Earnings

Earnings

-

MetLife and Prudential exceed expectations; cybercurrency desk will trade contracts linked to the digital currency’s value.

May 3 -

Mastercard's CEO sang the praises of a single "button" for online purchases, a stance that puts heat on online payment leader PayPal without the whiff of a direct attack.

May 2 -

If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

May 1 -

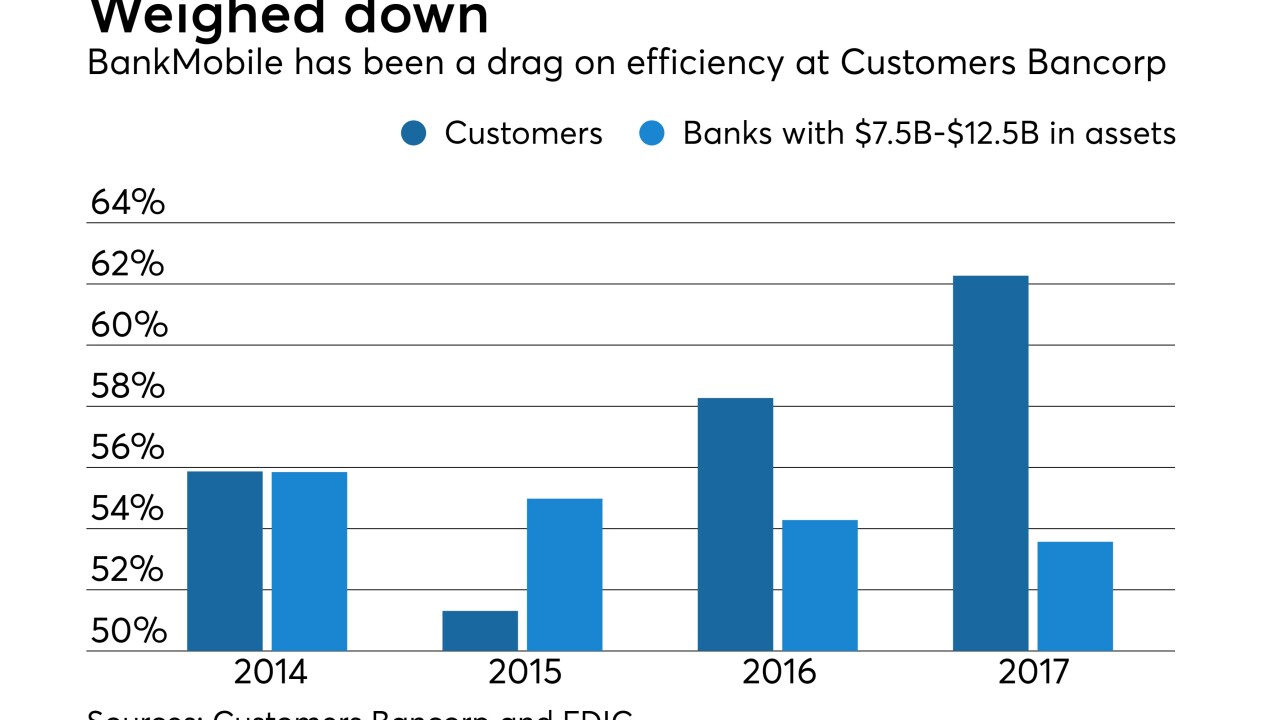

Because of the Durbin amendment, the once-prized asset has become an albatross. Spinning it off will remove a distraction and let management refocus on business banking.

May 1 -

The U.S. subsidiary of the Spanish banking giant BBVA said Friday that direct consumer loans increased 40% in the first quarter and that its digital strategy is bearing fruit.

April 27 -

The San Antonio company said that it has scaled back its exposure to energy loans in favor of a greater emphasis on loans of less $10 million.

April 26 -

Record originations on "better-yielding" used-car loans helped drive a 14% increase in its first-quarter profit. But Ally's shares were down Thursday on concerns of rising deposit costs.

April 26 -

Visa CEO Alfred Kelly is less publicly adversarial toward market rival PayPal than his predecessor Charlie Scharf, even as Visa's push for a "single button" for online payments seems to undermine PayPal's business model.

April 26 -

Bank’s net income plunges, will focus on Europe growth; FTC says the company charged hidden fees.

April 26 -

Spending on Visa Inc. debit cards — the favored plastic of the younger set — continues to grow at a faster clip than on credit.

April 25 -

Double-digit growth in personal loans and record wealth management revenue also helped the Tulsa, Okla., beat earnings forecasts.

April 25 -

The company, which reported a slight decline in loans, lowered its expenses during the first quarter.

April 25 -

The Florida bank's placement of all taxi loans on nonaccrual status in recent months strengthened its bottom line in the first quarter.

April 25 -

The Missouri company reported strong loan growth that also reflected a spike in factoring activity.

April 25 -

Double-digit gains in the bank's two largest loan categories offset declines in commercial and home loans.

April 24 -

Its decision to hire a consultant to trim expenses highlights the difficulty regionals face in making long-term technology investments in a low-growth era.

April 24 -

The Ohio bank's total deposits grew, unlike at some other regionals, and CEO Stephen Steinour said its 28-basis-point increase in overall funding costs will pay off.

April 24 -

CIT took a $22 million hit on a business loan, and overall loan growth was tepid.

April 24 -

The Seattle company has faced criticism from an investor over its commitment to the business, which lost money in the first quarter.

April 24 -

The Cincinnati bank reported strong profits, but its efforts to lower credit risk curbed lending as expenses rose in the first quarter.

April 24