-

The pandemic won’t halt the Cincinnati bank's plan to open about 100 branches in the Southeast, but features could be added to accommodate social distancing.

April 21 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

April 21 -

First Horizon still plans to complete its merger with Iberiabank on time, CEO Bryan Jordan said during the Tennessee company's earnings call.

April 21 -

Venture capital investment has plummeted in many coronavirus-ravaged economies, but larger, profitable fintech firms with the right digital products might still score funding.

April 20 -

The Dallas company also reported a first-quarter loss after the coronavirus outbreak caused "significant deterioration" in its economic outlook.

April 20 -

Executives say they can still meet their goal of $480 million in cost savings this year from the combination of BB&T and SunTrust despite unexpected expenses, unless the economy fails to rebound quickly.

April 20 -

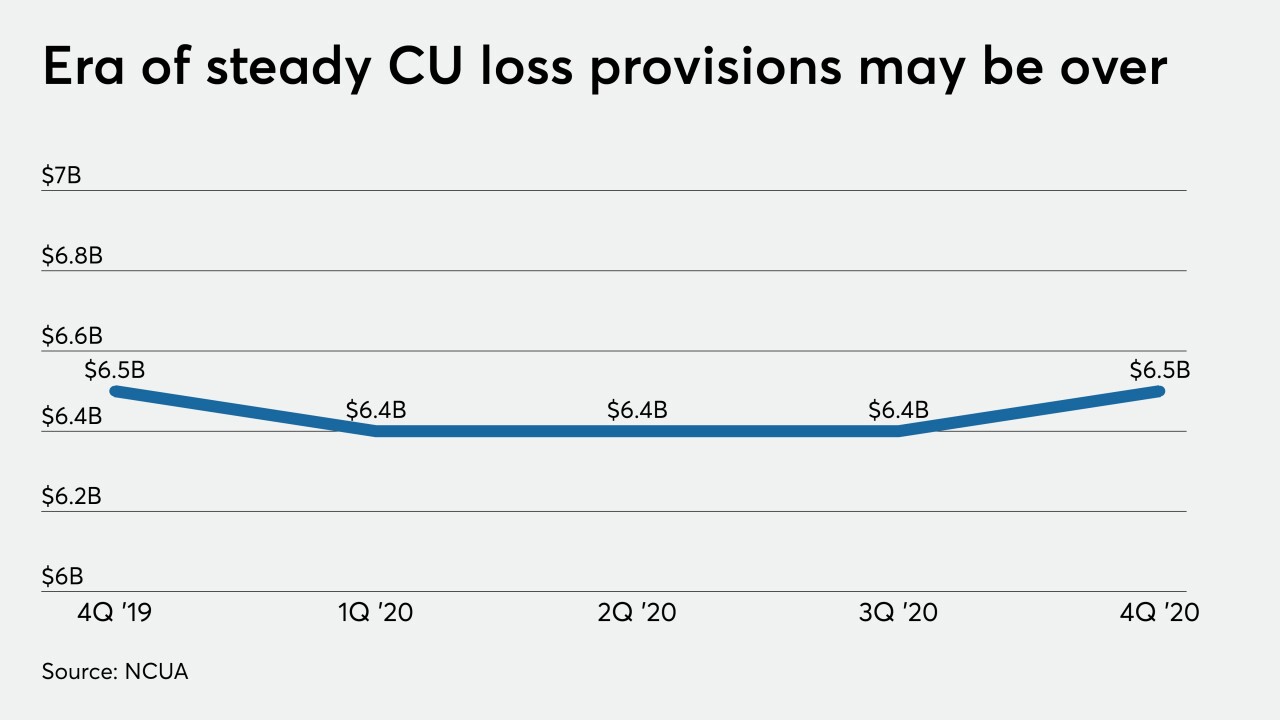

Smaller institutions should prepare themselves for some of what the competition has experienced, including increased provisions for losses and declining net interest margins.

April 20 -

Citizens, Regions and others say business investments initiated before the COVID-19 pandemic, including technology improvements and new consumer offerings, are on track.

April 19 -

The Senate Banking Committee chair will work with the heads of other panels in overseeing the $2 trillion stimulus package that Congress passed last month.

April 17 -

Wells Fargo tells business clients to consider other banks for emergency loans; JPMorgan Chase is temporarily reducing its exposure to the mortgage market; how TD Bank got a head start on pandemic preparations; and more from this week's most-read stories.

April 17