-

With consumer privacy issues in the spotlight, Citibank is betting its app — as an offering from a trusted data partner — will be more appealing than those from unknown brands or companies that have less liability if security breaches occur.

April 10 -

The self-regulatory body says working with data aggregators increases risk of cyber fraud, unauthorized transactions and identity theft. But aggregators say other links in the information chain are more vulnerable.

April 9 -

AI relies on catching the malware itself at a later stage, once it begins to operate in the system, and that's not enough to combat breaches and payment systems, according to Mordechai Guri, chief science officer at Morphisec.

April 9 Morphisec

Morphisec -

Brand and access to capital can suffer if companies don't take proper care of data from payments and other online activities, according to David Thomas, CEO of Evident ID.

April 6 Evident

Evident -

The agency’s acting director uses a reply letter to the senator not to answer her questions but to underscore that Congress lacks the ability to compel answers to such questions.

April 5 -

The one thing more valuable to consumers than their bank accounts might be their internet access — and a new version of the ‘Trickbot’ trojan targets both.

April 4 -

Options include multilayered security solutions that incorporate verification via passive biometrics, without adding friction, by evaluating a consumer’s inherent behavior online during the transaction process, writes NuData Security's Lisa Baergen.

April 4 NuData Security

NuData Security -

Employees still fall for phishing attacks, but there is technology that can remove the offending code before employees even view emails, writes Aviv Grafi, CEO of Votiro.

April 4 Votiro

Votiro -

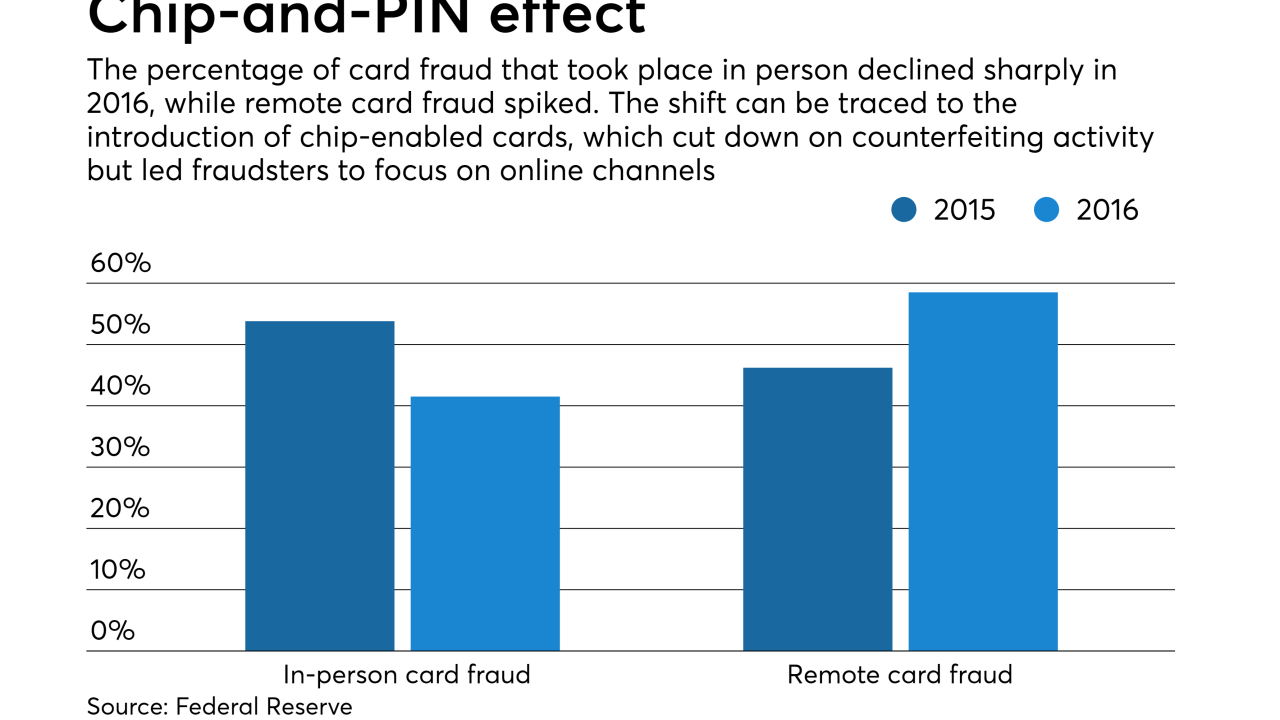

The central bank is taking a lead role in trying to combat the longstanding problem. A broad study by the Fed aims to measure the extent of payments fraud and to foster more collaboration in thwarting it.

April 3 -

Before reports of the data breach at Saks Fifth Avenue, Saks OFF 5th, and Lord & Taylor fade from the news cycle, there's one detail that should alarm merchants, card issuers and consumers — and sets a tone for future data breaches.

April 3