-

The slow U.S. adoption of real-time payments hurts half of Americans who live paycheck to paycheck, says Aaron Klein, a fellow at the Brookings Institution.

March 5 -

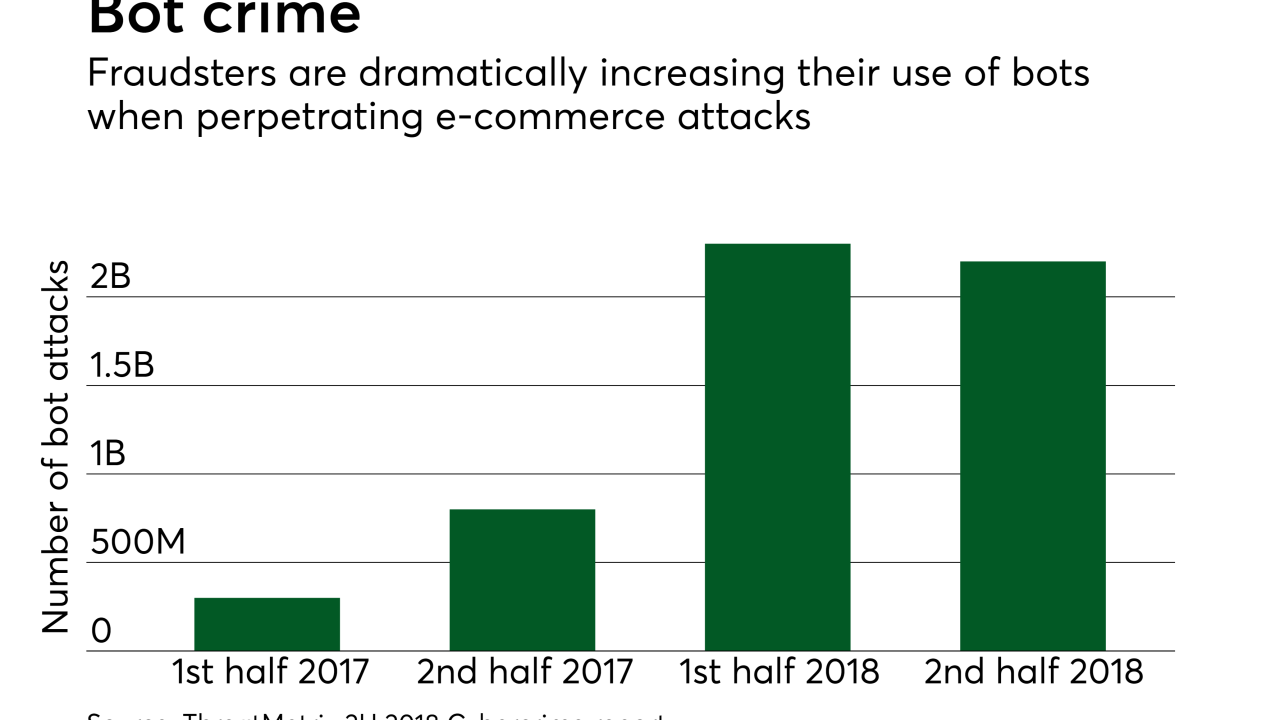

As companies invest heavily in artificial intelligence and other high-tech defenses, it is becoming more apparent that criminals are investing in equally powerful technology.

March 5 -

Financial institutions must manage compliance budgets without losing sight of primary functions and quality control, writes Chad Hetherington, global vice president of professional services for NICE Actimize.

March 5 NICE Actimize

NICE Actimize -

The industry cheered the bureau’s proposed repeal of its ability-to-repay requirement, but another part of the rule — on account debit restrictions — was left intact, and some companies aren’t ready to comply.

March 4 - Banking brands

The banks have no choice but to pick a new name, marketing experts say, but good luck: The best ones may already be taken, made-up names can sound forced, and any change might nudge more customers to rethink their loyalties.

March 4 -

Add the Alabama company to the list of lenders that are disappointed in the returns on loans made through car dealers and their inability to build broader relationships with those borrowers.

March 4 -

Maria Teresa Tejada joined the bank Monday as chief strategic enterprise risk officer.

March 4 -

Credit unions are getting better at using data analytics to pitch loan refinancing options to members, though there are still some pitfalls with the strategy.

March 4 -

Following a congressional mandate, the consumer bureau solicited public feedback on Property Assessed Clean Energy loans, which have been deemed risky by the Federal Housing Administration.

March 4 -

Donald Finn began his credit union career in 1964 by working as a loan officer for a Michigan institution.

March 4