Credit unions are staring down the possibility of depressed earnings for a prolonged period.

There are predictions that the return on assets for credit unions could be down through at least the rest of this year because of the economic collapse related to the coronavirus. Institutions across the country have already boosted their provisions for credit losses. With millions of Americans still jobless and facing reduced unemployment benefits, the situation could still get worse.

Because of that, credit unions may need to consider ways to cut costs and better utilize technology to help their bottom line.

“The outlook on profitability is troubling for a lot of reasons,” said Mary Beth Sullivan, managing director at the consulting firm Capital Performance Group. “Net interest margins are being hammered in the zero-rate interest environment. The loan-loss provision is anticipated to be higher. When you look at those two challenges, you have a profit challenge.”

Although different management teams may focus on different metrics to track their institution’s financial performance, return on assets can be particularly important, experts said. It’s better to use this statistic to compare profitability with peers than just net income. It also reveals how efficient an institution is at utilizing its assets.

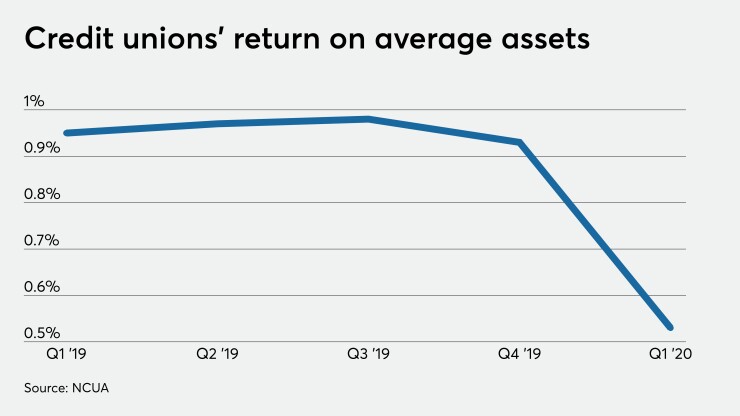

This metric has fallen steeply in the aftermath of the coronavirus and subsequent recession. The industry’s return on average assets declined to 0.53% in the first quarter, down from 0.95% for the same period a year earlier, according to data from the National Credit Union Administration.

Earlier this year, CUNA Mutual Group predicted income as a percentage of average assets could drop to 0.40% for 2020 and then just 0.10% in 2021.

“We are in a recession and its aftermath,” said Bill Hampel, a credit union consultant and economist. “That’s often bad for credit union earnings and it will be this time. But it won’t be like before or for the same reasons as the Great Recession a dozen years ago.”

Hampel noted that credit union profitability took a hit after the 2008 financial crisis because of elevated provisions for loan losses and assessments paid to the Temporary Corporate Credit Union Stabilization Fund.

Money set aside for bad loans will again increase as the business environment remains strained, unemployment is high and there are concerns about borrowers being able to service debt. Provision for loan losses jumped 34%, to $8.5 billion, in the first quarter from a year earlier, according to NCUA data.

But the biggest drain on earnings will be if the Federal Reserve keeps short-term interest rates low for a prolonged period, Hampel said. Credit unions will move to lower their cost of funds by decreasing interest paid to members. But at the same time, the funds institutions earn from investments will also be close to zero, Hampel added.

For the first quarter, the median credit union net interest margin was 3.23%, down 9 basis points from a year earlier and 15 basis points from the fourth quarter of 2019, according to data from NCUA.

“The only place [credit unions] will earn much is on mortgage loans but there is a limit on how much they can put on their books because of interest rate risk issues,” Hampel added.

Conditions could worsen as loan forbearance periods end and members potentially have trouble making payments, said Jeff Marsico, executive vice president at the consulting firm Kafafian Group.

Americans who are out of work were receiving an extra $600 per week in unemployment benefits, but that expired at the end of July and Congress has yet to reach a compromise on a new coronavirus relief package.

This potential loss of income could make it harder for some borrowers to catch up on loan payments. Marsico noted that lenders have allowed deferred loan payments on anywhere from 5% to a third of their loan portfolios.

“It’s unrealistic to think these borrowers will all catch up,” Marsico said. “There will be a period of elevated problem loans. We extended the period. [Lenders] will feel the pain by allowing that and that will drag out the rest of the year as these loans work their way through the nonperforming assets list.”

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

Affinity Federal Credit Union in Basking Ridge, N.J., is predicting its ROA will range from around 0.35% to 0.50% for the year, said Frank Madeira, senior vice president of finance and payments. Currently the institution is faring better than what management predicted four months ago when there was so much uncertainty. Initially management was worried about members withdrawing funds at elevated rates, so it stocked cash to ensure it would be able to meet demand but that issue never came to pass. Instead, deposits increased by about 15% year over year, Madeira said.

The next challenge will be dealing with the possibility of higher charge-offs and delinquencies, Madeira said. The $3.6 billion-asset credit union allowed deferred payments on about 10% of its loan portfolio for three months. Members are now starting to make payments again and so far most have been able to do so.

“That’s a positive sign,” Madeira added. “But there are still a lot of unknowns. We are sort of hoping for the best and planning for the worst in terms bolstering our reserves.”

Reducing expenses may become necessary for some credit unions to boost their bottom line, experts said. Most expenses are tied to maintaining branches and paying for employees and benefits. The coronavirus has accelerated the trend of consumers using technology for more of their banking needs so it’s likely that branch networks will be further trimmed to reduce costs.

However, management teams are often loathe to layoffs employees, especially during a tough economic environment.

Instead, executives should review their different businesses and products to ensure they are contributing to the bottom line, Marsico said.

“If you are spending too much on this line of business, then it’s a drag on your earnings,” he added. “You have dedicated resources to areas that you could be more efficient at.”

They could also consider temporarily cutting employee benefits, allowing headcounts to drop through attrition or look for ways to use technology to make processes more efficient, Sullivan said. That could mean automating the credit process or even financial reporting so fewer workers are involved.

“I do see folks looking at areas of process improvement where you essentially put tech in place and have fewer touch points and fewer humans involved in those operations,” she added. “That’s a big focus, but not something that you can improve overnight.”

Affinity’s management has been very cost-conscious since the pandemic began, Madeira said. Some expenses, such as travel, have essentially evaporated but other areas, such as origination costs, have increased as demand for mortgages has surged.

Executives are considering reductions in areas such as marketing and cutting back on new hires, he added.

“We aren’t replacing employees who leave,” Madeira said. “We aren’t doing slash and burn to expenses, but we are being conscientious.”