Want unlimited access to top ideas and insights?

The prolonged partial government shutdown hits especially close to home for Cabrillo Credit Union in San Diego.

The $300 million-asset Cabrillo serves U.S. border patrol and customs employees, among others. Border security – congressional Democrats' refusal to give President Trump $5.7 billion to build a wall along the country’s southern border – is at the heart of the shutdown.

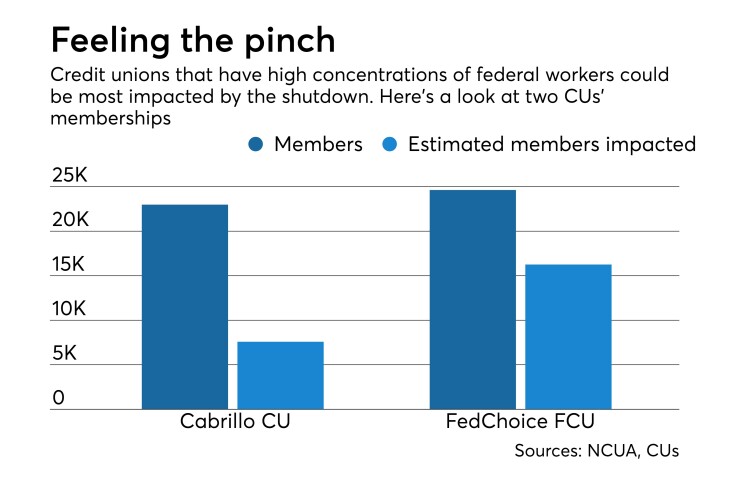

Federal workers – who have been furloughed or on the job without pay since Dec. 22 – make up about one-third of Cabrillo’s roughly 25,000 members. The institution has a variety of programs in place to aid members during work stoppages – and has offered these options for more than 20 years – including interest-free payroll advances of up to $5,000.

But like many other credit unions with a high concentration of federal workers, Cabrillo has to juggle the politically divisive topic of immigration while staring down issues of liquidity,

“The posturing that this could be a longer [shutdown], there’s some obvious concerns from the standpoint of we could be extending credit for one or two pay periods [but]…what happens if it goes on for three or four months?” said Jonathan Zide, Cabrillo’s chief operating officer. The member assistance programs have “got to be something we can sustain – how do you sustain providing a program like that for six months? We don’t know. We don’t know what to expect.”

While there has been a lot of fear and concern from Cabrillo’s members as a result of the shutdown, it has also helped endear many to the institution and even acted as a growth engine of sorts.

Cabrillo has a nationwide presence through a partnership with another agency associated with the border patrol. Prior to the shutdown, management began leveraging that into a handful of new memberships and loans, Zide said. Once the shutdown hit, however, online applications for membership – in part to take advantage of the CU’s payroll advances for government employees – have surged, jumping 36 percent during the first week of January alone from December.

Zide emphasized that while Cabrillo is growing as a result of the shutdown, it’s “not because we’re actively seeking it – it’s just that word of mouth is spreading.”

Still, border security is a politically fraught issue, and Zide said that the credit union tries to steer clear of anything political. But that doesn’t always work. Zide received a text message from the head of a border patrol group in Texas that said “Chuck Schumer stole Christmas with the shutdown but Cabrillo has our back.”

At Lanham, Md.-based FedChoice Federal Credit Union, about two-thirds of its members work for either the Internal Revenue Service or the Bureau of Alcohol Tobacco and Firearms, both of which are considered non-essential in the shutdown and workers are going without pay. The $412 million-asset institution is offering similar relief programs for affected members and has also seen some minor growth as a result.

“This is the time of year when we’re normally fairly slow,” said Kevin Roland, delivery channels director at FedChoice. “The silver lining to this cloud is it helps us from the new membership and loans perspective, but obviously we don’t want to be in this position in terms of growing this way.”

Credit unions that have a high concentration of federal workers could eventually face liquidity pressures. As employees go without paychecks, deposits made into these institutions will also suffer. That could potentially hurt their ability to make loans or sustain their programs to help federal workers.

Many executives across the industry are confronting difficult questions should the shutdown go on for months or years as President Trump threatened.

“You can only prop up the payrolls of government employees for so long and step in and try to protect them,” said Brad Smith, chief strategy officer at Frontwave Credit Union in San Diego, which was founded in 1952 to serve federal employees working at Camp Pendleton. “If it goes on for any extended period of time, a lot of these short-term solutions are not going to be effective.”

Smith said management is only starting those conversations about what to do if things carry on much longer, but he added that “experience would tell you that the pain will grow so fast and [lawmakers] will cave in and actually pay them. But you always have to plan for those contingencies where folks don’t have a paycheck.”

Lessons from the ‘90s?

Should the shutdown extend into next week, it will surpass the closure that ran from December 1995 to January 1996 as the longest ever. While politics and credit unions have changed dramatically in that time, one observer said this event could have a lingering impact for the industry.

“In the past, those workers within credit unions may have been the majority, and in some places that may not be the case, because some have opened up their fields of membership or may have merged with other SEG entities,” said Steve Williams, president and co-founder of Cornerstone Advisors.

Williams added that – particularly for smaller credit unions – this process could result in major conversations about an institution’s identity and who it wants to serve.

“Some who have been on the fence about ‘Should we go more community charter or stay close to our civil-service niche’….this may again have them say, ‘This charter or SEG base has risks to it; it used to be quite safe and steady, and now its volatile because of where politics is going. It may open up more charter and SEG discussions,” Williams said.

In the meantime though, many credit unions are just trying to make the best of a bad situation.

“We’ve got to be there to support them because right now they’re just pawns in a political game,” Cabrillo’s Zide said.