Some in-person credit union meetings may go virtual as a result of the coronavirus, but the change may not be temporary.

To help slow the spread of COVID-19 and prevent health services from becoming overwhelmed, experts have encouraged social distancing. Government officials have shuttered schools, ordered bars and restaurants closed, and prohibited large gatherings. The credit union industry has followed by

Individual credit unions are still required to hold board and annual meetings, however, and some institutions are now looking for ways to still host those gatherings while limiting face-to-face interactions.

“More and more credit unions across the country will turn to virtual meetings as a matter of caution,” said Michael Daigneault, CEO of Quantum Governance, a corporate governance consulting firm. “It’s a matter of honoring people’s health as a primary concern.”

Annual meetings in a digital world

Traditionally credit unions have not only used their annual meetings as a way to elect a slate of directors, but also as a time for staff to show their appreciation of members with a free meal or gift and tout the institution’s performance for the last year.

But that format may come to an end as some credit unions cancel their in-person annual meetings and instead opt to livestream them.

“I do see virtual meetings growing,” said Jeff Kennedy, CEO of TwinStar Credit Union in Lacey Wash. “We are living in a digital environment and people are looking for that. It gives you a much broader reach.”

Toronto-Dominion Bank plans to give most employees the option to return to the office this month and is aiming for workers to officially transition to their new working models by June.

The Biden administration once again extended the pause on student loan payments enacted to help borrowers during the COVID-19 pandemic, this time through the end of August.

Employees will still have some flexibility to work from home, but are strongly encouraged to collaborate with colleagues in person, according to people familiar with the matter.

Earlier this month the $1.5 billion-asset TwinStar decided to forgo its traditional annual meeting that included a breakfast and a raffle for members and instead hosted the event on Facebook Live because of concerns around the coronavirus outbreak. Washington state has been one of the hardest hit areas in the U.S.

TwinStar, which is state chartered, was able to have a virtual only event because

“In Washington, there’s a lot of just really forward thinking and planning,” said Amy Hunter, director of credit unions at the Washington State Department of Financial Institutions. “It’s just fortuitous that the law got changed.”

Century Federal Credit Union in Cleveland decided to cancel its in-person annual meeting after Ohio Gov. Mike DeWine banned gatherings over 100 people. The $413 million-asset institution’s meeting usually draws between 200 and 300 members and includes food and gifts for those who attend, said President and CEO Sharon Churchill.

Instead, Century will now host a virtual live webinar on the original date for the meeting. Members can tune in through Zoom or by telephone, Churchill said. A secret phrase will be given during the meeting so members can later repeat that at a branch to receive their gift.

More institutions could follow the lead of Century and TwinStar, experts said.

“We are getting significant interest [in virtual annual meetings],” said Keith Hardin, president of E Space Communications, a provider of cloud-based products to credit unions, such as CUBoardMembers, which offers a virtual conference room. “Credit unions are activating contingency plans and seeing what’s available to them to make these plans happen.”

However, not every credit union may be able to completely cancel in-person meetings and only stream the event online. Laws will vary by state for state-chartered institutions. An institution’s bylaws may also prohibit a virtual only event or may have certain requirements on the quorum that make an in-person component necessary.

The Federal Credit Union Act normally requires federally chartered institutions to host an in-person meeting, the National Credit Union Administration said last week. But the regulator issued guidance on Friday that said an institution could host a

There are still ways to reduce attendance if an institution determines it needs to have an in-person component, according to an alert sent out by the law firm Farleigh Wada Witt in early March. For example, credit unions may want to cancel incentives that encourage attendance, such as door prizes and free meals, the alert said.

“Your credit union annual meeting is important, but not as important as the health and lives of your members,” the law firm added. “The current coronavirus pandemic is forcing everyone to consider the need and logistics of large public gatherings.”

