-

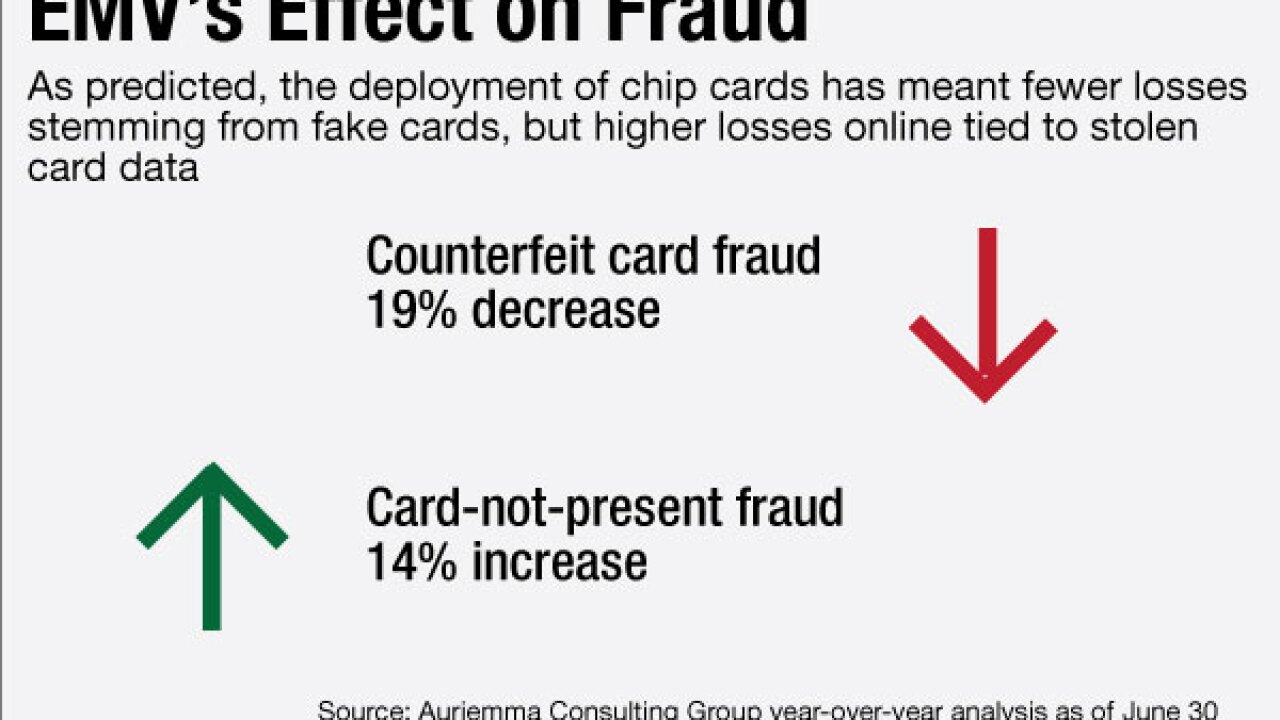

As online shopping and card fraud increase, startups offering easy-to-use "burner" cards could see strong traction.

December 13 -

Both major brands are accelerating a move away from traditional checkout, and all retailers need to make adjustments for the future.

December 13 Judo Payments

Judo Payments -

Merchants should check operating systems, since the PC-based operating systems which run most legacy point of sale software have security flaws and are targets for malware.

December 13 Revel Systems

Revel Systems -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated — and it is here to stay."

December 12 -

The payments messaging network Swift has told its client banks that the threat of cyberattacks "is very persistent, adaptive and sophisticated and it is here to stay."

December 12 -

Banks and data aggregators agree that screen scraping is a practice probably best left behind. In the coming year, the two might get better at sharing data via APIs.

December 12 -

Too many data breach reports show that companies suffering compromises were unaware that cardholder data was present in their systems. The Payment Card Industry Security Standards Council wants to fix this.

December 12 -

Crooks are getting more clever when hacking e-commerce sites to hide illegal activity, requiring banks and processors to developer a broader picture of merchants and payment activity.

December 12 EverCompliant

EverCompliant -

Mobile payment initiatives have largely failed because they focus on changing transactions instead of changing the way consumers and merchants engage with each other, according to Carta Worldwide, which touts new tokens as a way to reverse that.

December 12 -

When BankMobile, the brainchild of Jay Sidhu and his daughter Luvleen, relaunches on a new platform in January, security especially for the onboarding process will be completely redesigned.

December 8