-

The owner of The Shuckery in Petaluma, Calif., says she was unable to get a Paycheck Protection Program loan until she responded to an email from the delivery service and BlueVine.

August 5 -

KeyBank, Regions and others are using self-service portals, robotic processing automation and virtual assistants to digitize the collections process and make it more humane in anticipation of rising delinquencies.

August 4 -

Five banks, including BBVA USA and BMO Harris Bank, and one credit union will begin offering Google-branded bank accounts in 2021.

August 3 -

Heritage Bank and Dime Community Bank are among those financial services firms taking online and app-store reviews seriously. Here’s why all banks should pay attention.

July 31 -

"We can control our destiny," says Colin Walsh, CEO of the challenger bank, which spent more than three years seeking to become a full-fledged bank.

July 31 -

Banks, data aggregators and fintechs have clashed for a decade over how consumers’ bank account data should be shared with third parties. The agency says it will offer a plan, and industry officials have plenty of suggestions already.

July 30 -

The pioneering online lender had long struggled to live up to the hype that drove its early growth, even before the pandemic pushed it to the brink.

July 29 -

The accounting and payroll software provider’s QuickBooks Cash account is fee-free and integrates with other products the company offers small businesses.

July 29 -

Current, Stoovo and other companies are reaching out with low-cost, low-fee financial services and even tools to help users search for part-time jobs.

July 27 -

BBVA and Rockland Trust have taken a highly numbers-driven approach to branch reopenings. All banks are having to rethink their branch networks during the pandemic and beyond, and analytics software is helping.

July 26 -

Finding loan forgiveness programs and keep-the-change loan paydowns are examples of services startups like Savi, Summer and FutureFuel.io are offering banks to help borrowers manage their monthly payments.

July 23 -

Voice and text banking will be embedded in the Minneapolis bank's mobile app through a chatbot assistant that also caters to users with disabilities.

July 23 -

The IBM-BNP collaboration and other new developments show that high-profile breaches haven't deterred banks from using the cloud to store data.

July 22 -

The online lender has already branched out into facilitating payments and analyzing cash flow for small-business customers. Its new checking account is meant to round out those services.

July 22 -

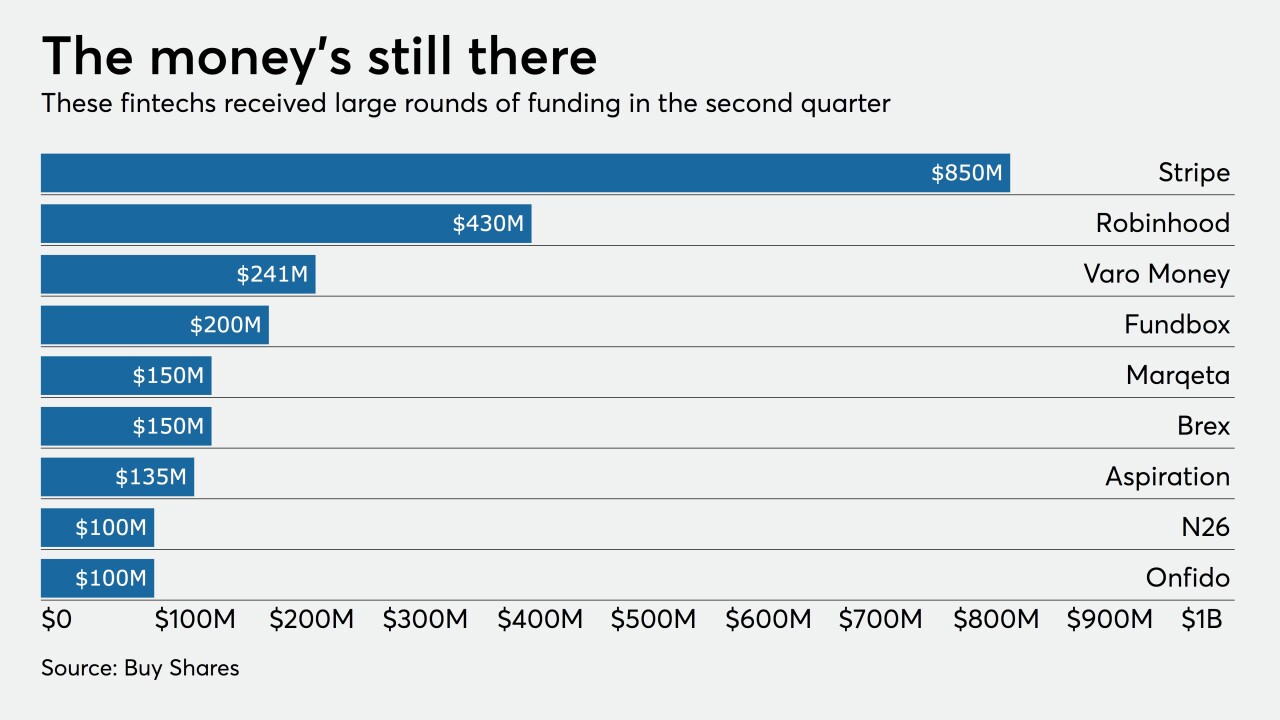

Business models and adaptability will determine the success — or failure — of financial technology companies as they deal with fallout from the coronavirus outbreak.

July 20 -

Fintechs like Greenlight and gohenry have drawn millions of teens with features like savings goal tracking and customizable debit cards.

July 16 -

Rho initially focused on startups, but now it’s targeting businesses with 100 or more employees.

July 16 -

The Minneapolis company said 75% transactions have been handled online since the pandemic hit.

July 15 -

After tech firms assisted community bankers in processing applications in the Paycheck Protection Program, small-business lenders are continuing to engage with cloud providers and other outside companies to automate the loan forgiveness process.

July 10 -

The Wall Street firm is jumping into a market dominated by a handful of big U.S. banks, betting that superior technology can lure companies with complex cash-management needs.

July 8