This story is the final installment of a series on best practices for improving board diversity. Previous entries can be found

Credit unions continue to change their charters and broaden their fields of membership in a push to serve more consumers, but some observers say CU boards of directors have not followed suit and are still too closely tied to the institution’s roots.

Michael Daigneault, CEO and founder of Quantum Governance, explained that all too often CUs that once served a single business and later expanded their charter to include multiple SEGs or large geographic areas have boards that as much as 10 years later still remain too closely tied to the original sponsor, with boards consisting entirely of employees or retirees from the original sponsor.

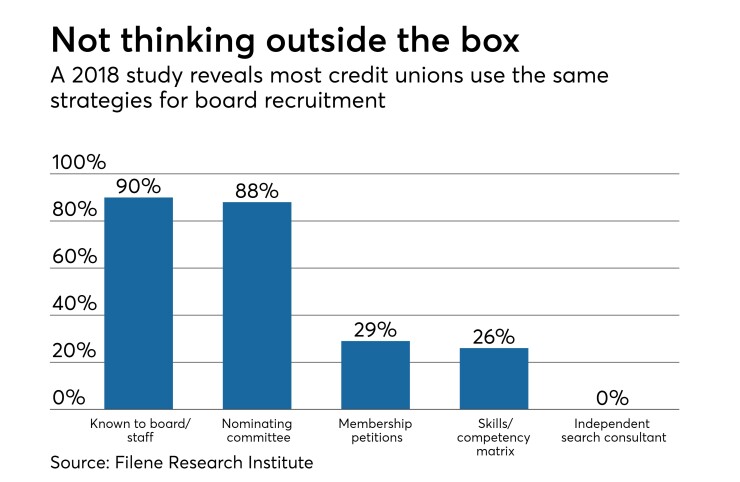

A

Boards stuck in the single-sponsor past “remains a common challenge,” said Daigneault, not just for institutions that have merged or acquired other CUs, but even for those that began as single-SEG shops and later expanded to a community charter.

That was the case at XCEL Federal Credit Union, a $169 million-asset institution in Bloomfield, N.J., formerly known as The Port Authority of New York and New Jersey Federal Credit Union.

“You can see why a shorter name was chosen subsequently,” quipped Stacey Walker, a member of the CU’s board. Even after the name changed, explained Walker, the credit union’s board was made up entirely of current or former Port Authority employees.

“The board made a conscious decision to seek employees from other SEG groups to keep up with the changing membership,” Walker said. “Shortly after I joined as a director [in 2005], I was told my candidacy was appealing, in part, because I previously worked for the federal government and not for the former single sponsor.”

Similarly, Charleston, W.Va.-based Element FCU was chartered as a single-SEG credit union, but when it broadened its field of membership to multiple SEGs and underserved areas, its board still represented the original SEG, explained CEO Linda Bodie.

“Even though they were all from the same employer, they did recognize the need for voices from outside the SEG,” said Bodie. “When board members chose to retire, we looked outside the employer group to recruit more diverse talent. It was a gradual process…not something that can be forced.

SCE Federal Credit Union, a $730 million-asset institution headquartered in Irwindale, Calif., also started as a single-SEG institution but while its field of membership today is “constantly changing,” said board member Michael Maxwell, the board itself has expanded along with the rest of the institution.

“This can make it tough to constantly keep up with the additions, but we currently only have one member of our board who was affiliated with the original SEG,” he said. “Attrition and a focus on diversifying the board have contributed to this change. While we serve multiple states, incomes and SEGs, I believe we have the right mix of voices on our board that accurately represents our field of membership.”

Make room for new members

Credit union boards are often stereotyped as consisting primarily of elderly white men, and Nancy Herbert, chair of the board of directors for $2 billion-asset Elevations Credit Union, Boulder, Colo., said for many years her CU’s board reflected that stereotype. To solve that problem, the Elevations board underwent two shifts that “dramatically changed” the panel’s composition and diversity: nine-year term limits for board members were instituted in the 1990s and in 2003 the CU converted to a community charter.

“Prior to those two strategic decisions, the board consisted solely of representatives from our select employer groups of the University of Colorado and surrounding federal labs,” Herbert explained. “It was apparent to the board of directors that the future success of the credit union would require a broad, diverse group of leaders.”

This emphasis worked, Herbert continued. By the mid-2000s, the Elevations CU board consisted of one university leader, one federal lab leader and then a majority of female directors. In 2014, the term limit for directors was reset to 12 years.

“Currently, our board is keeping up with the growth of our field of membership by ensuring geographic diversity of directors,” Herbert said.

According to Daigneault, board diversification at CUs is a “lag-time phenomenon,” especially in the case of a significant change to the institution’s field of membership.

“There is a decision made to change to a community credit union, but it may take the board years to reflect the change,” he said. “The question for credit unions is: how to appropriately construct the board to be the members’ voice.”

Daigneault recommended a variety of methods for diversifying legacy boards, including conducting outreach to new and different segments of the community, asking people to be part of community events and committees, and expanding the board to add new voices.

Elevations CU’s Herbert advocated that last strategy, noting that adding more director slots helps alleviate “possible anxieties” that current directors will be required to retire to make room for individuals with the diversity of demographics, competencies and attributes needed.

SCE Federal Credit Union’s Maxwell said boards can diversify now and into the future by creating a pipeline to get new members engaged.

“This could be a junior board of directors that can be mentored, or the credit union could shift the composition of its supervisory committee and utilize that as a pipeline to vet new candidates,” Maxwell offered. “People avoid change, but coming up with a transition plan that make take a couple years while exposing the legacy board members to newer candidates early on can make the change more seamless.”

Walker said XCEL FCU knew it needed to add new voices as it transitioned from a single sponsor to multiple SEGs, but it also wanted to retain volunteers from the Port Authority who had “served with excellence.” To accomplish both goals, XCEL established a “board emeritus” position, which allowed volunteers to serve in an advisory capacity following their board tenure.

“The board emeritus position allows XCEL to maintain an ongoing relationship with volunteers who have a vast historical knowledge while providing informed opinions,” Walker said. “To keep up with changes in membership, it is important for every board to recognize changes as they occur contemporaneously and then to address them appropriately within their respective credit union’s culture.”