Board members tuning in remotely

Credit unions may turn toward virtual options for board meetings as well, experts said. Although the Federal Credit Union Act requires monthly board meetings, only one face-to-face meeting is required per year,

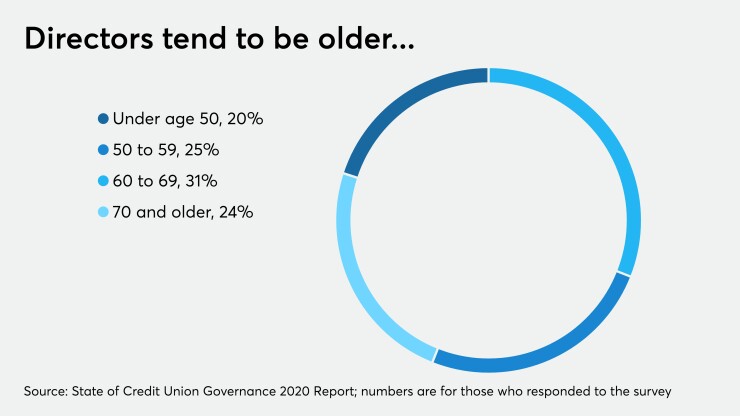

Implementing virtual options during the coronavirus, which has affected older people more severely, may become essential since directors tend to skew older. Only 20% of credit union supervisory and audit committee members that responded to a survey were younger than 50 years old, according to the State of Credit Union Governance 2020 Report from CUES, Quantum Governance and the David and Sharon Johnston Centre for Corporate Governance Innovation. The average age of a board member was 60, according to the report.

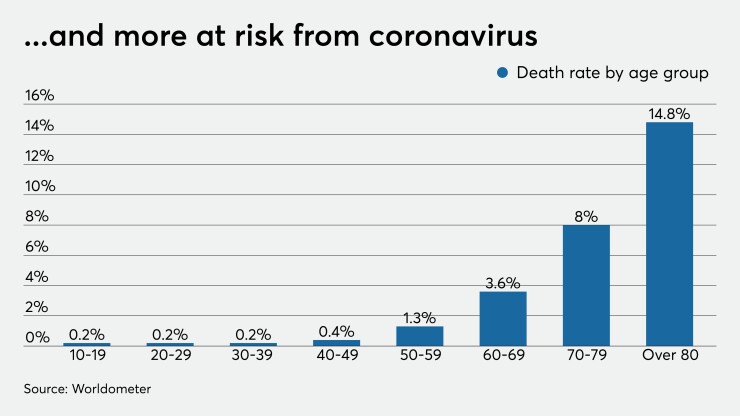

The coronavirus has a fatality rate of far less than 1% for those 49 and younger but it ticks up to 1.3% for those in their 50s, according to Worldometer, which tracks global statistics. It then jumps to 3.6% for those who are in their 60s and continues to increase from there for older demographics.

“Some board members are in their 70s and 80s and they are uniquely at risk,” said Daigneault of Quantum Governance. “They have to be protected.”

Directors also need to think about cybersecurity when hosting a remote meeting since sensitive information may be discussed, said Eileen Iles, a partner at Crowe. The institution should complete its normal third-party due diligence before selecting a vendor for a virtual board meeting.

“You have to monitor to make sure no one gets onto the meeting that shouldn’t,” Iles said. “Some systems are more secure than others.”

Broadening reach

Despite these concerns, implementing virtual options for annual and board meetings may increase a credit union’s reach, experts said. For instance,

Livestreaming an annual meeting may allow that information to reach a broader audience, especially if an institution’s membership covers a large geographic area – an increasingly common occurrence as

Because of this, credit unions that initially implement virtual elements because of the coronavirus outbreak may continue to use them long after the threat has passed.

“I think once credit unions start using it more, they will find it’s a nice tool and handy,” Iles said. “You get in and out of meetings fairly quickly.”

Century, which will have its live webinar later this week, will see how the event goes before making any decisions, Churchill said.

“This is a first for us,” Churchill added. “I am not certain that we will continue to do a virtual meeting as our members that attend look forward to it. Many of our board members don’t want to give it up as well. On the other hand, [we] have a few board members who would prefer virtual. So we’ll just have to wait and see.”