-

The conflict pushed oil price futures above $100 a barrel for a short time earlier this week, which affected bond investors and the 10-year Treasury yield.

8m ago -

Federal Reserve Vice Chair for Supervision Michelle Bowman outlined upcoming changes to the bank regulatory capital framework in a speech Thursday, focusing on streamlining bank capital requirements through Basel III and Global Systemically Important Bank surcharge rules.

1h ago -

The bank-owned instant payment network has added a new use for its seldom-mentioned disbursement business.

4h ago -

Noelle Acheson argues that banks' focus on deposit tokens rather than stablecoins is a clear example of the "innovator's dilemma" at work: few economic incentives to embrace the innovation happening at the periphery.

5h ago -

The war may out a damper on bank mergers; and financial crime has become a global industry -- a big global industry

6h ago American Banker

American Banker -

The conflict with Iran has thrown volatility into bank stock prices, which is often the currency of dealmaking. "Stability is important to be able to do deals," one analyst said.

7h ago -

Brookfield, Wisconsin-based Landmark Credit Union's planned takeover of American National Bank-Fox Cities is the second credit union-bank acquisition announced in 2026.

March 11 -

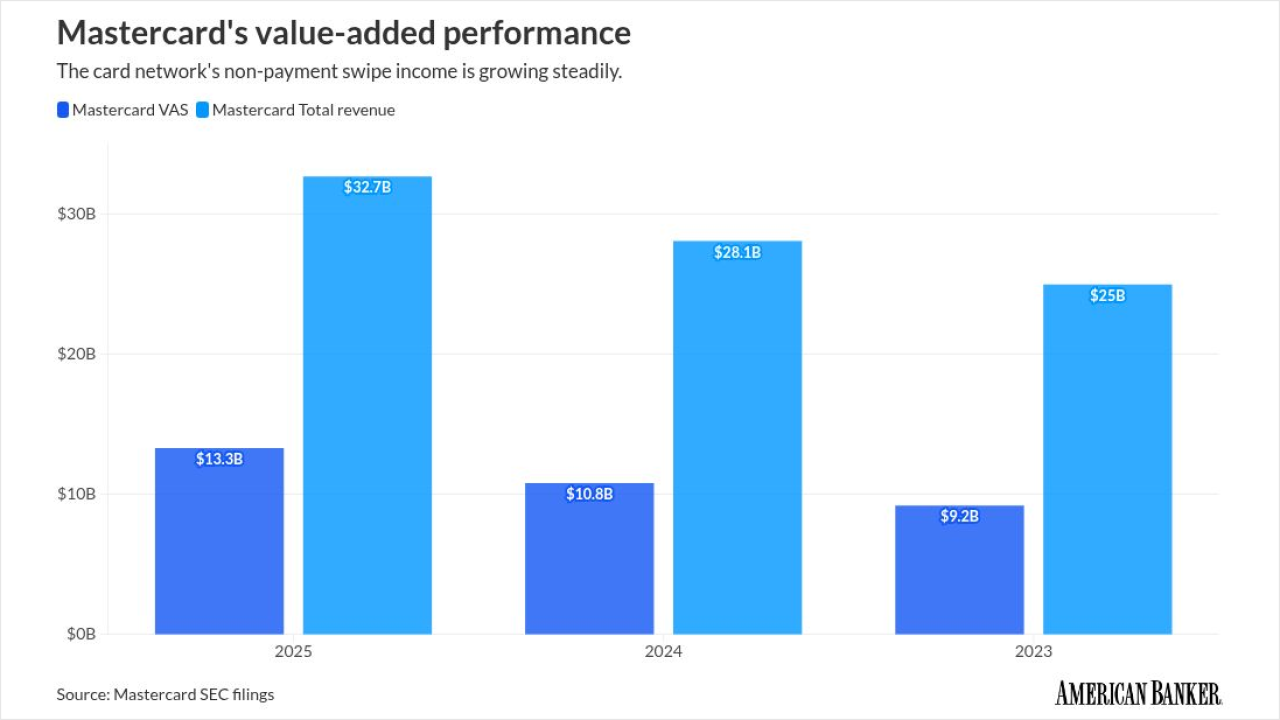

The card network hopes to increase revenue from non-card payments and is tapping two major technology trends.

March 11 -

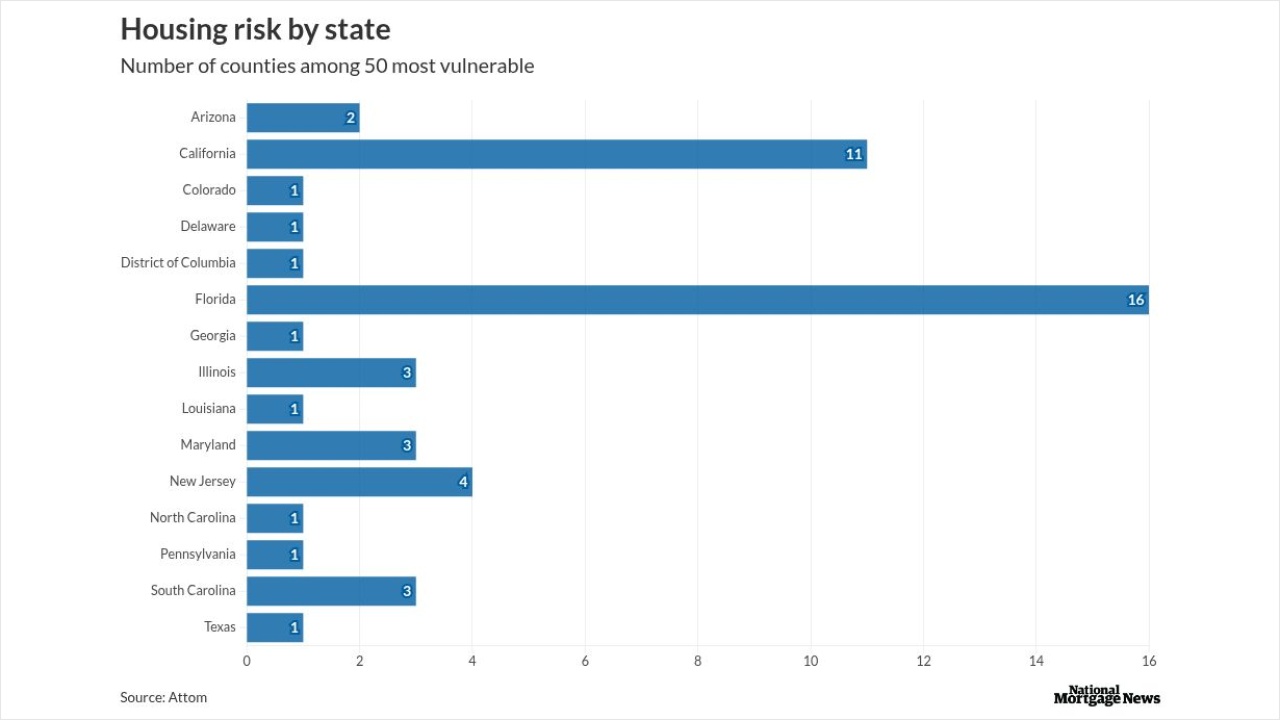

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

March 11 -

Cameron Bready, the firm's CEO, noted the company's clients include 12 large Middle Eastern airlines, and the closed airspace "isn't ideal."

March 11