Despite earnings challenges this year, credit unions haven’t cut expenses.

In fact, third-quarter noninterest costs ticked up about 6% from a year earlier to $50.7 billion, even as year-over-year earnings fell by 25%, according to data from the National Credit Union Administration.

Increasing labor costs were a significant driver behind the rising expenses, but institutions also continued to make investments in digital technology as more members shifted to online and mobile banking because of social distancing and restricted branch access brought on by the pandemic. Experts said rising labor costs and continued investments into digitization are likely to continue into 2021.

“Credit unions need to be mindful of every dollar increase in operating expenses and how that translates into revenue,” said Claude Hanley, a partner at the consulting firm Capital Performance Group. “It’s a tough operating environment, so that revenue is very hard to come by. New members will be hard to come by. That means you have to be disciplined around where you are spending money.”

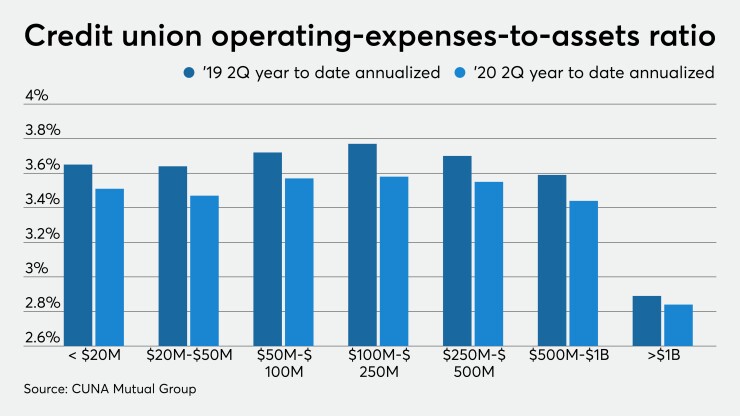

One key expense metric this year — the operating-expense-to-asset ratio — has actually declined from the prior year. As of the second quarter, that figure annualized was down for every asset category when compared to the same period in 2019, according to data from CUNA Mutual Group. Second-quarter figures were the most recent data available.

But that decline can’t necessarily be attributed to better expense management or larger structural changes, experts said. Instead, credit unions have rapidly grown their assets this year in an attempt to manage a surge in deposits. In the third quarter, assets increased by 16% while deposits rose by almost 18% from the previous year, according to NCUA data.

“You want that ratio to get lower since that shows economies of scale,” said Steve Rick, chief economist at CUNA Mutual. “You are spreading the fixed expense over a larger asset base. … It did take a big drop because the denominator has had explosive growth. We’ll have to see what it looks like when the assets aren’t growing so much.”

A better metric to look at would be noninterest-expenses-to-gross-income, Hanley said. This ratio was 0.61% in the third quarter, up from 0.58% a year earlier, according to NCUA data. That means expenses are rising faster than what the industry is earning.

An increase in labor costs accounted for almost two-thirds of the overall increase in noninterest expenses, NCUA said. There could be a few reasons for that, experts noted. For one, credit unions are traditionally reluctant to layoff employees, even during hard economic times, and some institutions have given bonuses and hazard pay this year to frontline staff members.

“A lot of credit unions don’t like laying people off because you invest so much in training,” Rick said. “You don’t want to have to train new people once you are hiring again.”

Compensation could also be up for some workers because of the mortgage-refinancing boom. Interest rates hit record lows this year, and mortgage lending surged as a result. Some employees could have compensation tied to volume in this area. And some credit unions may have had to give pay raises to mortgage lenders to keep them from getting recruited by rivals to handle the significant loan volume right now.

Additionally, some institutions have accelerated plans to invest in technology as branch lobbies had to close because of the pandemic and more members adopted digital banking. Credit unions could be paying for these items out of their current expenses or they could dip into their capital, said Sam Taft, associate vice president of analytics at Callahan & Associates. Because of that, it’s hard to track exactly what is happening.

Some have suggested that continued investments in technology could

Taft added that he didn’t think expenses would decline in 2021.

“Board and management teams have indicated digital is a focus,” Taft said. “What COVID has done in terms of virtual work, it has also done to digital banking. I think it’s accelerated that trend by five years just in terms of making people adapt.”

As the pandemic hit, Hiway Credit Union in St. Paul, Minn., sped up plans for a technology upgrade. Originally it had intended to add a video banking option next year but decided to move that up to 2020 after the coronavirus upended members visiting branches.

The $1.5 billion-asset credit union did a soft launch for the product on its website in early December and plans to add it to its mobile banking app.

“So many people are used to video calls and Zoom now,” said Hiway President and CEO Dave Boden. “It allows us to provide a little more personal service in a remote world.”

Despite this expense, Hiway has managed to keep its overall costs down this year by adjusting its budget in other areas, such as suspending most new hires and reducing marketing expenses. Its noninterest expenses totaled $28.1 million through the third quarter, down about 1% from the same period a year earlier, according to NCUA call report data.

Management also

“We are asking a lot of our associates this year, especially in terms of flexibility,” he added.