-

The combined refinance and purchase total was nearly double the average quarterly volume logged before the pandemic, the company said in its third-quarter earnings call.

October 29 -

The Texas bank, which has spent six years reducing its exposure to fossil fuel companies, aims to bottom out at around 5% of its total loan portfolio.

October 29 -

Steve Steinour, the Ohio bank’s CEO, said the slowdown in car manufacturing due to the global chip shortage will continue to stifle loan demand in the months ahead.

October 28 -

The deal for Michigan-based Flagstar Bancorp, announced in April, was originally expected to be completed by the end of the year. The New York bank’s CEO expressed optimism that it will still get regulatory approval.

October 27 -

The credit card issuer benefited from consumer loan growth in the third quarter, but investors seemed spooked by increases in its marketing and technology costs.

October 27 -

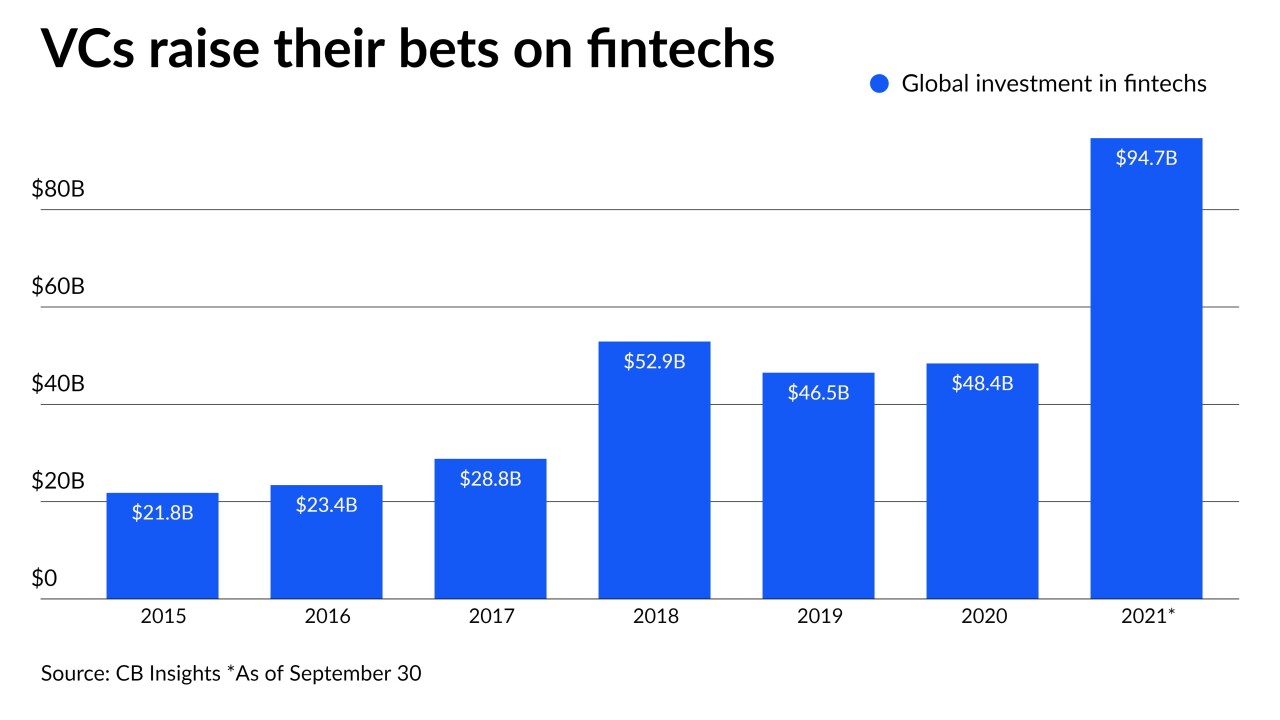

These venture capital firms are investing in young companies that could help small financial institutions meet their growing technology needs.

October 26 -

Maxwell, a startup that operates an online platform catering to mortgage loan officers and smaller lenders, raised $28.5 million in equity funding from investors led by the venture firm Fin VC and Wells Fargo Strategic Capital.

October 26 -

Businesses trying to meet a surge in demand for consumer goods are knocking on community banks' doors to finance expansions.

October 25 -

During third-quarter earnings calls, Bill Demchak of PNC raised concerns about stablecoins, while Jane Fraser of Citigroup pledged that there will be accountability for fixing her company's regulatory troubles and Jamie Dimon of JPMorgan Chase sounded downbeat about the Biden-era regulatory environment.

October 25 -

The Alabama company agreed to buy two nonbank lenders earlier this year. It’s still on the lookout for possible deals, potentially in corporate finance or wealth management, its chief financial officer told American Banker.

October 22 -

Steve Squeri said installment lenders primarily cater to debit card users and that even American Express's own BNPL product does not compete with the company's credit and charge cards.

October 22 -

Investment banking fees helped propel the Cleveland bank's noninterest income, which has been a focus for the last decade and continues to rise as a percentage of total revenue.

October 21 -

The auto lender’s acquisition of Fair Square Financial would diversify its consumer product lineup. The pandemic derailed its last effort to buy a card company.

October 21 -

Roger Hochschild predicts consumers will keep using their Discover cards in the months ahead, particularly when shopping online.

October 21 -

The Buffalo, New York, bank dipped relatively close to the minimum common Tier 1 equity ratio in stress tests run by the Fed. The results “suggested that there might be more capital-friendly ways to participate” in the commercial real estate industry, its chief financial officer said.

October 21 -

The Tennessee company, which reported 1% linked-quarter loan growth, has sought to “protect the integrity of the balance sheet” and has a strong pipeline of commitments.

October 20 -

Though the Providence, Rhode Island, bank is in the midst of three deals, CEO Bruce Van Saun said it remains on the lookout for other nonbank purchases that could help boost fee income and generate cross-selling opportunities.

October 20 -

The Dallas company plans to move aggressively to recruit customers and employees of rival banks involved in mergers that are shaking up the banking landscape in two of its key markets.

October 20 -

At Fifth Third, Synovus and Zions, third-quarter loan growth and improved outlooks indicate that businesses are finally more open to borrowing. Industrywide data further suggests “a much hoped-for rebound” has begun, according to analysts at Piper Sandler.

October 19 -

Strong growth in loans to private equity and venture capital firms fueled a 74% increase in third-quarter profits — and helped the New York bank hit a new milestone.

October 19