Some credit union advocates are arguing that the National Credit Union Administration needs to further ease field-of-membership rules to address issues highlighted by the coronavirus.

Last year, a long legal battle over previous changes NCUA made to FOM requirements was settled after the

But the Credit Union National Association and others are calling for requirements to be loosened even further to ensure the financial viability of credit unions, especially those that currently serve a narrow group of members and may be interested in expanding.

“Field-of-membership changes have been impactful and beneficial,” Mike Schenk, chief economist for CUNA, said during a hearing regarding NCUA’s budget. “And more can and should be done.”

In 2016, NCUA updated FOM requirements to expand how credit unions can define membership eligibility, including across broad rural areas that cross state lines or excluding core-based statistical areas. Credit unions hoping to serve rural districts across a broad geographic area can do so without having to seek permission from multiple state regulators.

But Schenk argued that the pandemic demonstrated that this expansion of FOM wasn’t enough. The economic turmoil related to the outbreak further showed the heightened safety-and-soundness issues for credit unions with concentrations in specific industries.

For example, the leisure and hospitality industry — including restaurants, hotels and theme parks — saw a near-immediate decline in employment once the coronavirus became widespread. The industry lost 8.3 million jobs in the two months that ended in April, according to a letter CUNA submitted about the budget.

As local economies opened, the employment situation in the hospitality sector improved, but overall employment remained more than 20% lower than February’s pre-pandemic level, according to the letter.

Schenk said during the regulator’s budget hearing late last year that CUNA hopes the regulator will use the COVID-19 crisis as a reference point for meaningful field-of-membership reform.

But Sam Brownell, founder and CEO of CUCollaborate in Washington, D.C., said some of the burden of those narrow memberships falls on the institutions themselves as they often fail to take full advantage of expansion possibilities and are hesitant to branch out.

“In almost all cases it’s a lack of interest from the credit unions,” he said. “They are resistant to broadening their club and allowing more people in.”

That’s because most of the institutions believe that operating within their chosen niche is the best path to success, he said.

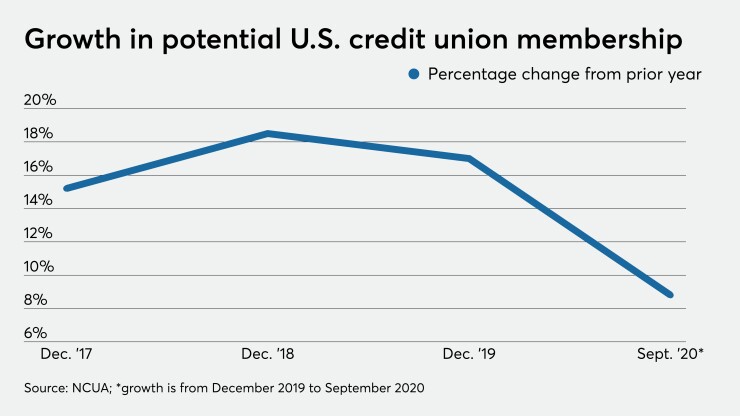

Additionally, the number of potential members has already expanded for the overall industry in recent years, increasing by 73% from December 2016 to September, according to NCUA data. Potential membership reached about 4.3 billion in the third quarter, according to the data. However, that counts some Americans more than once since they could fit the field of membership for multiple institutions.

Gerber Federal Credit Union in Fremont, Mich., was a single-sponsor credit union for decades but converted to a

John Buckley, president and CEO of the $187 million-asset institution, said he believes Congress should take up a rewrite of the Federal Credit Union Act to open up field-of-membership rules further.

“The bankers will scream at the top of their longs, but it does become a safety-and-soundness issue from the standpoint of concentration risk,” he said. “You could say the same thing about geographic concentration, but that would tend to drive industry consolidation around a few large players, which is not what most of the industry wants.”

NCUA Chairman Rodney Hood said in an interview the regulator is closely monitoring credit unions that serve hard-hit industries, but he stressed that the pandemic underscores the need for greater financial inclusion for lower-income families.

“Concentration is an area to consider, but I’m looking more broadly at the picture around the COVID-19 pandemic,” he said.

Jim Kasch, the former CEO of Darden Employee Federal Credit Union, said the pandemic highlighted the requirement for single-sponsor credit unions to have good relationships with both their sponsors and the people in their communities. Darden Employees FCU was launched in 2010, as the U.S. was coming out of the Great Recession, to serve workers of Darden Restaurants. The institution merged with the $819 million-asset USF Federal Credit Union in Tampa, Fla., four years later due to significant growth — loans and assets ticked up by 650% and members reached 12,000.

Kasch, now a consultant, said there is only so much institutions can do when serving sectors hit as hard as the restaurant industry has been in recent months, for example.

“There’s no question it would have hindered our ability to maintain and continue to grow if there's that many people out of work,” he said. "If you’ve been known to serve only a particular sector for a long time, it can be difficult internally to shift the mindset."

John McKechnie, credit union consultant and partner at Total Spectrum, said field of membership was never meant to be a barrier to entry for consumers, and the NCUA has made several

"In the future, as technological changes such as mobile access and fintechs are remaking the financial services landscape, the NCUA should be exploring additional options to ensure credit union access for as broad a range of consumers as possible, particularly concerning what now defines a community in a 21st century context," he said.

In December, NCUA voted on a proposed rule that could make it easier for institutions to expand their FOM. The

The Federal Credit Union Act requires credit unions to have a facility reasonably close to members. Under the current rule, that means institutions must have an ownership stake in a branch or ATM for the facility to qualify.

But if the rule is changed, that means institutions may not have to spend significant amounts of capital to build new facilities and hire staffing as they expand their membership base.

Carrie Hunt, executive vice president of government affairs and general counsel for the National Association of Federally-Insured Credit Unions, said modernized field-of-membership rules are crucial to the future well-being of the credit union industry. The trade group is supportive of measures that will allow credit unions to grow and access all of the potential tools available to help their members and communities amid the ongoing pandemic.

“FOM reform will help credit unions do what they do best,” she said. "We have been working with the agency on ways to do more."

For CUNA’s part, the trade group largely believes that field of membership is outdated in the modern banking landscape, and Jim Nussle, the trade group’s chief executive, argued in an opinion piece last year that FOM

“We’ve had a policy for a long time that we thought field of membership as a concept is obsolete, and we’ve been working very hard to expand the ability of credit unions to serve all consumers, and so that’s certainly something from our perspective that should be on the table,” said Ryan Donovan, CUNA’s chief advocacy officer.

But that doesn’t mean reforming the Federal Credit Union Act will be front-and-center on the trade group’s agenda when working with the new congress.

“If a [Democratic] policy objective is to have greater financial inclusion and access to credit, is there more credit unions can do or is there more the law can allow credit unions can do to help achieve that policy objective?” he said. “I think there’s an opportunity there for us to have a conversation…But what I’m focused on right now is how do we have that discussion and align that interest with the discussions we know are taking place on Capitol Hill.”

Aaron Passman contributed to this story.