Overdraft income at credit unions surged in the first quarter of 2018 while banks and savings institutions saw declines, according to a new study from Moebs $ervices, an economic reseach firm based in Lake Forest, Ill.

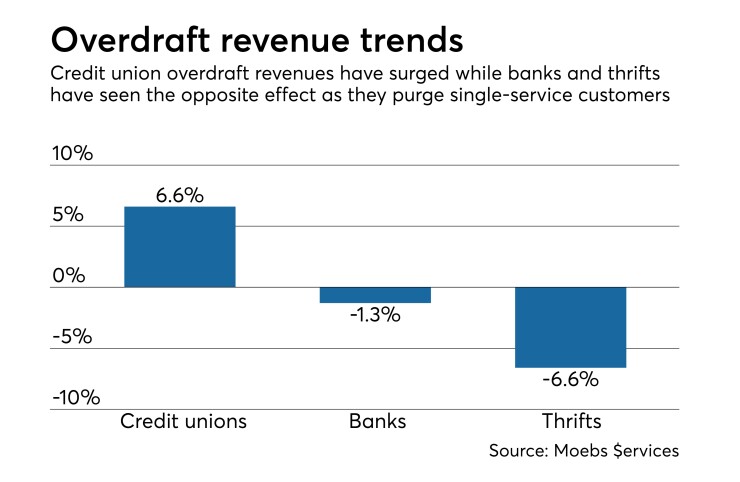

The Moebs study revealed a 6.6 percent increase in overdraft revenue at CUs comparing the first quarter of 2018 with the first quarter of 2017. During that same time period, banks saw overdraft income decline by 1.3 percent, while savings institutions experienced a 6.6 percent drop. That data, said CEO Mike Moebs, is a sign banks and S&Ls are shedding unprofitable customers.

“What’s happening is banks and thrifts are shedding single-services households when the only account is checking,” he said in a statement. Meanwhile, CUs are welcoming those consumers on the belief that they can gain fee income from transactions like overdraft fees, while also establishing relationships for the future.

As a whole, overdraft revenue at all depositories fell by 0.1 percent from the first quarter of last year, with the gains at CUs not enough to compensate for the drops in revenue at banks and thrifts. Moebs noted demand deposit account balances by consumers and businesses also rose by 6.2 percent during Q1, exceeding the $2.1 trillion mark.

“Normally DDA is about 4 percent of total money stock, yet currently is 13.2 percent of money stock,” states Moebs. “This signals the consumer has not yet reengaged with the economy.”

Annualized, total overdraft volumes stood at about 1.1 billion transactions, with Moebs noting the number of such transactions at credit unions rose by nearly six percent, with a corresponding decline at thrifts and a 1.3 percent decline at banks. This, he added, indicates banks and thrifts are emphasizing two or more services per household, reducing overdraft transactions and thereby revenue as banks move away from transaction business — in particularly checking debits and payments.

CUs, meanwhile, seeing the shift from the competition, are reaching out to those consumers, relying on fee revenue as part of a larger strategy to boost non-interest income.