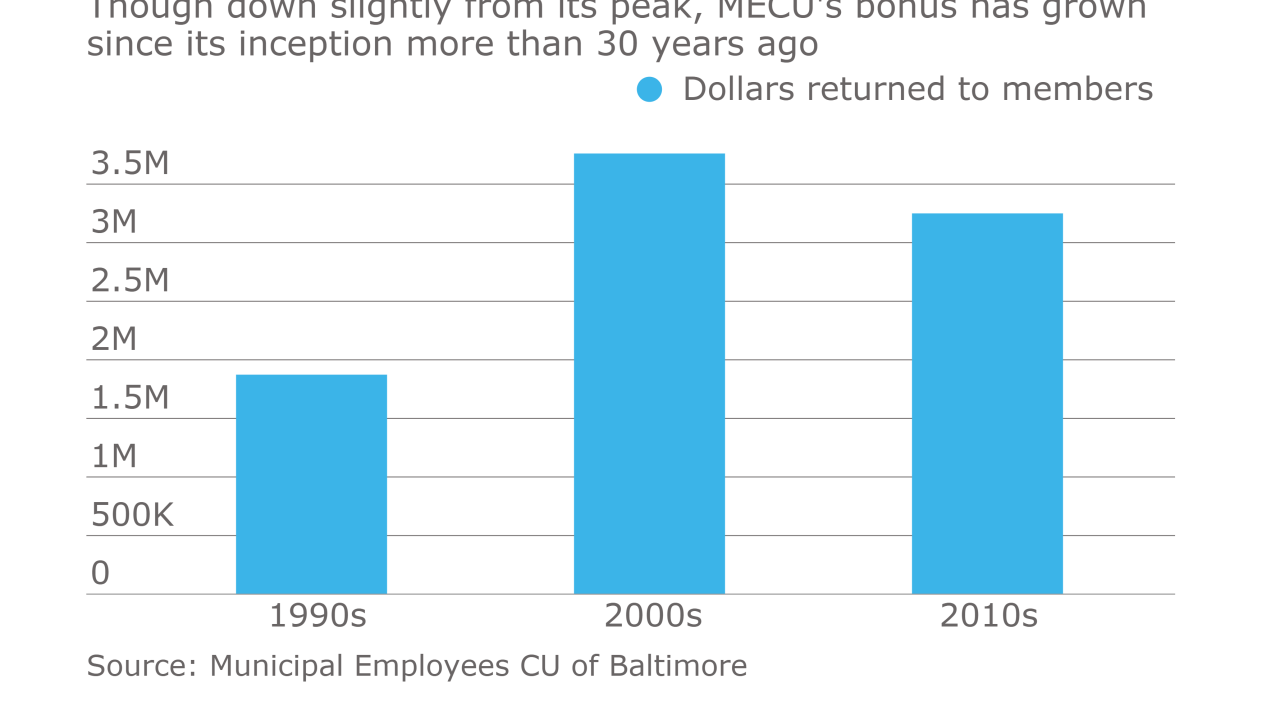

The $1.2 billion CU has returned more than $80 million to members over the last 36 years that it has been issuing annual bonuses to its membership.

January 31 -

The Livingston, N.J., company took a big hit in the fourth quarter as it continued to divest certain business lines and restructure its operations.

January 31 -

The Lompoc, Calif.-based CU is building a new main office in Santa Maria, Calif., after topping the $1 billion mark.

January 30 -

The two institutions are rewarding members for contributing to the credit unions’ success throughout 2016

January 27 -

Sugarman left less than two weeks after the SEC launched an investigation into company statements.

January 27 -

The $1 billion-asset credit union will now serve five counties across New York's Finger Lakes Region.

January 26 -

James Helt had previously served as the president of ACNB’s bank.

January 26 -

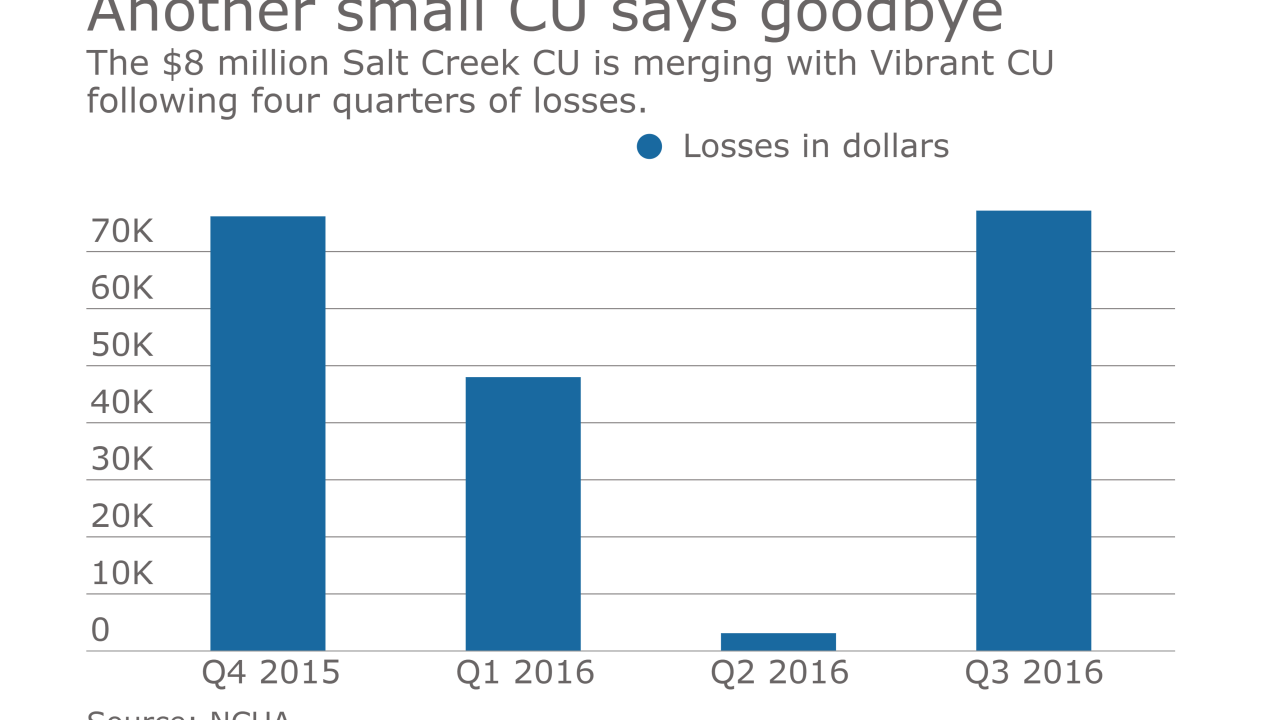

The $8 million credit union’s single office will become a branch

January 26 -

Five federally insured, low-income credit unions earned certification as community development financial institutions

January 24 -

Legion Partners said it has “serious concerns” about the company’s disclosure of inaccurate information.

January 24 -

The New York credit union is touting double-digit growth for 2016.

January 24 -

Quarterly profit fell at SunTrust Banks in Atlanta as noninterest expense rose 8.4% and its loan-loss provision increased.

January 20